Hyderabad: The Indian auto industry has been one of the worst-hit sectors after the Coronavirus pandemic stalled the economy.

The recent data by the Federation of Automobile Dealers Associations (FADA), the apex national body of automobile retail industry in India, showed that total vehicle registration in the country tumbled 42% in June compared with a year ago.

Though this is better than the 88% year-on-year degrowth seen in May, things still look far from stable, especially for two key segments – commercial vehicles and three-wheelers.

CVs & Three-Wheelers

New commercial vehicle (CV) registrations in India dropped by a massive 84% to just 10,509 in June compared with 64,976 a year ago, while those of three-wheelers dropped over 75% to 11,993 from 48,804.

In comparison, registrations of two-wheeler and personal vehicle segments were down by 41% and 38%, respectively.

CV sales in India have taken a major hit due to declining freight demand amid slowdown in private consumption and economic growth.

Transporters are reluctant to make new purchases as only 30-40% of the fleet capacity is currently being utilised in the country, according to industry estimates.

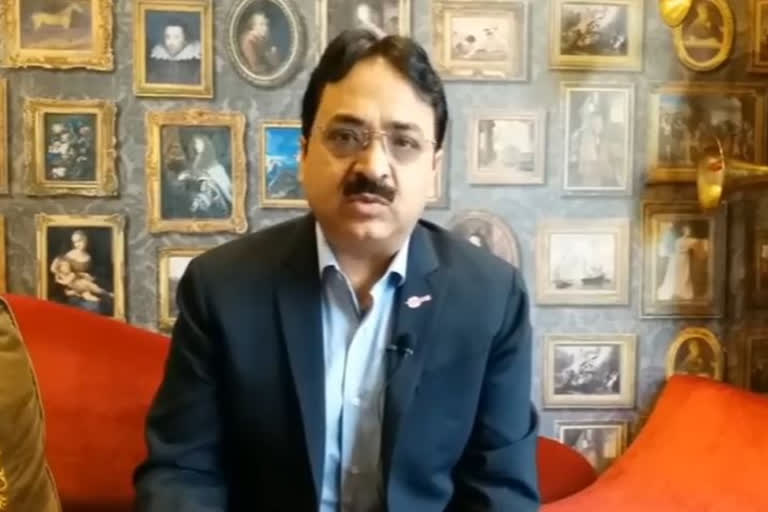

Talking to ETV Bharat, FADA’s Vice President Vinkesh Gulati said: “CV sales are down as production and manufacturing across the country is far below the pre-Covid levels. Factories in containment areas are not operating at all. Different transport associations have come out and said that they are running at just 30-40% of their capacity. This shows that recovery is going to be bleak till the economy is completely back on track.”

Read more:Govt extends gold jewellery hallmark deadline till June

The three-wheeler segment has also taken a major hit as public transport has been severely disrupted in the past few months.

Also, since most of such vehicles are bought on loans by low-income groups, constraints in retail lending due to lockdown has worsened the situation.

“Three-wheeler segment is disturbed as different district administrations are giving different guidelines… most of them are allowing only at most 2 people to sit in the auto to adhere to the social distancing norms,” said Gulati.

“This is directly hitting the earnings of 3-wheeler drivers as earlier they used to carry 3-5 people at one go. Three-wheeler sales are unlikely to normalize until and unless there is a vaccine for Covid-19 or social distance norms ease considerably,” added Gulati.

Two-Wheelers & Personal Vehicles

The milder de-growth in the two-wheeler and personal vehicle in June is also not being seen as a sure shot sign of recovery since concerns over sustainability persist.

Gulati said: “Lot of sales were lost in the peak months of April and May (which see good demand due to the Navratri and wedding season) as the country was under complete nationwide lockdown. So, June saw a lot of pent-up demand.”

“The trend is similar in July so far… but due to lot of intermittent lockdown in different states, the uncertainty factor is back. Aspirational purchases are unlikely this time as safety is a major issue for buyers. Also, priorities of consumers have changed. So, any big discretionary spending might get delayed,” he added.

Sales Outlook

The auto industry was reeling under severe de-growth, even before the pandemic, due to the shaky macro-economic environment in the country.

Domestic auto sales were down nearly 18% in 2019-20, one of the worst declines seen in recent years, but there were hopes of some recovery this year.

The FADA has projected vehicle sales to witness a de-growth range of 15-35% across various segments in FY 2020-21. However, the tractor segment looks set to clock positive annual growth on robust crop situation and timely arrival of monsoon in the current financial year.

“Before the Covid situation, we were expecting to cover up to 50% of the degrowth seen last year. But the situation has changed now,” said Gulati, adding: “I am afraid the real recovery for the auto sector may not happen before 2023-24.”

(ETV BHARAT REPORT)