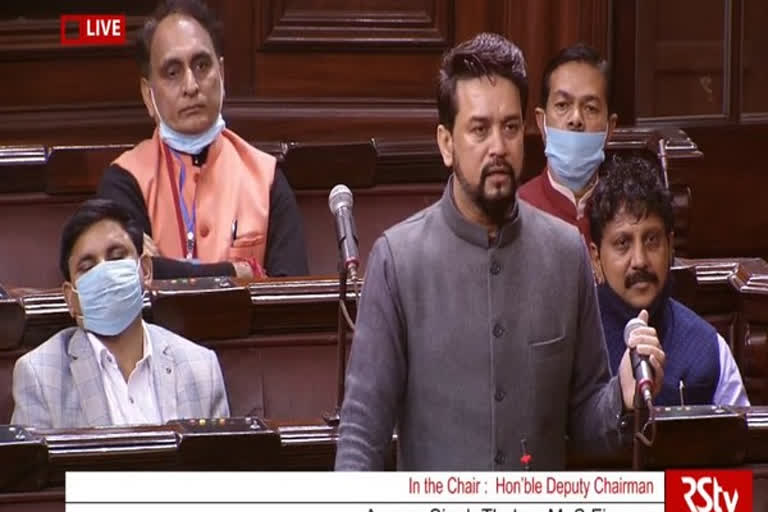

New Delhi: Vivad Se Viswas direct tax dispute resolution scheme launched by the Modi government last year has a success rate of 28% in resolving the income tax and corporation tax-related disputes pending at various forums, Anurag Thakur, minister of state for finance, told the Lok Sabha. Describing the scheme as a success, Anurag Thakur said the government has collected Rs 53,346 crores from taxpayers until March 1, 2021.

In his written reply, the minister informed the Lok Sabha that a total of 1,28,733 declarations have been filed under the scheme which covers 1,43,126 pending tax disputes, including cross-appeals. According to Thakur, there were 5,10,491 tax dispute cases that were eligible to avail the tax dispute resolution scheme.

“The declarations received under the scheme cover more than 28% of pending tax disputes,” he said.

Anurag Thakur said the primary objective of the scheme was an amicable resolution of a large number of pending tax disputes and collection of over Rs 53,000 crore, which was blocked in the litigation was an added advantage which has accrued to the government.

Talking about the benefits of the scheme, Anurag Thakur said of the total over 1.28 lakh declarations made under the Vivad Se Vishwas scheme, 1,393 declarations were filed by the Central PSUs and 833 declarations were filed by State PSUs and boards.

He said the declarations made under the scheme covered tax disputes amounting to Rs 98,328 crore while the taxpayers have made payment of Rs 53,346 crores until March 1 this year.

Faceless assessment, faceless appeal

Talking about the taxpayer-friendly measures, the minister said the faceless appeal scheme was notified in September last year to infuse efficiency, transparency and accountability in the disposal of appeals at the Commissioner level.

Under the scheme, appeals at the commissioner level will be disposed of by removing the interface between the Commissioner (Appeals) and the appellant in the course proceedings.

The minister, however, clarified that appeals relating to serious frauds, major tax evasion, sensitive and search matters, international tax and the black money act will not be covered under the faceless scheme.

Faceless ITAT

The minister said the Finance Bill 2021 will empower the government to notify a scheme that will allow the elimination of interface between the Income-tax Appellate Tribunal (ITAT) and the parties to the appeal.

In addition to Vivad Se Vishwas scheme and faceless assessment and faceless appeal scheme, the finance bill 2021 also proposes for the creation of dispute resolution committees (DRCs) to resolve the issue related to small taxpayers.

The DRC shall have the powers to reduce or waive any penalty imposable or grant immunity from prosecution for any offence under the Income-tax Act of 1961.

Board for Advance Rulings

In order to avoid disputes related to the assessment of tax liability and to provide tax certainty, the Authority for Advance Rulings (AAR) was constituted in 1993.

This year, the government has moved an amendment through the finance act to replace AAR by the Board of Advance Rulings.

Also Read: 'Women journalists more compassionate towards public interest issues'