New Delhi: The Finance Minister has done away with the dividend distribution tax.

"Companies will no longer be required to pay DDT. A total of Rs 25,000 crore is revenue foregone due to DDT abolition. This will make India an attractive investment destination," said FM

She also said that the government has permitted DICGC to raise deposit insurance coverage by five times to Rs 5 lakh.

Deposit Insurance and Credit Guarantee Corporation (DICGC), a wholly-owned subsidiary of the Reserve Bank of India, provides insurance cover on bank deposits.

Deposit insurance coverage will be enhanced from Rs 1 lakh to 5 lakh per depositor, the Finance Minister said her Budget speech in Lok Sabha.

At present, the DICGC provides Rs 1 lakh insurance to a depositor regardless of deposit in case the lender fails or liquidated.

- 'Vivad se Vishwas' scheme for direct taxpayers whose appeals are pending at various forum says FM.

- Govt to further ease process of allotment of PAN. Govt to launch system for instant allotment of PAN on the basis of Aadhaar.

- Govt proposes 100 per cent tax concession to sovereign wealth funds on investment in infra projects.

- Concessional tax rate of 15 per cent extended to power generation companies.

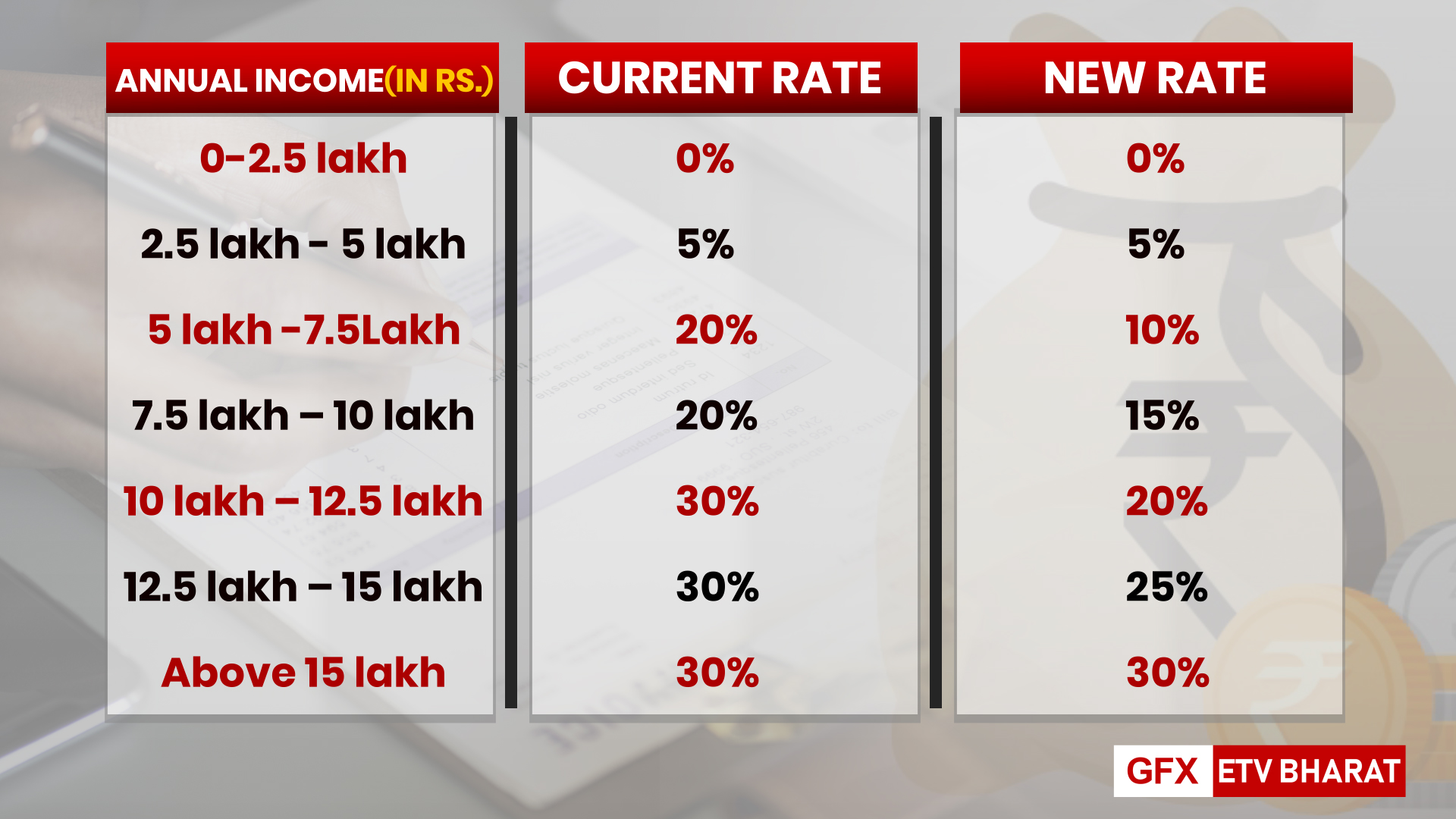

- A person earning Rs 15 lakh per anum and not availing any deductions will pay Rs 1.95 lakh tax in place of Rs 2.73 lakh now: FM.

- No tax on Income up to Rs. 5 Lakh for Individual Tax Payers.Proposed Income Tax Rates

- 25% income tax rate for income between 12.5-15 lakhs income above 15 lakhs remain at 30%.

- 20% income tax rate for income between 10 -12.5 lakhs.

- 15% income tax rate for income between 7.5-10 lakhs.

- Tax rate cut to 10% from 20% for income bracket 5-7.5 Lakh.

- Expected tax buoyancy will take time, says FM.

- Govt proposes amendments to facilitate separation of govt pension trust from PFRDA, says FM.

- The limit for FPI on corporate bonds increased to 15%

- Depositor insurance is increased from 1 lakh to 5 lakhs.

- Insurance cover increased to 5 lakhs from 1 lakh.