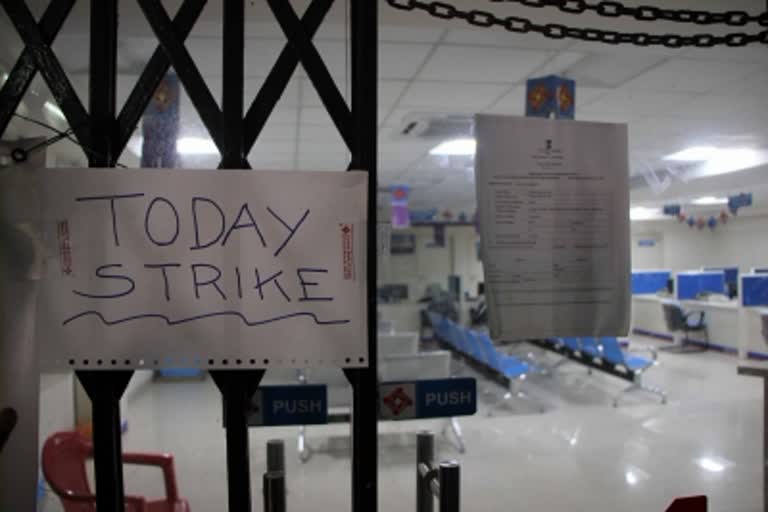

New Delhi: Banking operations including cheque clearance across the country got affected on Monday as bankers under the aegis of the United Forum of Bank Unions (UFBU) have gone on a nationwide strike to protest against the proposed privatisation of two state-owned lenders.

UFBU, an umbrella body of nine unions, had given a strike call for March 15 and 16, and claimed that about 10 lakh bank employees and officers of the banks will participate in the strike.

Reports emerging from different parts of the country suggest that services of public sector banks as well as private sector banks were affected due to the strike.

Speaking to PTI in Kolkata, All India Bank Officers Confederation (AIBOC) joint general secretary Sanjoy Das said: “We have got a tremendous response. Our strike call has also been supported by the National Confederation of Officers Association, farmers, CITU and AITUC.”

"Most of the bank branches in the state are closed due to the strike. ATMs are not functioning except those located at hospitals, railway stations and airports," he added.

ANI has reported that besides the public sector bank employees, employees of private sectors banks like Axis Bank and Kotak Mahindra Bank also participated in the strike in West Bengal.

In Maharashtra, State-run lenders, including Central Bank of India among others have informed their customers to use their digital channels like internet or mobile banking, ATMs services for making transactions during the two-day strike.

The unions have claimed that about 40,000 bank employees and officers working in about 10,000 bank branches across the state have joined the nationwide strike.

In Punjab and Haryana, bank employees held protest rallies at many places to oppose the privatisation move by the Centre.

On the other hand, some bank customers complained that they are facing inconveniences as banks are closed for four consecutive days as March 13 and March 14 (second Saturday and Sunday) were holidays for banks.

Read More: 'We are ready to discuss petroleum products issue in GST Council meeting'

Transactions worth Rs 16,500 crore impacted

CH Venkatachalam, General Secretary, All India Bank Employees' Association (AIBEA) claimed that the strike was a complete success and it has impacted the clearance of two crore cheques or instruments worth about Rs 16,500 crore.

"On an average, about 2 crore cheques/instruments worth about Rs 16,500 crore are held up for clearance. Government treasury operations and all normal banking transactions have been affected," he said.

Besides, money markets and stock markets are also going to face problems as payments would be impacted, he said.

"The strike to save the savings of our people. The strike is to ensure more loans to priority and weaker sections," Venkatachalam added.

He further said that the banks are making operational profits and they are showing net loss owing to provisions because the corporate borrowers defaults.

“During 2019-20 the operating profits of government banks were Rs 1,74,336 crore, provision for doubtful debts Rs 2,00,352 crore and the net loss stood at Rs 26,016 crore,” he told IANS.

Read More: Explained: What is Initial Public Offering?

Why the bank unions gave the strike call?

Last February, the United Forum of Bank Unions (UFBU), an umbrella body of nine unions, gave a call for a two-day strike from March 15 to protest against the proposed privatisation of two state-owned lenders.

Presenting the Budget for FY 2021-22, Union Finance Minister Nirmala Sitharaman had announced the privatisation of Public Sector Banks (PSBs) as part of a disinvestment drive to garner ₹1.75 lakh crore.

"Other than IDBI Bank, we propose to take up the privatization of two Public Sector Banks and one General Insurance company in the year 2021-22," she said during her latest Budget speech on February 1.

The government last year consolidated 10 public sector banks into four and as a result, the total number of PSBs came down to 12 from 27 in March 2017.

Members of UFBU include All India Bank Employees Association (AIBEA), All India Bank Officers' Confederation (AIBOC), National Confederation of Bank Employees (NCBE), All India Bank Officers' Association (AIBOA) and Bank Employees Confederation of India (BEFI).

Others are the Indian National Bank Employees Federation (INBEF), Indian National Bank Officers Congress (INBOC), National Organisation of Bank Workers (NOBW) and National Organisation of Bank Officers (NOBO).

(With Agency Inputs)