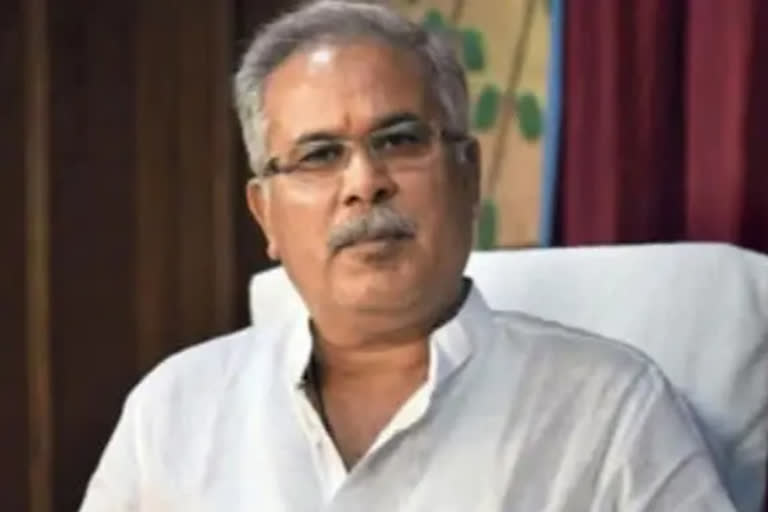

New Delhi: Chhattisgarh Chief Minister Bhupesh Baghel reiterated the state's demand for the continuation of GST compensation grant for next five years in the pre-budget meeting on Thursday.

Bahgel's demands came during the customary pre-budget consultation meeting Union Finance Minister Nirmala Sitharaman held with state finance ministers, as well several CMs, including Baghel, at Vigyan Bhawan in Delhi.

Along with GST compensation, he also demanded reimbursement of expenditure worth Rs 15,000 crores on the Central Security Forces deployed for Naxal eradication. He further sought the transfer of Rs 4,140 crores collected as 'additional levy' from coal block companies in Chhattisgarh.

While briefing the Union Finance Minister, the CM also said that the state’s economy has been impacted due to disruption of financial activities during COVID-19 pandemic. On GST compensation, he asserted that the state government will be able to spend on development programmes and schemes if the pending amount is received.

Also read: Govt extends FY21 GST annual return filing deadline till Feb 28

"There has been a loss of revenue to the states due to the GST tax system, the Center has not made arrangements to compensate the loss of revenue of about Rs 5000 crores to the state in the coming year, so the GST compensation grant should be continued for the next 5 years even after June 2022", Baghel pointed out.

Baghel claimed that Chhattisgarh has received less share of central taxes by Rs 13,089 crore in the Union Budget of the last three years. "In the coming budget, the share of central taxes should be given to the state completely," he also said.

He also demanded that Rs 4,140 crore deposited with the center at the rate of Rs 294 per tonne on coal mining from coal block companies should be transferred to Chhattisgarh soon.

Chhattisgarh has demanded for a special provision to be made in the next budget for the reimbursement of the expenditure of 15 thousand crores made by the state government on the central security forces deployed in the state for the eradication of Naxalism.

Apart from these, Baghel has also given suggestions like generous amount to the farmers and laborers through various schemes, to make the wage rate of MNREGA at par with the labor commissioner's rates, to give special incentives for production of pulses/oilseeds, the establishment of International Cargo Terminal in Raipur, a campus of Central Tribal University and marketing center under Vocal for Local Scheme in the Union Budget.

Also read: Only bullets can't solve Naxalism, need 360-degree strategy: Chhattisgarh CM Bhupesh Baghel

The Chhattisgarh CM also raised the issue of Excise tax reduction on the rates of petrol and diesel. He said, "Due to the reduction of Central Excise Tax on petrol and diesel by the Center, there will be a reduction in the amount of the state's share and also there will be a reduction in the revenue from VAT, so in future, instead of excise tax, the cess should be reduced."

He also raised a demanded increase in the premium limit of Rs. 1100 per family for the states which are performing better under Pradhan Mantri Jan Arogya Yojana (Ayushman Bharat). Along with this, he said that the families eligible under the National Health Insurance Scheme should also be eligible under the Pradhan Mantri Jan Arogya Yojana and the share of states should be reduced to 75 percent by reducing the participation of the states in the Pradhan Mantri Awas Yojana and Jal Jeevan Mission.