MSME SECTOR

1. Collateral free automatic loan

A total of 45 lakh MSMEs to benefit. loans will have a moratorium of 12 months and the amount will be Rs. 3 lakh crore. SMEs will be able to avail a four year period loan, 100% credit guarantee given to banks on principal and interest. Facility will be open till 31st October 2020, No guarantee fees.

2. Subordinate debt provision

We want to infuse Rs 20,000 crore for stressed MSMEs. Stressed MSMEs have liquidity facility, 2 lakh SMEs expected to be benefited. NPAs or stressed MSMEs can take benefit of this scheme. Government to provide Rs 4,000 crore, through Credit Guarantee Trust.

3. Fund of funds

A fund to infuse liquidity into the MSMEs. Fund of funds will ensure equity infusion of Rs 50,000 crore, it’s for those SMEs who are viable and need holding due to COVID-19. The union government to create a corpus of Rs 10,000 crore, through mother and daughter corpus. It will help SMEs to expand and get listed in the market.

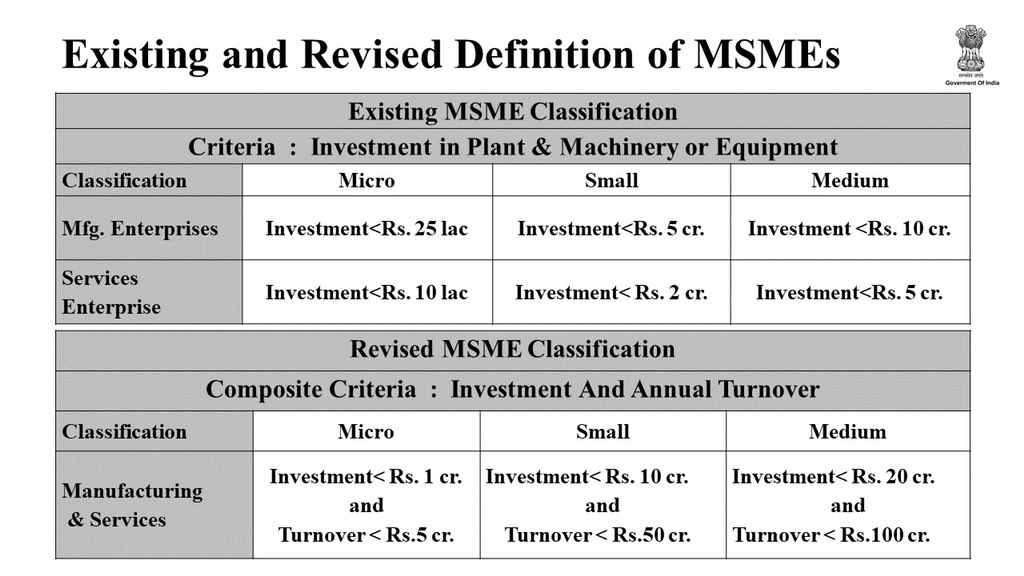

4. Definition of MSMEs revised

Definition of SME changed in the favour SMEs, there was a fear among successful SMEs that if they grow beyond a size then they will lose SME benefit.

New definition based on investment. Investment limit to be revised upwards for small and micro industries, additional criteria of turnover also being introduced. Besides, distinction between manufacturing and service sector eliminated.

5. Shift in Global Tender policy

Tenders up to Rs 200 crores will no longer be on global tender route. It means for government tenders worth up to Rs 200 crore, global tenders will be disallowed. It means local industry will be given exclusive rights for govt tenders worth Rs 200 crore or less.

CPSEs and Govt of India will clear all the receivables (their pending bills for the job done by them or for the supplies being made by them) in 45 days.