Srinagar: Despite the government's claim of improving the economic situation in the Union Territory of Jammu and Kashmir, the liabilities have increased since 2019, as per the budget approved by the Government of India.

However, the Jammu and Kashmir administration defends its liabilities, saying it has maintained the ratio between debt and gross state domestic product (GSDP).

As per the budget 2024-2025 approved by the Parliament, the liabilities of Jammu and Kashmir have increased to a staggering Rs 1,12,797 crore in the fiscal year 2022-23 from Rs 83,573 crore in 2019-2020.

In 2020-2021, the liabilities increased to Rs 92953 crore, which increased to Rs 101462 crore in 2021-2022 and Rs 112797 crore in 2022-2023.

Of the liabilities of 2022-2023, the public debt stands at Rs 69,617 crore, which includes Rs 68,786 crore in internal liabilities and Rs 831 crore in loans and advances from the government of India.

The remaining Rs 43,180 crore comprises insurance and pension funds (Rs 1,331 crore), provident funds (Rs 28,275 crore), and other obligations (Rs 13,574 crore).

As per the budget, the public debt alone has increased from Rs 62,395 crore to Rs 69,617 crore in one financial year.

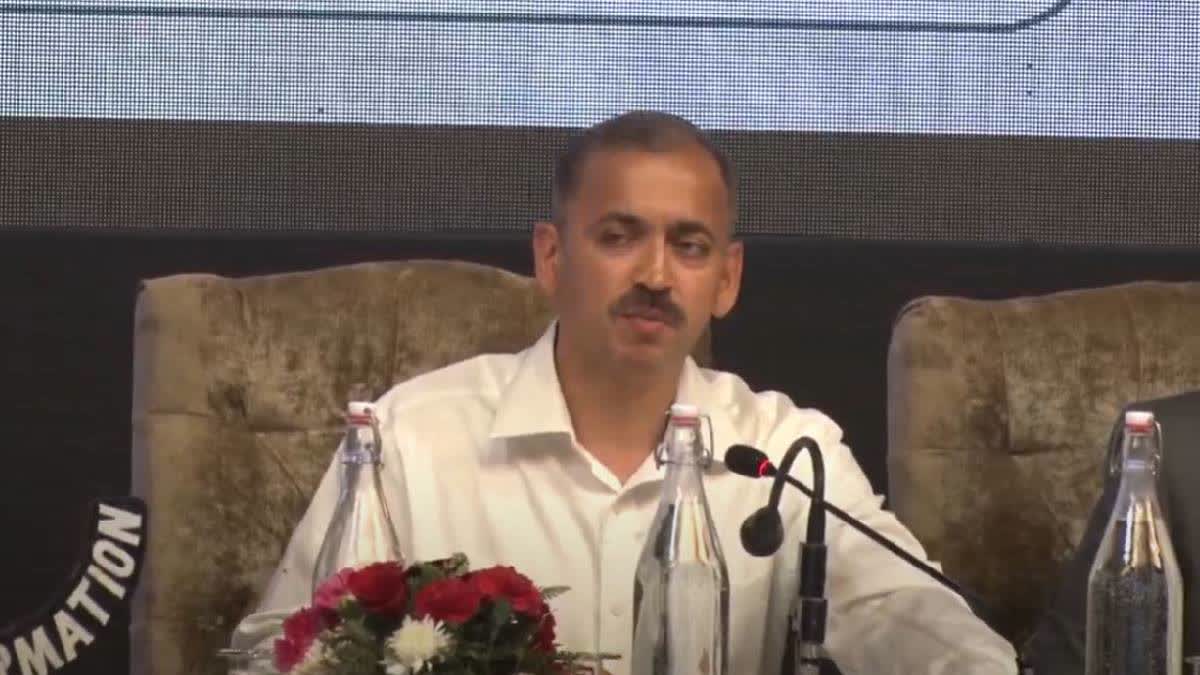

Santosh D Vaidya, Principal Secretary to the Government of Jammu and Kashmir, Finance Department, said that as far as the economy of Jammu and Kashmir is concerned, the ratio of debt liabilities has remained between 49 to 51 percent in the last 40 years. This year also, our GSDP is Rs 2.63 lakh crore and debt is Rs 1.12 lakh crore; so overall, we have tried to maintain the ratio, he said.

"Infact, if you see the Union Budget it is also going as per the same trend, that without targeting fiscal deficit how much debt can we manage. The country is also moving towards that," Vaidya told ETV Bharat.

Zuhaib Mir, PDP leader, said the debt burden is likely to constrain the region's economic recovery and development efforts in the coming years.

"The dramatic rise in debt reflects either an inability to control spending or lack of effective revenue generation strategies. The significant jump to Rs. 1,12,797 crore in 2022-23 indicates that the administration has not been able to curb its borrowing despite warnings from financial bodies like the Comptroller and Auditor General of India (CAG). The CAG's criticism that borrowed funds are being used for current consumption rather than for capital creation points to unsustainable fiscal practices," Mir told ETV Bharat.

Responding to Vaidya's debt to GSDP ratio theory, Mir said the debt-to-GDP ratio of 51 percent projected for 2024-25 is alarmingly high, placing J&K in a precarious position.

"A high debt-to-GDP ratio limits the government's ability to invest in essential infrastructure and social services, thereby stifling long-term growth," he said.

Economic experts said high debt is detrimental to growth as it crowds out space for economic development because of debt repayment and debt servicing obligations.

"For an economy like J&K which has a limited productive capacity, carrying a debt to GDP ratio of around 50 percent can be disastrous. It tailspins into a classic debt trap where you borrow more to repay previous debt. The cycle gets more lethal with every new iteration of borrowing. Its deteriorating condition is even violating the FRBM Act of fiscal responsibility," economist Ejaz Ayoub told ETV Bharat.

Read more

No Power Tariff Hike In Jammu And Kashmir In Last Three Years: LG Manoj Sinha