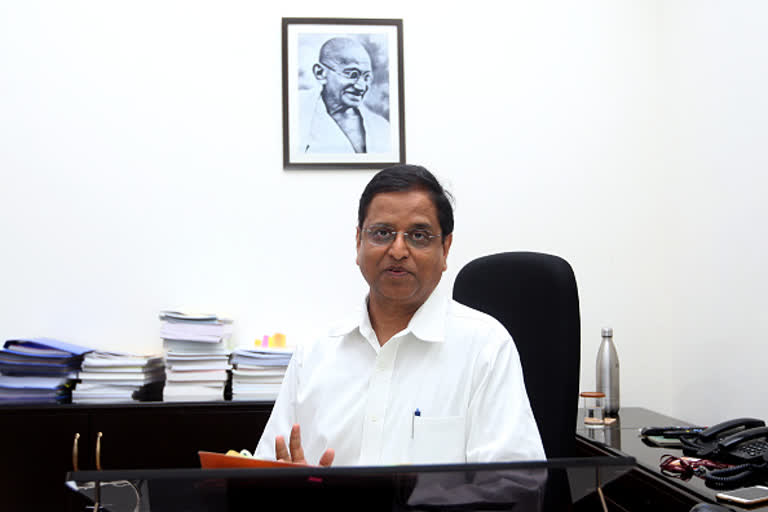

New Delhi: Ahead of the Budget, former Finance Secretary Subhash Chandra Garg on Sunday suggested a simplified four-rate personal income tax structure without cess or surcharge amid the increasing clamour for moderation in the tax rate.

Following corporate tax rate cut in September, there has been a growing demand for reduction in personal income tax which has developed deformity over the years due to cess and surcharge.

"Corporate Tax structure has been made reasonable and competitive during the current year. No more action is expected in this regard. There are quite a few major tax reforms, which need to be undertaken in the taxation structure of Personal Income Taxes," he said in a blog.

There are as many as eight slabs of income tax with the highest effective tax rate exceeding 40 per cent.

Emphasising that rate structure should be reformed, Garg said, "a rate structure with no tax for taxable income less than 5 lakh, 5 per cent on income from 5-10 lakh, 15 per cent on income from 10-25 lakh, 25 per cent on income from 25-50 lakh and 35 per cent on income more than 50 lakh would be quite a simple and fairer structure."

As there would be no cesses and surcharges, such a structure would be welcomed by taxpayers, he said.

Read more:Davos readies for determined push to help launch a decade of delivery

"The states would also find this system a non-distortionary and their complaints of Centre gaining at their expense would also be over. The revenue considerations would also not be affected too adversely," he said.

Garg, who was instrumental in designing three Budgets including an interim, also suggested that it is high time to abolish the Dividend Distribution Tax (DDT) taking advantage of the digital banking and record keeping.

"Assesses will get taxed for the dividend income at the rates applicable to them. A provision of tax deduction at source (TDS) can also be introduced for dividend distribution of over Rs 10,000 to a person by a Company at the rate of 20 per cent," he said.

He also said that the long-term capital gains should continue to be taxed and be streamlined only as part of the larger reforms in capital gains taxation.

Observing that the Goods and Services Tax (GST) is still work in progress, he said, utmost attention requires to be given to complete the invoice uploading and matching process and other needed process reforms.

"While the underlying tax revenue situation is grim, it is the right time to initiate much needed reforms in the taxation structure," he said.

Overall, he said, there is likely to be shortfall of Rs 3.5 to 3.75 lakh crore in gross tax collections of the Centre.

"Expecting that the Centre could revise transfers to the States out of the Centre taxes (about 32 per cent of shortfall), the net taxes to the Centre are likely to be short by Rs 2.5 lakh crore or 1.2 per cent of GDP," he said.

The government had budgeted gross tax revenues of Rs 24.59 lakh crore.