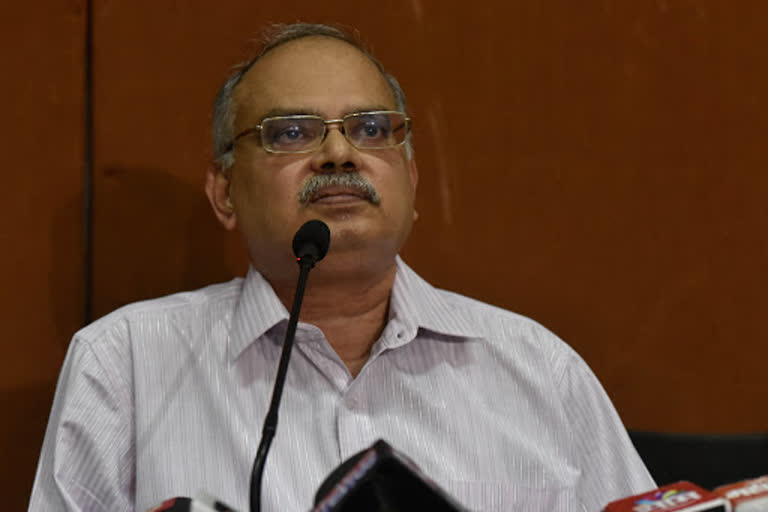

Mumbai: Former Managing Director of Punjab Maharashtra Cooperative Bank, Joy Thomas, was arrested on Friday in connection with the multi thousand crore scam crore scam at the bank by the Economic Offences Wing of Mumbai Police.

Thomas was summoned to the EOW office at the city police headquarters and arrested after questioning, a police official said.

On Thursday, EOW had arrested HDIL directors Rakesh Wadhawan and his son Sarang Wadhawan in connection with the same case.

Background:

The PMC bank as of March 2019, had deposits of Rs 11,617 crores and advances of Rs 8,383 crores respectively. As against Rs 100.90 crore in March 2018 its net profit was Rs 99.69 crore in March 2019. The bank’s gross non-performing assets (GNPA) were 3.76% and net NPAs were 2.19% of its advances.

According to Bloomberg as per exposure norms laid down by the RBI in 2013, an urban cooperative bank can lend up to 15% of its total capital to a single borrower and 40% to a group. The urban cooperative banks total capital funds as on March 31 stood at Rs 1055 crore

But HDIL directors Sarang Wadhwan and Rakesh Wadhwan have been accused of Rs. 6,500 Crore Loan Default which is far beyond the lending limit.

The suspended managing director of Punjab and Maharashtra Cooperative (PMC) Bank, Joy Thomas, has blamed the auditors for the mess at the bank.

In a five-page letter to the Reserve Bank of India (RBI) dated September 21 after a board member blew the lid on the fraud at PMC, which is among the top ten urban cooperative banks, Thomas has confessed to the role of the top management, including a few board members, in hiding the actual NPA numbers and also the actual exposure to the bankrupt HDIL, which is stated to be around Rs 6,500 crore or over 73 per cent of its total loan book of Rs 8,880 crore.

Of the 44 loans worth nearly 73 per cent of PMC's total loan book size of Rs. 8,880 crore it has violated the regulations which forbid banks from handing out such a large proportion of cash to one sector let alone a single firm.

Read more: Loans to become cheaper after RBI cuts interest rate to a decade low