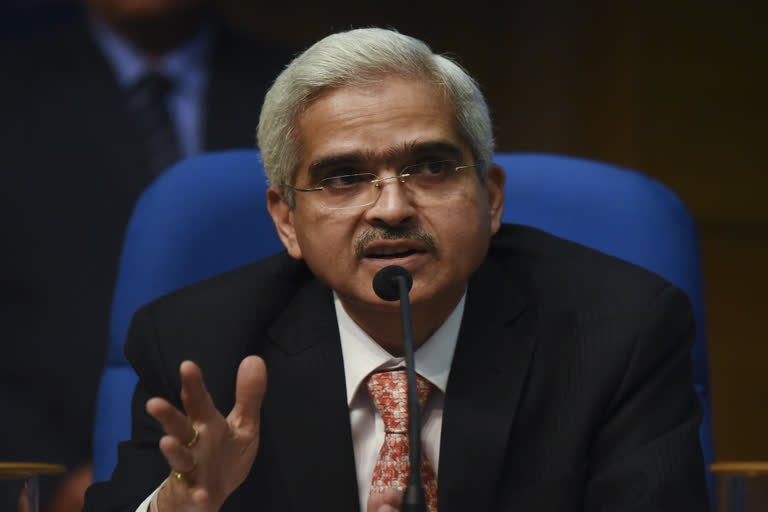

Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das on Thursday said the country's economy has recovered stronger than expected from the initial impact of the COVID-19 pandemic, but there is a need to be watchful of demand sustainability after the end of festivities.

Speaking at the annual day event of Foreign Exchange Dealers' Association of India (FEDAI), Das said there are downside risks to growth across the world and also in India.

It can be noted that the Indian economy contracted by 23.9 per cent in the first quarter of the fiscal year, and the RBI expects the economy to shrink by 9.5 per cent in FY21. However, there has been recovery after the opening up of the lockdown restrictions, especially during the festive season.

After witnessing a sharp contraction in the economy by 23.9 per cent in Q1 and a multi-speed normalisation of activity in Q2, the Indian economy has exhibited stronger than expected pick-up in momentum of recovery, Das said.

Even as growth outlook has improved, downside risks to growth continue due to recent surge in infections in parts of Europe and also in parts of India, he said.

We need to be watchful about the sustainability of demand after the festivals and a possible reassessment of market expectations surrounding the vaccine, he said.

Das said regulatory reforms have moved the financial markets to the next trajectory amid the pandemic and affirmed RBI's commitment to ensure an orderly conduct in the markets.

He also said that India will continue to approach capital account convertibility as a process, rather than as an event within a broad macroeconomic framework.

Capital account convertibility will continue to be a process, rather than an event

India will continue to approach capital account convertibility as “a process rather an event”, Das said.

He said that the capital account is convertible to a “great extent” at present and enumerated the specifics on both inward and outward flows which are allowed.

Read more: E-com biz helps B'luru Airport register 26-month high export growth

It can be noted that capital account convertibility is a very sensitive subject as it deals with liberalisation of capital transactions into and out of a country. India, which started opening up on this front with the reforms of the early 1990s, is partially convertible right now with caps and other restrictions.

“Capital account convertibility will continue to be approached as a process rather than an event, taking cognisance of prevalent macroeconomic conditions,” Das said.

He added that a long-term vision with short- and medium-term goals is the way ahead on this.

Das said foreign portfolio investment (FPI) in Indian debt markets has been expanded within calibrated macro-prudential norms and added that limits under the medium-term framework for investment by FPIs have been gradually increased and procedures rationalised.

At present, inward foreign direct investment (FDI) is allowed in most sectors and outbound FDI by Indian incorporated entities is allowed as a multiple of their net worth, he said, pointing out that there has been a liberalisation in the external commercial borrowing framework as well to include expanding eligible borrowers.

“Internationalisation of financial markets can lower transaction costs with efficiency gains,” he said.

“Over the last three decades, India has undergone a transformation from being a virtually closed economy to one that is globally connected and open to a much larger volume of international transactions and capital flows than before,” he added.

Das said allowing banks in India to deal in the offshore rupee derivative markets was a major milestone towards opening up of the markets and added that the move is expected to achieve the objectives of reducing the segmentation between onshore and offshore markets and also reducing volatility.

(PTI Report)