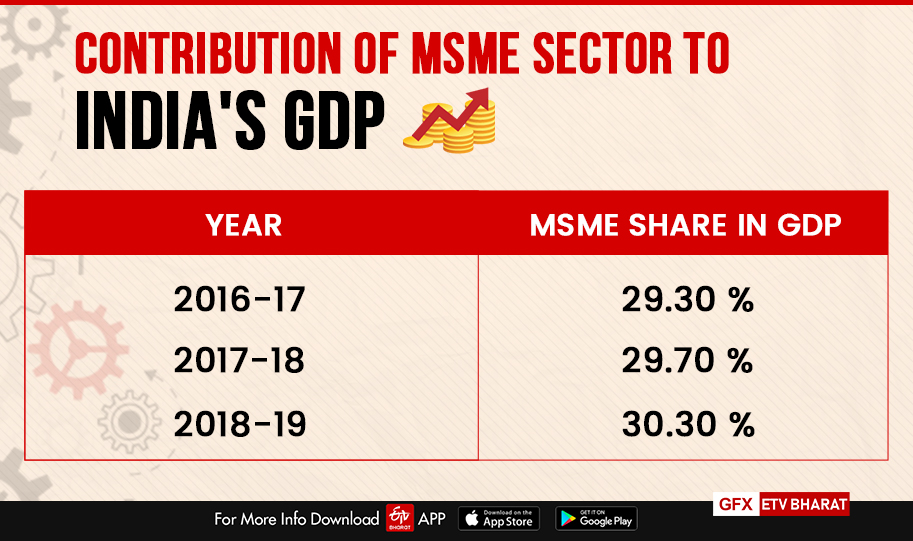

Hyderabad: The significant role of Micro Small and Medium Enterprises (MSME) in developing the economy has been well established. Besides its significant contribution to GDP and exports, the livelihood of large section of population, more particularly in hinterland are dependent on the sector. It provides employment and succor to millions of skilled/semiskilled/unskilled work force. Considering its importance to the economy, the ‘Atmanirbhar Bharat Abhiyan’ as announced by the Central Government has provided a series of relief measures.

Even when India has moved up significantly in the scale of World Bank’s ‘Ease of doing business index’ from 142 in 2014 to 63 in 2020, the plight of MSME entrepreneurs has not improved proportionately.

Battered in the midst of demonetization struggle and nuances of GST regime, when the sector was trying to resurrect, the shock of COVID-19 lockdown and its collateral damage had crushed them that warrants tending them with care. The government has accordingly planned to nurse them but much of the success will depend on how quickly the benefits reach them.

The highlights of the relief to MSMEs:

Unlike providing cash relief as a one-time measure to ailing entrepreneurs, a model adopted by many countries, government has used multipronged strategies to use it as an opportunity to undertake policy reforms that will have lasting impact on making MSME sector more competitive.

The softer bank loans, in the meantime will provide immediate liquidity to ramp up the commercial activities of the unit that went into standstill mode during lockdown. The specific relief measures are:

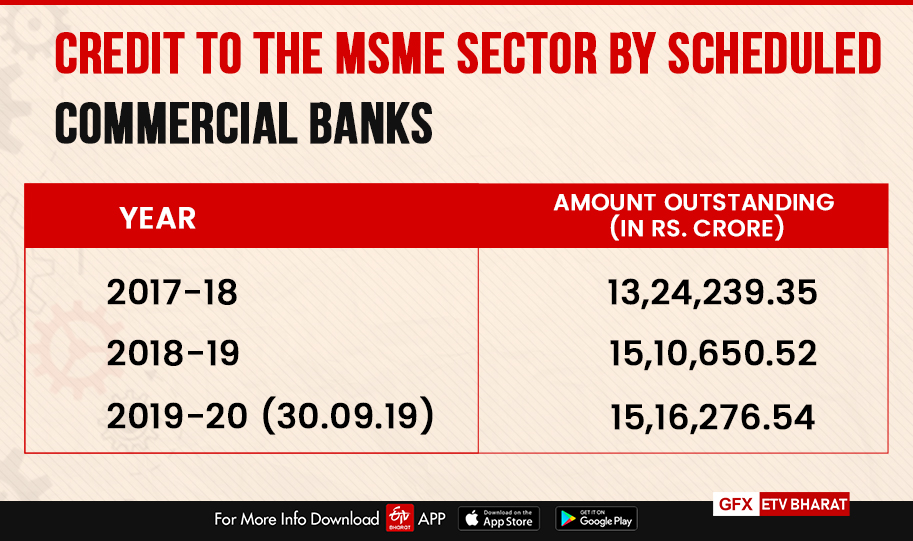

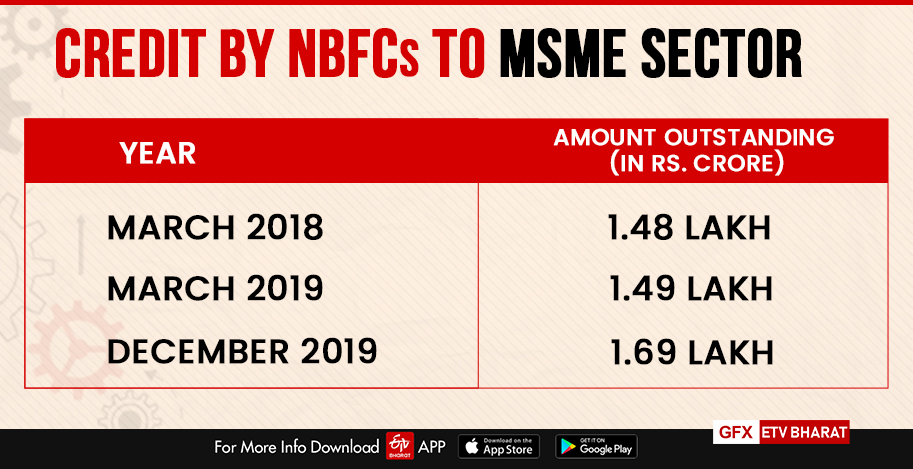

- Specially designed government credit guaranteed collateral free loans of up to 20 percent of outstanding credit as on February 29, 2020 to units with turnover up to Rs 100 crores having existing outstanding loans up to Rs.25 crores. The loan scheme open up to October 31, 2020 will have a four-year tenor with a moratorium of 12 months on principle payment. According to RBI data, the outstanding MSME loans are at Rs 15.74 lakh crore on February 28, 2020 and a Rs 3 lakh crore guarantee covers the prospective loans. Both banks and non-bank financial companies (NBFCs) can grant the facility.

- A subordinate debt will be available to even stressed MSME units within an outlay of Rs.20000 crores.

- Government will also provide Rs.4000 crores to CGTMSE that will offer partial credit guarantee support to banks for lending to MSME units.

- Capital infusion of up to Rs 50000 crores will be provided to MSME units by floating ‘Fund of Funds’ scheme with an initial corpus of Rs.10000 crores. The beneficiaries under the scheme will be encouraged to list on stock exchanges with a futuristic view to open up equity route to them.

- MSME definition is changed from size in terms of amount of ‘investment in plant and machinery’ to ‘investment and turnover’ and combined manufacturing and service sector. (a) investment up to Rs 1 crore and turnover under Rs 5 crore will be micro-units. (b) investment of up to Rs 10 crore and turnover under Rs 50 crore will be small businesses. (c) investment up to Rs 20 crore and turnover under Rs 100 crore will be Medium Enterprises

- The government will not allow global tenders in procurement tenders up to Rs. 200 crores to protect MSMEs from unfair competition from foreign companies. This will enable local entrepreneurs to bid and get benefited. The pending MSME payments will be released in 45 days. The data of e-marketplace will be utilized to benefit the MSME sector.

Delivery of benefits:

The array of benefits/schemes has been well orchestrated to pull out the MSME sector from the COVID-19 inflicted abyss, provided they reach the intended target group. The huge responsibility of delivering the stimulus package will rest with the local government, MSME forums, non-government agencies, financial intermediaries, more and importantly; banks having wider reach in rural areas.

Read more:COVID-19 Relief Package: Big decisions for MSMEs, implementation will be key

Banks, including Public Sector Banks (PSBs) that have the umbilical connect with masses are also toiling with widespread disruptions of consolidation and COVID-19 repercussions. RBI, on its part has brought down the benchmark repo rates to a historic low of 4 percent and infused enough liquidity. With such robust stage well set to propel MSME sector to rejuvenate, banks need to plunge into action to lend on a scale that has not been witnessed in recent times. It is a crisis rescue and gearing up has to be in sync with the magnitude of challenges.

Credit delivery reforms:

In order to organize huge credit delivery to MSME sector, banks will have to be innovative and need to think out of box. Given that large section of MSME borrowers may not be digitally literate, banks will have to move in traditional mode but creating a procedural ease to complete all the loan formalities – credit appraisal, credit rating, working capital computation, processing of proposal, documentation and conducting spot inspections and so on. Banks normally have the same credit policy and common procedures that are highly information/document intensive.

Given the fact that it is a special relief loan to MSMEs well covered under the Emergency Credit Line Guarantee Scheme (ECLGS) , banks will have to simplify and innovate a template driven credit delivery model with minimum paper work to ease their burden and to make borrowers comfortable.

RBI has already permitted co-origination of loans in league with Non – Bank Financial Companies (NBFCs), a strategic tie up could be worked out to use the synergy of each other. Banks can also lend to NBFCs for on lending to individual borrowers in their books.

Since Fintech companies are also forming part of NBFCs, banks can use these intermediaries to disseminate credit on a large scale on digital platform to borrowers who are comfortable to deal online.

What is more important is to think different to ease the workflows of operating staff. Since lending rate is fixed at 9.25 percent requiring no further computation of risk premium, the delivery of credit could be made faster.

Read more:Modi government's Rs 3 lakh crore SME credit line fails to cheer up the sector

With abundant liquidity at low rates of interest and reducing deposit rates, the overall cost of resources for banks have gone down substantially. So, even 9.25 percent of interest makes a good commercial case to lend on large scale with immense opportunities for cross-selling and winning patronage of good borrowers.

Unless banks work out a special credit delivery mode and uses NBFCs, including fintech companies, the intended last mile delivery to MSME units will not be possible with scheme closing by end of October 2020.

It therefore casts a huge onus on the government to ensure that the vital MSME sector survives COVID-19 shock that would need meticulous tracking of delivery of benefits to the intended beneficiaries. Hence, the relief work has just begun, wherewithal is readied and its successful outcome will depend on how it pans out in implementation stages and delivers value.

(Article by Dr. K. Srinivasa Rao. The author is Adjunct Professor, Institute of Insurance and Risk Management – IIRM, Hyderabad. Views expressed above are his own.)