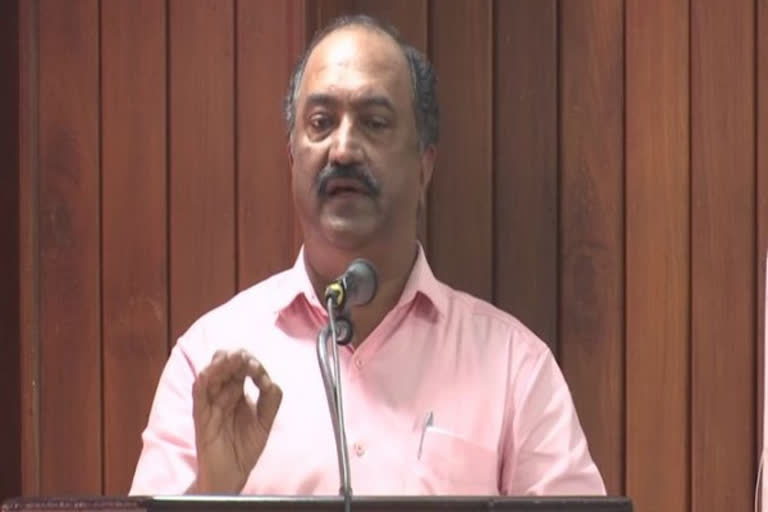

Thiruvananthapuram(Kerala): The citizens have not received the full benefit of the cut in excise duty on petrol by the Centre and the consequent reduction, by Kerala, in the tax on the fuel due to an increase in its base price by oil companies, the state government claimed on Monday. State Finance Minister K N Balagopal in a statement, claimed that with the Rs 8 cut in excise duty on petrol and the Rs 2.41 reduction in the tax on the fuel, the total decrease should have been of Rs 10.41, whereas in reality it was only Rs 9.40.

There is, however, no such issue in the case of diesel where the benefit of excise duty cut and reduction in state tax is in full effect at the pumps.

The reason it is not so in the case of petrol, according to the minister, was the increase in the base price of the fuel by 79 paise. Sources in the state Finance department said that the oil companies increased the base price of petrol with the concurrence of the Centre.

Balagopal, in his statement, said that if the Centre allows the price of petrol to be hiked like this, then the benefits of the cut in excise duty and state taxes on the fuel would be lost within a month. On Sunday, the Congress-led UDF had disputed the LDF government claim of having cut taxes on petrol and diesel, after the Centre slashed excise duty on the two fuels, saying it was just a consequence of the central government's decision and not a conscious reduction by the state.

Congress leaders contended that it was unfortunate that the state was claiming it has cut tax on petrol and diesel, when in reality the reduction was a proportionate decrease due to the slash in excise duty by the Centre.

Also read: Maharashtra, Kerala, Rajasthan reduce VAT on petrol, diesel after Centre cuts excise duty

The contention was denied by Balagopal who claimed that the reduction was a conscious decision and not a proportionate decrease. He had also said that the state has decided that when there is a reduction in price of petrol and diesel, it would reduce the taxes on them. However, everyone agreed on one point that the Centre needs to slash the excise duty even more. The Union government on Saturday had cut excise duty on petrol by Rs 8 per litre and that on diesel by Rs 6 per litre to give relief to consumers being battered by high fuel prices which has also pushed inflation to a multi-year high.

PTI