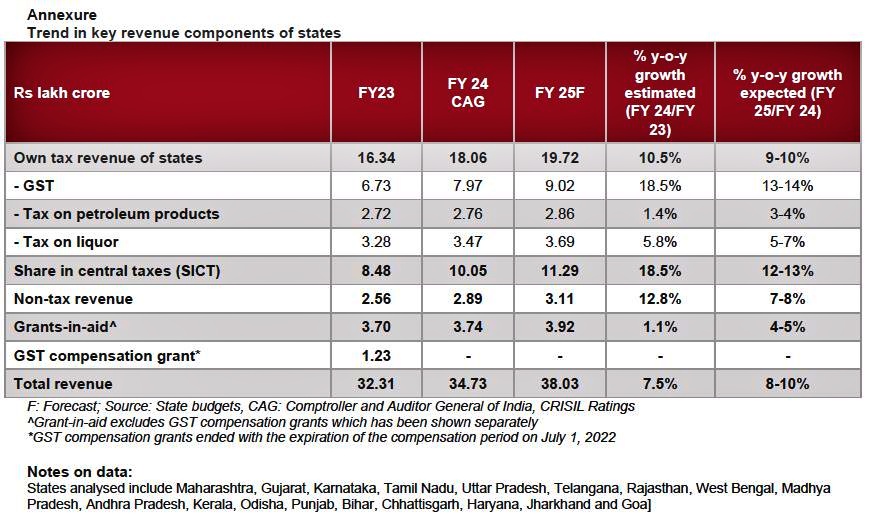

Mumbai: Revenue of India’s top 18 states, which account for over 90% of India’s gross state domestic product, is likely to grow at a steady pace of 8-10% this fiscal to Rs 38 lakh crore, according to a CRISIL Ratings report. Last fiscal, they grew at 7.5%.

The growth will be primarily supported by healthy Goods & Service Tax (GST) collections and devolution from the Centre, which together comprise ~50% of aggregate state revenues. While revenue from tax on liquor sales (10% of total revenue) will remain stable, mid-single-digit growth in sales tax collections from petroleum products (7-8%) and grants recommended by the Fifteenth Finance Commission (10-11%) will be modest.

Revenues Of Top 18 States To Grow At 8-10% This Fiscal: CRISIL (CRISIL Ratings) “The biggest impetus to revenue growth will continue to come from aggregate state GST collections that, after growing ~18% on-year last fiscal, will climb up another 13-14% in the current fiscal. This will be driven by the resilience of the Indian economy to global turbulence, improving tax compliance, and the shift in economic activity from unorganised to the organised sectors, leading to greater formalisation of the economy," said Anuj Sethi, Senior Director, CRISIL Ratings.

Central tax devolutions, expected to grow 12-13% this fiscal will be the second important driver, the report said. While the proportion of the devolution is determined by the Finance Commission, the overall kitty is linked to gross tax collections by the Centre. This pool, which expanded by 19% on-year last fiscal, should grow at healthy pace this fiscal as well, supported by rising income tax and GST collections, it added.

Tax garnered from liquor sales is expected to grow 5-7%, primarily due to rising consumption. A majority of the 18 states analysed, barring Karnataka and Kerala, have kept their liquor tax structure unchanged.

“Revenue from sales tax on petroleum products will grow a modest 3-4% on-year this fiscal after a flattish last fiscal. This will stem from higher fuel consumption driven by vehicular and industrial activity, even as the tax structure remains largely unchanged. While consumption is expected to grow ~5-6%, cuts in the prices of petrol and diesel undertaken this March will impact growth in sales tax collections by ~200 bps," said Aditya Jhaver, Director, CRISIL Ratings.

Grants from the Centre will grow by 4-5% on-year, in line with the Union Budget outlay, including for centrally sponsored schemes and Finance Commission grants which comprises grants towards post-devolution revenue deficits based on the budget calculations and the commission’s own stipulations, the report added.

The calculations assume a real GDP growth forecast of 6.8% for this fiscal. Volatility in the global economy and its impact on the economic activity can alter the revenue projections. On the other hand, better-than-expected tax buoyancy, or support from the Centre in the form of higher grants will augment the revenue of states. To ensure sustainable growth in revenue, states will have to focus on expanding own revenues and improving collection efficiencies.

Read More

- Cost of Veg Thali Goes Up By 9% in May and Goes Down By 7% For Non-Veg Thali

- Power Demand Hit All-Time High of 156 BU in May 2024 Compared to 2023