Business Desk, Etv Bharat: State-owned Indian Railway Catering and Tourism Corp. Ltd (IRCTC) had created huge buzz in the primary stock market in September last year when its initial public offering (IPO) had opened for investors.

The IPO received humongous response, getting subscribed by a massive 112 times, as analysts and investors found the issue to be attractively priced at Rs 315-320 per share. As expected, due to such oversubscription, many investors missed the bus then as they were not allotted shares during the IPO.

Now, within a year of its listing, the government is again planning to sell some stake in the public sector unit (PSU) in order to meet its FY21 divestment target.

On Thursday, reports said that the central government has invited bids from merchant bankers for IRCTC stake sale, setting a deadline of 10 September.

The government reportedly intends to divest stake through the Offer for Sale (OFS) route in order to bring down its current shareholding in IRCTC from 87.4% to 75% as mandated by the Securities and Exchange Board of India (SEBI).

Given the success of the IPO, one can assume that IRCTC’s OFS may also generate investor interest. But much has changed in terms of pricing that plays a key role in the success of an issue. The IRCTC IPO was priced at Rs 315-320 per share. Now, the current stock price is Rs 1,342, over four times higher than the IPO price. Given the previous pricing trends, the IRCTC OFS should be priced somewhere around the current stock price levels, which many investors may not find attractive enough.

Moreover, IRCTC’s fundamentals have also taken a hit after the pandemic. A research report by brokerage firm Prabhudas Lilladher dated 11 July said: “IRCTC’s performance was marred by COVID-19 during 4QFY20 (impact was evident from the month of January itself)… as passenger train services are suspended until 12 August 2020 and traffic growth will be lower in the initial few months after operations resume, we expect H1 FY21 to be a complete wash out.”

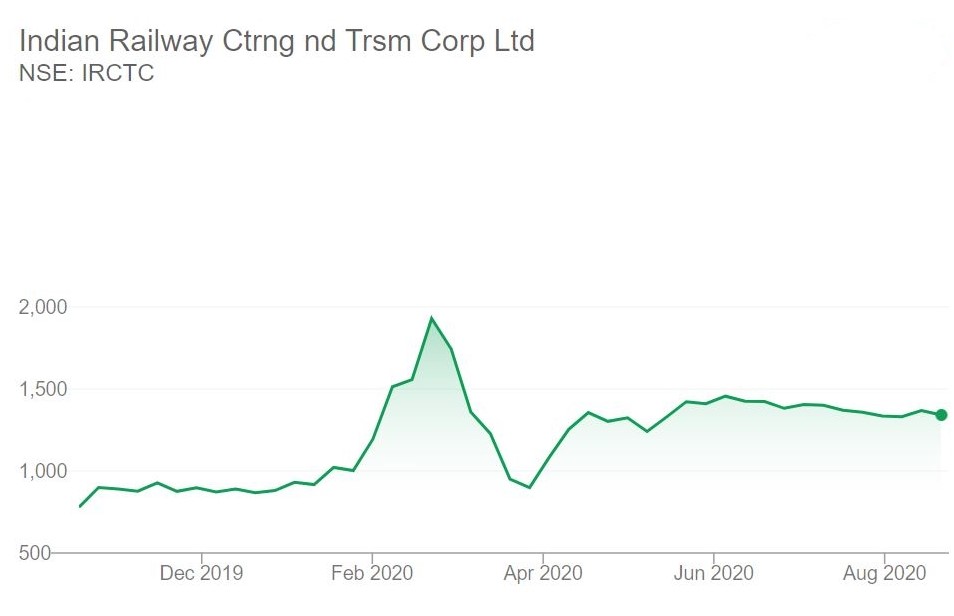

The volatile scenario is visible in the company’s stock performance as well. IRCTC shares had hit a high of as much as Rs 1,994 apiece in February this year, just before the coronavirus outbreak spoiled the party.

Read more: Lost job? Know how can you avail higher unemployment allowance

As train services were suspended nationwide, the stock saw massive correction, slipping nearly 60% from its highs to trade at Rs 815 levels in March.

However, the stock has been gradually recovering since then. It is still up 42% year-to-date compared with a 7% fall in the benchmark Sensex.

As a central public sector enterprise wholly owned by the government of India, IRCTC continues to remain on investors’ radar as it is the only entity authorised by Indian Railways to provide catering services to railways, online railway tickets and packaged drinking water at railway stations and trains in India.

Moreover, analysts are still positive on the company’s outlook once the pandemic ends and the situation returns to normal. “We keep our FY22E estimates broadly intact and expect CAGR (compounded annual growth rate) in sales/profit after tax of 17%/22%respectively over three years driven by 1) capacity expansion of Rail Neer 2) tariff hike in mobile/static catering by ~70%/60% respectively and 3) reintroduction of service fee on e-ticketing,” Prabhudas Lilladher report said.

Looking back, when IRCTC shares made a stellar debut on bourses on 14 October, listing at Rs 644 on BSE, they managed to double investors’ money in a single day. Taking that into account, it would be interesting to see how the company’s OFS will perform.