Any major industry manufacturing goods takes off with one facility. Further expansion to multiple locations depends on the scale of the product endeared by the end consumer. They foray into the market gradually at local, regional, national and global levels. In these segments, consumers switching a choice between brands depends on individual perceptions. Capex of these businesses will be in synchronous with sales outgo, enabling their profit margins be ploughed back for follow-up capital. That is to say initial roll-out expenditure can be minimal.

The story of the telecom sector as a service is not so. The service needs to be rolled out throughout the licensed service area or nation at one go, to provide seamless national connectivity. Taking all parameters into account such as prevailing government policy, spectrum availability, regulatory hiccups, hardware longevity and compatibility, future technological changes, and varied geographic conditions of the service area, the CAPEX requirement is huge.

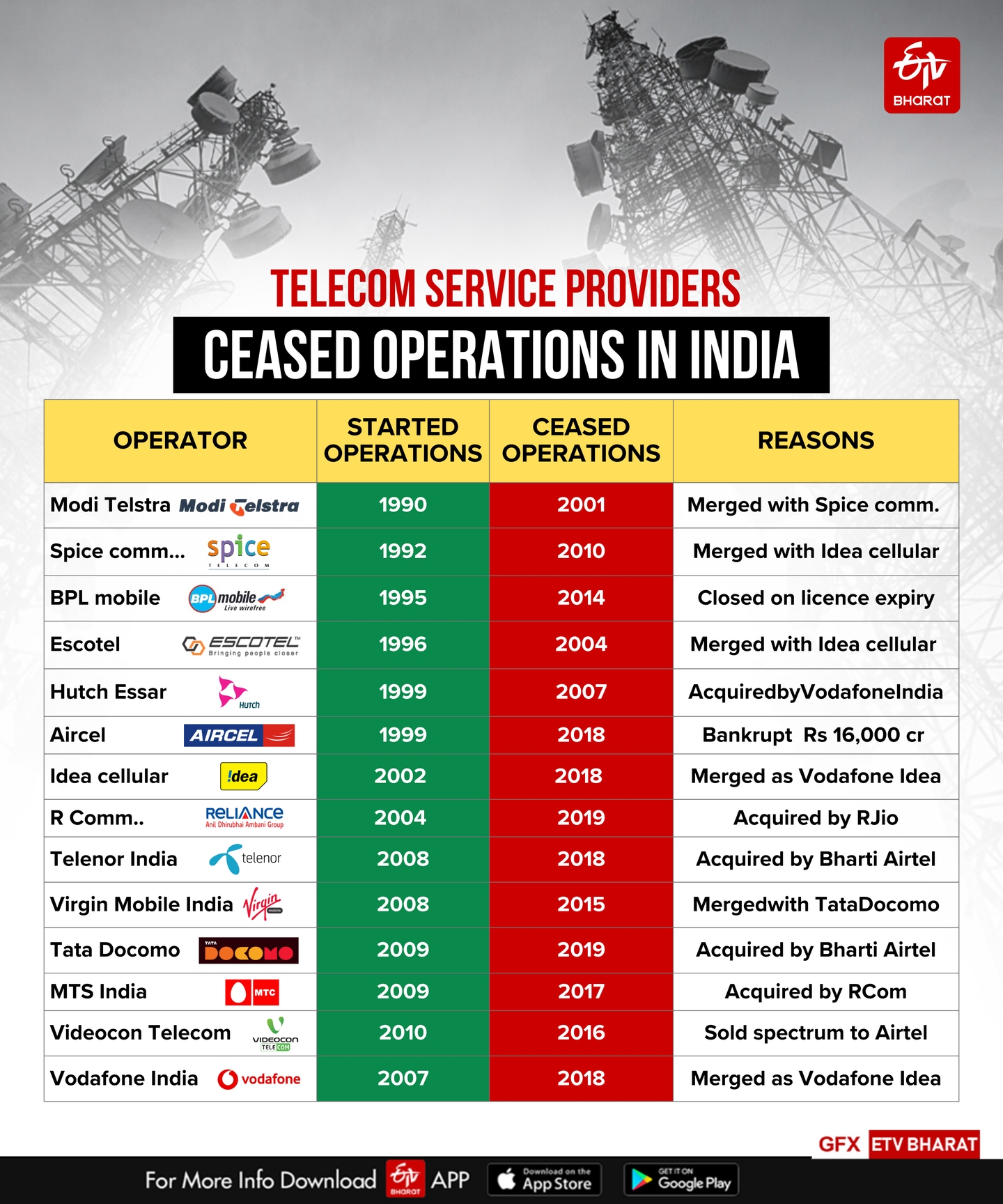

To obviate this difficulty, the TSPs resort to freebies in different forms of promotional offers. The tariffs of varied products knowingly kept below cost price, to make lucrative and attract mass migration of customers from already existing TSPs, notably from BSNL/MTNL. Thanks to the MNP allowed by TRAI from January 2011 onwards. Post-liberalisation after 1990, dozens of TSPs forayed to roll out mobile services under a competitive environment, and the belligerence in irrational pricing gained pace with the entry of Rcom in 2004. The next decade witnessed many smaller TSPs.

It is worth recalling that, then Chief Minister of West Bengal, Jyoti Basu made the first mobile phone call in India, inaugurating Modi Telstra's MobileNet service, from Calcutta (now Kolkata) to then Union Telecom Minister Sukhram at New Delhi, on July 31, 1995.

The launch of Jio platforms in 2016 changed the market dynamics substantially as the company offered free data/voice services during its first year of operations, prompting a fierce price war in the market. Jio managed to garner over 100 million subscribers in its first six months of operations. Bharti Airtel could only withstand the onslaught. Idea Cellular and Vodafone India Ltd were forced to merge to form Vodafone Idea Ltd in 2018, for survival, besides the strategic BSNL. GOI is obligated to be sympathetic towards VIL in considering the delayed payment of AGR dues, converting dues to equity etc, to avoid duopoly in this vital sector.

In the just concluded 25th June 2024 spectrum auction, while the government placed 10,500 MHz of radio waves worth over Rs 96,238 crore for auction, Airtel, RJio and VIL together bought only 141.4 MHz for Rs 11,341 crores. This considerably reduced the budgeted revenue of the Government of India. Funds crunch for telcos is one of the reasons.

Due to unethical competition and irrational pricing adopted by private TSPs, Indian consumers enjoyed data at NO cost/LOW cost for more than two decades. For a long time, India stood the cheapest per GB cost among 237 countries in the world and currently hovering around the 8th position, while the United Kingdom is at 58 and the USA at 219. Now the TSPs trio increased tariff by 12 to 25 per cent and hopes to see the ARPU from the current 200 levels to scale to 300 rupees by the end of the Financial Year 2025. Financial experts opine that rational returns on capex employed would make telcos operationally leveraged, and enable them to concentrate on QOS simultaneously with growth, by augmenting its tower infrastructure as needed, for smoother hand-overs and avoiding call dropping. Pampering the customer gradually should come down to zero.

Regulators and the Government of India should seriously think of rational pricing, which will not only benefit the TSPs but also banks and financial institutions, to reduce NPAs caused by TSPs. The government should not compromise on the base price of the spectrum, and realisation of AGR dues in full, which should aid its own fiscal kitty, to combat the formidable cyber threats. This will also contribute to a reduction in emissions due to the frugal use of data by consumers.

(Disclaimer: The opinions expressed in this article are those of the writer. The facts and opinions expressed here do not reflect the views of ETV Bharat)