Patna: With more users getting connected to the Internet and entering the digital payments ecosystem, cyber-fraud incidents may go up in 2021, a researcher at cybersecurity firm said.

The year 2020 saw several UPI-related frauds and several banks have issued advisories alerting their users about the same.

In addition to players like Paytm and Google Pay, the crowded Indian digital payments market will now be joined by WhatsApp which recently got approval to start its payments service in a graded manner.

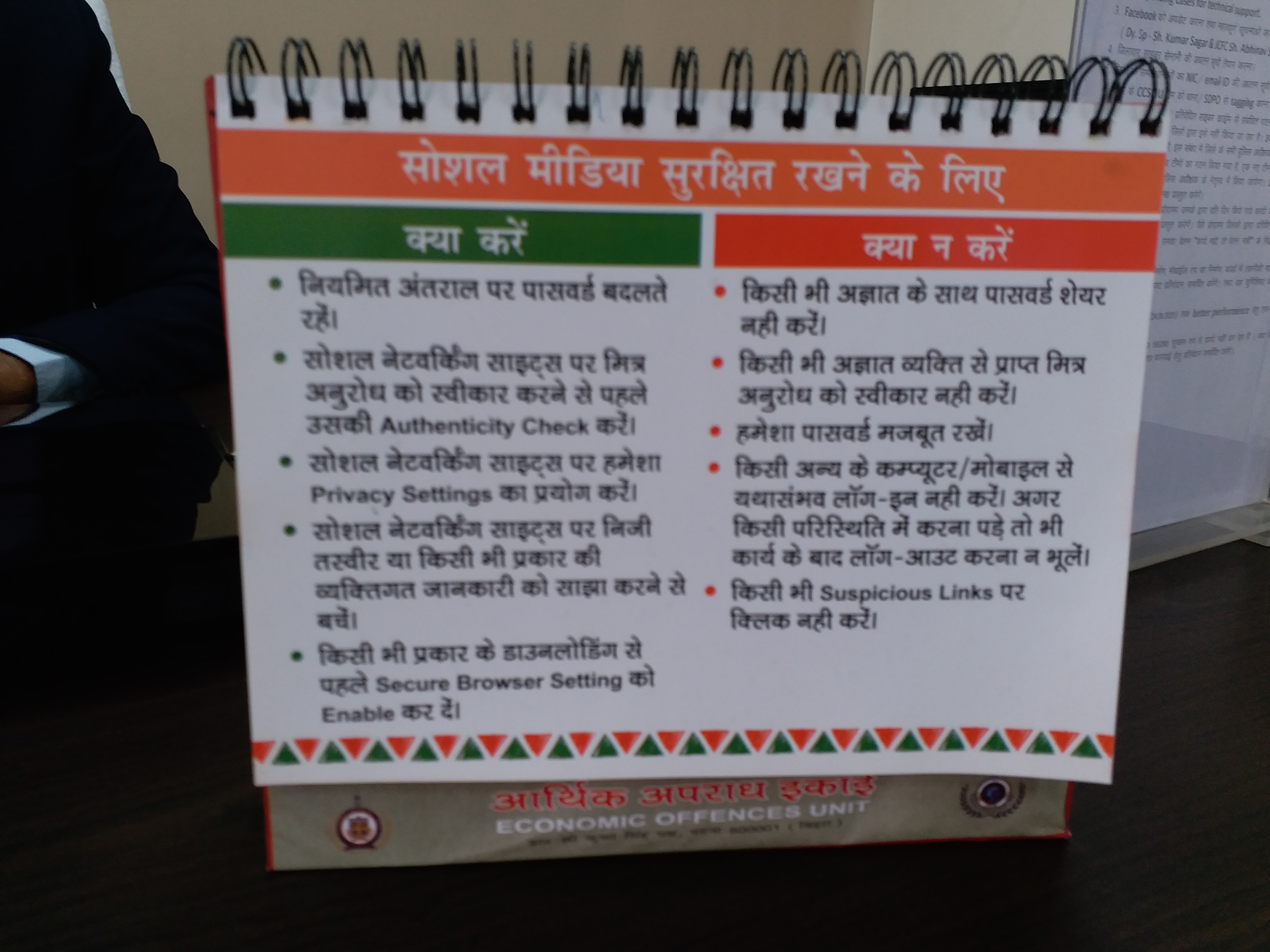

In order to aware the customers who are actively using internet banking and Unified Payments Interface as their primary payment method, financial crime branch, Patna has distributed a cyber calendar which has several precautionary measures printed on every alternate page.

Also Read: 'Awareness and alertness key to protection from cybercrimes'

While speaking to ETV Bharat, Jitendra Singh Gangwar, ADG, Financial Crime Branch, said that the calendar will alert the users about the safety measures that should be taken while performing any online transactions.

"The craze of online transactions have been mounting day by day. This also increases the probability of getting cheated by the fraudsters. Usually, the fraudsters call or ask to share a one-time password (OTP) and then they transfer the amount to their account", added Gangwar.

Further, he shares a few precautionary measures which should be taken before performing any online transactions:

- If no relatives living abroad, try to decline the call

- Never share OTP to others

- Enable two-factor authentication

- Never click on suspicious links

- Banks never call for personal details; never share your bank details to anyone

- Avoid accepting friend requests which are unknown to you

- Never use public Wi-Fi while using internet banking

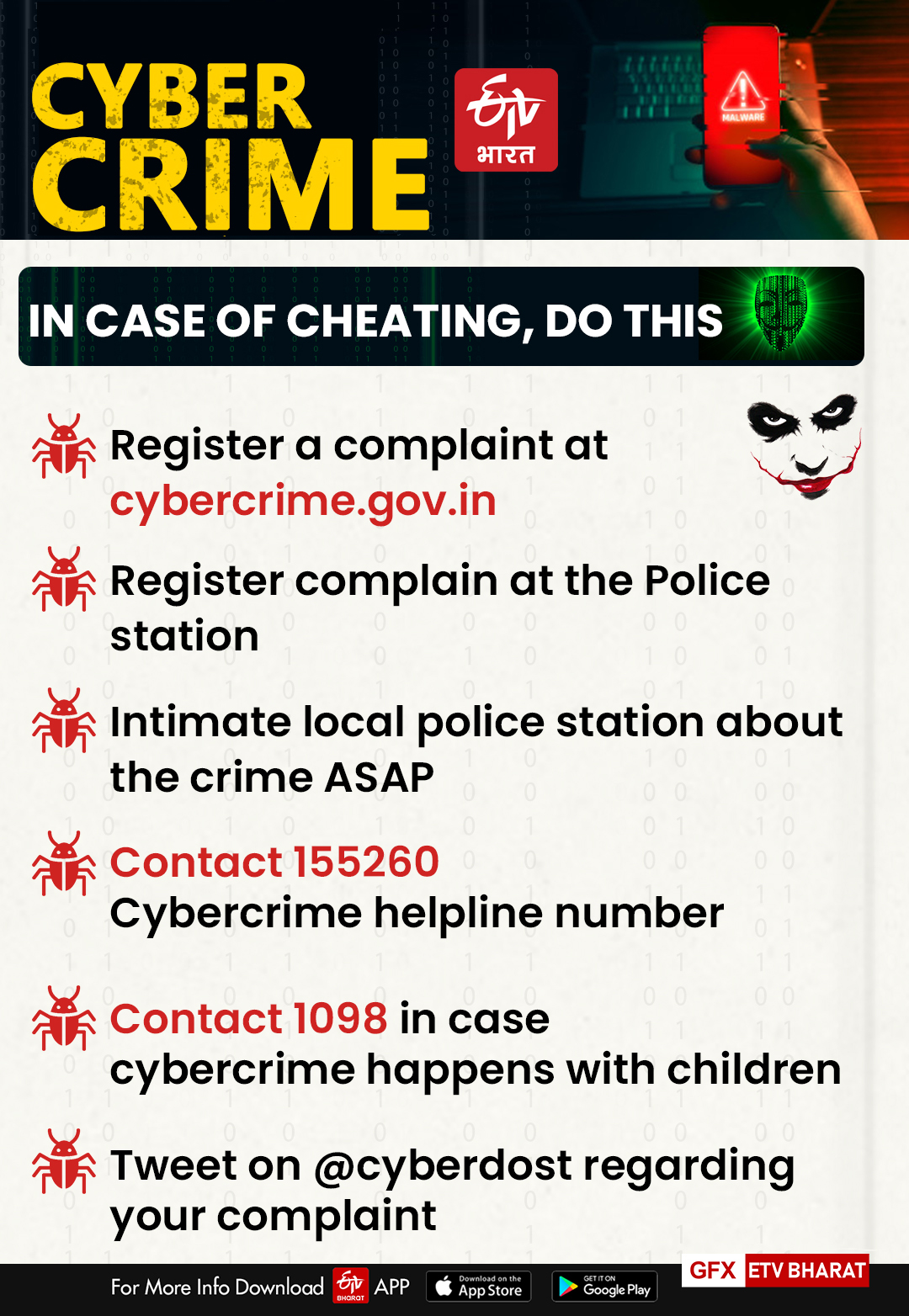

Also, the Financial Crime Branch ADG advised filing a written complaint to the nearest cyber police station within 24 hours of the transaction.

"A criminal is a fast learner. He keeps upgrading his skills in line with his changing surroundings, making it difficult for the law enforcing agencies to keep pace. Those involved in white-collar crimes are even harder to trace and arrest as, unlike other criminals they can commit a crime without being physically present near the victim. Now it seems that cybercriminals have fast adapted to the country's state of lockdown and evolved new tactics to dupe people. So, beware of such fraud calls and messages also", added Gangwar.

Also Read: Amid privacy concerns, cyber experts stress need for a strong data protection bill