Kolkata: The Reserve Bank of India (RBI) has declared its highest-ever dividend payout, amounting to Rs 2.11 lakh crore, to the Central government for the fiscal year 2023-24. This decision is expected to greatly improve the Centre's management of the fiscal deficit or the shortfall between the government's revenue and expenditure. This allocation was significantly higher than the previous high of Rs 1.76 lakh crore achieved in 2018-19. The dividend or surplus transfer by the RBI to the Centre was Rs 87,416 crore for fiscal 2022-23. The previous high was Rs 1.76 lakh crore in 2018-19.

The decision on the dividend payout was taken at the 608th meeting of the Central Board of Directors of the RBI held under the chairmanship of Governor Shaktikanta Das.

What led to the increase in RBI dividend payout?

The Reserve Bank of India's record dividend to the Central government could have mostly come from high income from the forex holding of the Central Bank. RBI's surplus transfer to the government for the financial year 2024 is based on the Economic Capital Framework as per recommendations of the Bimal Jalan Committee. A research report by the State Bank of India said that the surplus income for the Central Bank was decided by its liquidity adjustment facility operations and interest income from its holding of domestic and foreign securities. Balances under the daily liquidity adjustment facility show that RBI was in absorption mode for most of the financial year and that it absorbed liquidity for 259 days out of the 365 days. An increase in the price of gold also added to the overall expansion in RBI's balance sheet, according to SBI.

Incidentally, the record dividend payout by the Central Bank is 40 per cent higher than the total dividend of Rs 1.5 lakh crore that the Centre is expecting from the RBI, state-owned financial institutions and non-financial public sector companies combined, in 2024-25, according to the interim budget tabled by the Centre in last February.

| Year | In crore rupees |

| FY24 | 2,10,874 |

| FY23 | 87,416 |

| FY22 | 30,307 |

| FY21 | 99,122 |

| FY20 | 57,128 |

| FY19 | 1,75,988 |

RBI dividend history

Higher dividends will help the new government

The new government’s budget following the release of election results in June is likely to be presented in July and it will determine how the dividend will be used.

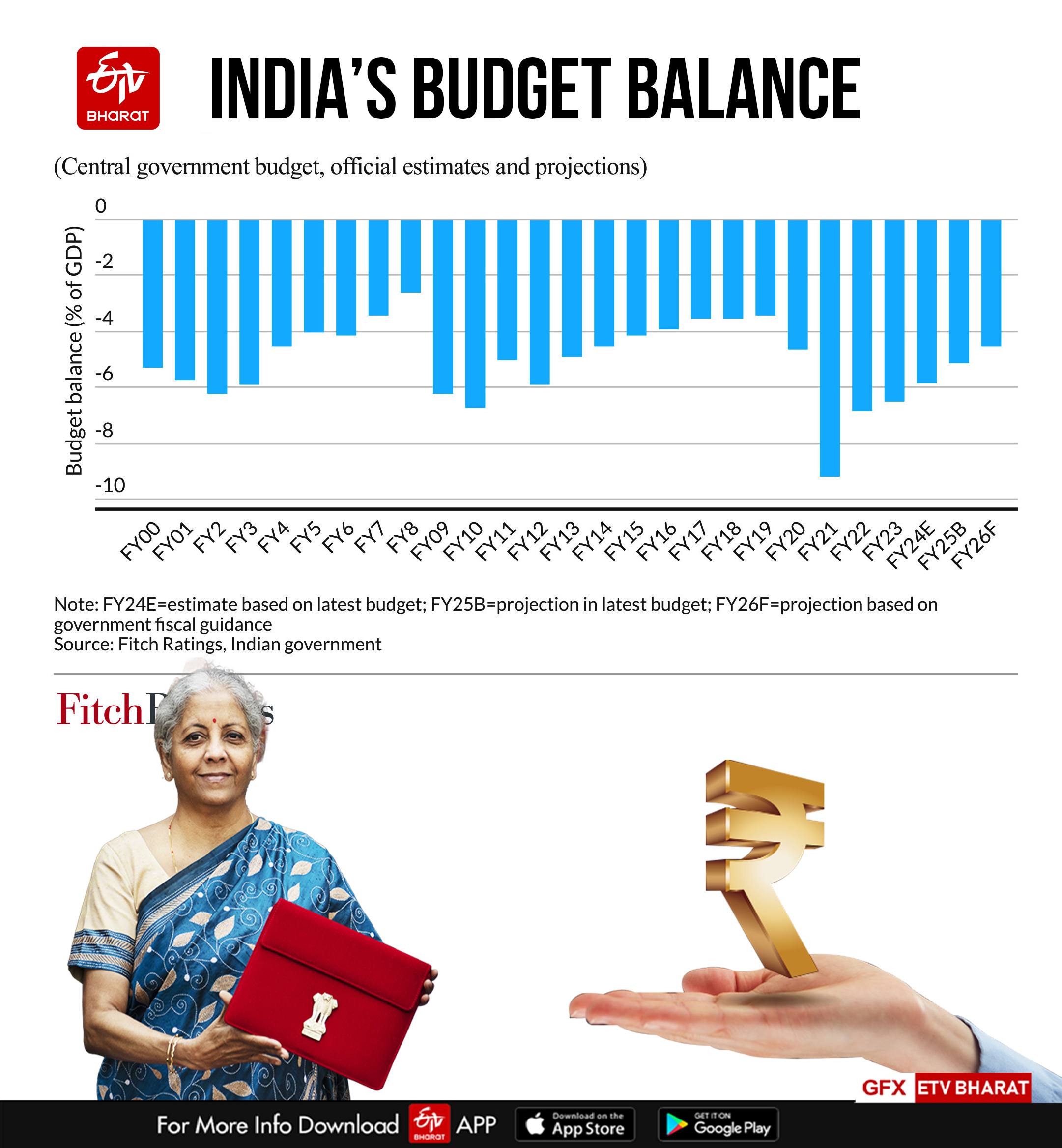

The larger-than-expected Reserve Bank of India (RBI) dividend to the government should help to ensure the 5.1% of GDP deficit target for the fiscal year ending March 2025 (FY25) will be met and could be used to lower the deficit beyond the current target, says Fitch Ratings. The government has signalled it and aims to narrow the deficit gradually to 4.5% of GDP by FY26. Sustained deficit reduction, particularly if underpinned by durable revenue-raising reforms, would be positive for India’s sovereign rating fundamentals over the medium term.

The RBI recently announced a record-high dividend transfer to the government equivalent to 0.6% of GDP (INR2.1 trillion) from its operations in FY24. This is above the 0.3% of GDP expected in the FY25 budget from February so will aid the authorities in meeting near-term deficit reduction goals. An important driver of higher RBI profits appears to be higher interest revenue on foreign assets, though the Central Bank has not yet provided a detailed breakdown.

The impact on Union Budget

In its post-election budget, the new government has two alternatives, Fitch Ratings said. First, the government could opt to keep the current deficit target for FY25, and the windfall could allow the authorities to further boost spending on infrastructure, or to offset upside spending surprises or lower-than-budgeted revenue, for example from divestment. Alternatively, all or part of the windfall could be saved, pushing the deficit to below 5.1% of GDP. The government’s choice could give greater clarity around its medium-term fiscal priorities.

Economists argue that channelling the surplus towards deficit reduction could be beneficial for India's sovereign ratings. According to Citi Research's Samiran Chakraborty, using the funds to cut the fiscal deficit could bring it down by 0.3 per cent of the gross domestic product (GDP). This approach is likely to be favoured by bond markets, which would see a decline in yields, as already indicated by a recent drop in bond yields following the surplus announcement.

Alternatively, the government could boost spending on infrastructure or introduce populist measures. Equity markets would likely support this route, as increased spending can stimulate economic activity and growth. The Sensex’s rise by 1,300 points in response to the surplus news underscored investor optimism about potential expenditure increases.

Can RBI continue with a higher dividend payout?

Transfers from RBI to the government can be significant at the margin for fiscal performance, but depend on various factors, including the size and performance of assets held on the Central Bank’s balance sheet and India’s exchange rate. Transfers may also be influenced by the RBI’s views on what level of buffer is appropriate to maintain on its balance sheet. The potential volatility of transfers means there is significant uncertainty about their medium-term path, and we do not anticipate that dividends as a share of GDP will be sustained at such a high level, said Fitch Ratings.