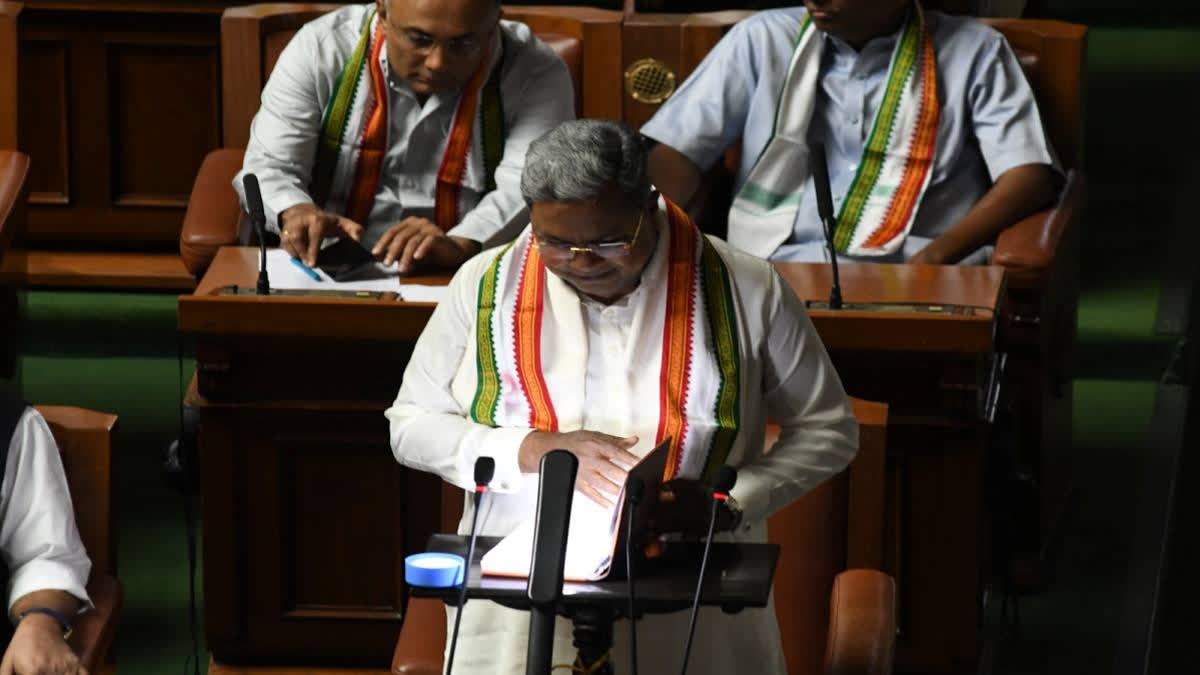

Bengaluru(Karnataka): Karnataka Chief Minister Siddaramaiah on Friday presented the state budget 2024-25 announcing a revision in tax slabs for Indian Made Liquor and beer along with restructuring of the tourism policy to attract more investment.

This is Siddaramaiah's 15th budget presentation with the first being in 1995-96. After forming the government in May 2023, Congress is set to revise beer prices for the second time. In its previous budget in July, the state government had imposed an additional excise duty of 20 percent on beer.

Tabling the budget in the Assembly, Siddaramaiah said that Rs 100 crore will be given for developing Anjanadri Hills and areas of Koppal district that hold mythological importance. He said that the tourism policy will be revised to draw more tourists and invite higher investment to the sector. Around Rs 52,000 crore has been reserved for the guarantee schemes and 50 women-run hotels or cafes would be set up across the state.

The 'Anna Suvidha' scheme is aimed at providing food to the elderly population aged above 80. A new scheme for cereals 'Namma Millet' has also been announced.

Siddaramaiah slammed the Centre for alleged GST (Goods and Services Tax) shortfall of Rs 59,000 crore. He said, "The state suffered a financial loss due to the Centre's unscientific implementation of GST. The Centre had assured of a 14 percent growth when GST was introduced and had promised to compensate states in case of any shortfall."

"It was estimated that GST tax collection would be 4,92,296 crore from 2017 to 2023-24 but in reality, only 3,26,764 crore was collected leading to a shortfall of 1,65,532 crore. However, the Centre released a compensation of 1,06,258 crore resulting in the state incurring a loss of 59,274 crore," he added.

The state government has also decided to set up a Bangalore Business Corridor. A new 44 km metro route has been approved along with the construction of a 250 metre-high skydeck in the city. The airport metro line will be completed by 2026 and the Cauvery phase-5 will be completed by December this year.

Read More

Assam Govt Tables Rs 2.9 Lakh Crore Budget, Proposes No New Tax