Hyderabad: Schools and colleges will report 12 to 14 percent revenue growth this fiscal amid higher enrolments that allow upward fee revisions and students searching new course options, CRISIL Ratings, a subsidiary of CRISIL Limited said in a statement.

The growth will be despite the high base following three consecutive years of high-teen growth.

Higher enrolments and better utilisation of assets should cover increasing salary costs for faculty and other ancillary expenses for new courses and, thereby, aid in maintaining the operating margin at around 28 percent. Also, educational institutes will continue to help capital expenditure (capex) to improve infrastructure and enhance intake capacities, the report stated.

Study including 96 institutions:

"An analysis of 96 educational institutes rated by CRISIL Ratings, accounting for almost Rs 20,000 crore fee income, indicates as much. Enrolments for the educational institutes in the K-12 segment, largely schools, will continue to rise due to two reasons namely rising demand for high-quality education and improved affordability as income levels rise," it added.

The government aims to increase the gross enrolment ratio (GER) for higher education to 50 percent by 2035, from below 30 percent (presently), by promoting new institutions while expanding and improving existing institutions as well as increasing penetration among the addressable population. Even as intake capacity increases, utilisation rates for schools and higher-education institutes may improve around 86 to 87 percent this fiscal from 85 percent last fiscal, the report said.

Occupancy in institutes to be boosted by better placements:

Himank Sharma, director, CRISIL Ratings, said "Occupancy in Computer Science courses in engineering colleges remained healthy in 2024 fiscal despite subdued placements. Moreover, new courses on Artificial Intelligence, Data Science and Machine Learning were in high demand. Occupancies in these courses will be further boosted by better hiring signals in 2025. Medical colleges and schools, too, continue to register high enrolments, driving fee income growth. Hence, educational institutes have the flexibility to undertake periodic fee revisions, which will result in fee income being higher by 12 to 14 percent in the current fiscal."

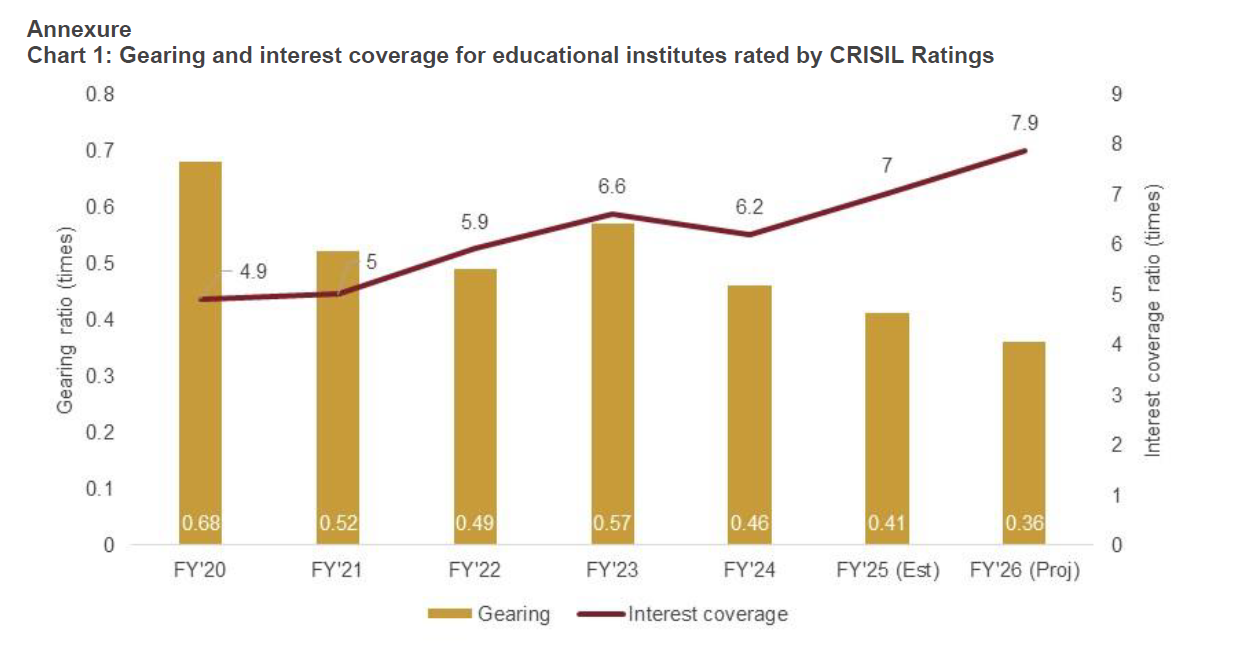

Despite the increase in fee base, working capital requirement will remain minimal as fee receivables have been controlled at 45 to 50 days over the past few fiscals. Further, interest coverage ratio will improve to around 0.41 and 7.0 times, respectively, this fiscal, as against 0.46 and 6.2 times last fiscal

Nagarjun Alaparthi, associate director, CRISIL Ratings, said, "Strong cash generation by educational institutions led to capex spends increasing by 18 to 20 percent of existing gross blocks, reaching an all-time high in 2024. Even in the current fiscal, schools and colleges will continue to expand their capacities by investing heavily in land and infrastructure, around 14 to 16 percent of existing gross blocks, while adding various new courses to their portfolio. Yet, credit profiles of education institutes will remain stable as leverage continues to be low."

Read more