Due to higher income from agriculture, the rural economy has a good chance of recovery this year. Agile decision-making is necessary to take advantage of current global prices. Decisions to ease restrictions on trade need to come as easily as the decisions to impose them. The prospects of Kharif output appears to be quite promising and the government has already begun to change the export policy with regard to a few crops, particularly the soybean.

The hound reality suggests that similar measures are needed to be taken up with regard to rice and sugarcane. In expectation of a good harvest, the union government announced a number of decisions on trade. In addition, some more easing of export restrictions on non-basmati rice and sugar can be expected in the next couple of months.

Edible oils: Protecting farmers

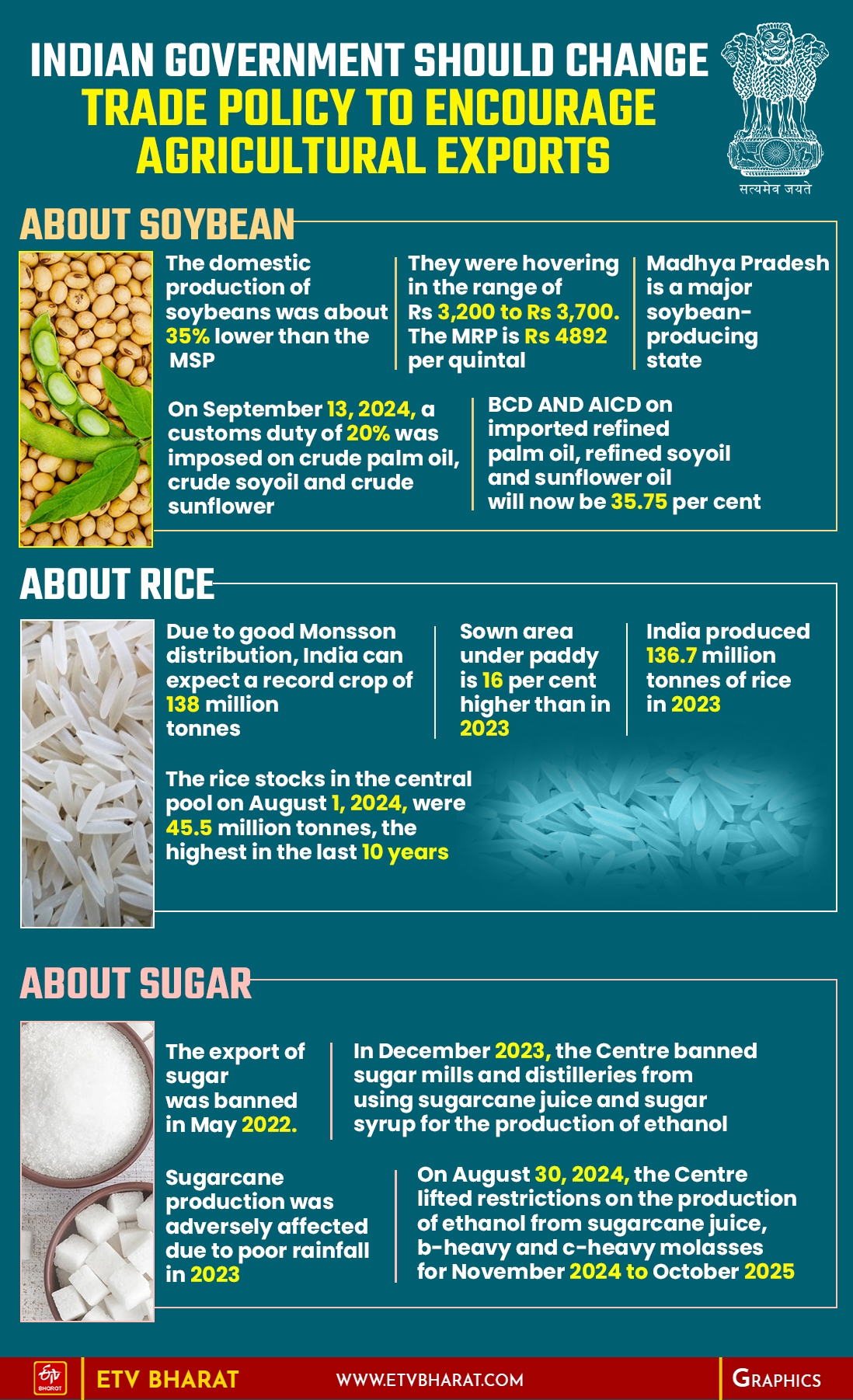

The most important announcement was to raise import duty on edible oils as the sown area under soybean is 2.16 lakh hectares more than normal. The domestic prices of soybean were about 35 per cent lower than the MSP as they were hovering in the range of Rs 3,200 to Rs 3,700 per quintal while the MSP is Rs 4892 per quintal. These prices were almost at par with the prices ten years ago. Madhya Pradesh is a major soybean-producing state and it is the home state of the agriculture minister.

The government did well to protect the soybean farmers from these low and absolutely unremunerative prices. On September 13, 2024, basic customs duty (BCD) of 20 per cent was imposed on crude palm oil, crude soyoil and crude sunflower oil. So far, the BCD was zero and imports attracted only 5.5 per cent of Agriculture Infrastructure and Development Cess (AIDC). The overall import duty on these oils now will now be 27.5 per cent.

The BCD and AIDC on imported refined palm oil, refined soyoil and refined sunflower oil will now be 35.75 per cent against the earlier rate of 13.75 per cent. Notwithstanding higher duties, procurement by government agencies may still be required, at least in the early days of market arrivals.

Globally, soymeal prices are lower than last year. India's soymeal is non-genetically modified, but exporters are not able to get a premium for that. The government needs to highlight this through media campaigns. Exports to Iran, Bangladesh and other Southeast Asian countries can lift soymeal prices and it can enable soybean processors to pay at least the MSP to farmers.

If farmers do not get a remunerative price for soybean, it is possible that the farmers may switch to paddy next year as (due to the bonus declared by the state government) they receive Rs 3,100 per quintal for paddy while its MSP is Rs 2,183 per quintal.

Rice: Export ban needs to go

The other crop of concern is rice. Due to good monsoon distribution, India can expect a record crop of up to 138 million tonnes. Sown area under paddy is about 16 per cent higher than last year. Despite poor monsoon rainfall in 2023, India produced 136.7 million tonnes of rice. The rice stocks in the central pool on August 1, 2024, were 45.5 million tonnes, the highest in the last ten years.

Due to the lower procurement of wheat in the last two years, the government has been giving rice even in predominantly wheat-eating states (under the National Food Security Act, 2013). The government has even allowed the Food Corporation of India to give up to 2.3 million tonnes of rice for ethanol. Ethanol distilleries will probably get it around the price fixed under the open market sale scheme (Rs 2,800 per quintal) while the economic cost of rice for 2024-25 is estimated at Rs 3,975 per quintal.

Excessive stock of rice with the government in the central pool is due to a ban on the export of non-basmati raw rice since July 2023. In view of a bumper crop of rice, there is a strong case for lifting the ban on the export of raw rice. This will not only provide storage space with FCI and state agencies for rice procured under Kharif Marketing Season 2024-25, but it will also reduce the carrying cost of rice.

Also, the canalisation of exports through National Cooperative Export Limited (NCEL) needs to be removed and private trade allowed to export. This will be India's contribution to the food security of the Global South.

Sugar: Global market provides an opportunity

The export of sugar was banned in May 2022. In December 2023, the government banned sugar mills and distilleries from using sugarcane juice or sugar syrup for the production of ethanol. This was done to ensure adequate availability of sugar for domestic consumption.

Last year, sugarcane production was adversely impacted due to poor rainfall, especially in Karnataka and Maharashtra. Considering good monsoon distribution, the government on August 30, 2024, lifted the restrictions on the production of ethanol from sugarcane juice, b-heavy and c-heavy molasses for the next ethanol supply year (November – October).

The Indian Sugar and Bio-Energy Manufacturers Association (ISMA) estimates that at the end of the current sugar year on September 30, there will be 9.1 million tonnes of sugar in India. There is no need for carrying such a high level of stock as the sugar production in 2024-25 is estimated at 33.3 million tonnes. In 2023-24, about 2 million tonnes was diverted to ethanol.

Since domestic consumption is projected to be about 29 million tonnes in 2024-25, even if four million tonnes of sugar is diverted to ethanol, India will have about 9 million tonnes of sugar on September 30, 2025.

The price of white refined sugar at ICE London is about $527 per tonne. India can realise about $530 per tonne if export is allowed. There is scope for allowing the export of up to one million tonnes of refined sugar to realise good prices in the global market.

In view of the current global demand for the above-discussed agricultural produce, the government should change the export policy immediately.

(Disclaimer: The opinions expressed in this article are those of the writer. The facts and opinions expressed here do not reflect the views of ETV Bharat)