Mumbai: The Reserve Bank of India on Wednesday decided to keep the policy rate unchanged for the tenth time in a row but changed its stance to 'neutral' which may lead to a cut in the forthcoming policies.

RBI maintained the status quo despite the US Federal Reserve lowering the benchmark rates by 50 basis points last month. The central banks of some developed nations have also reduced their interest rates.

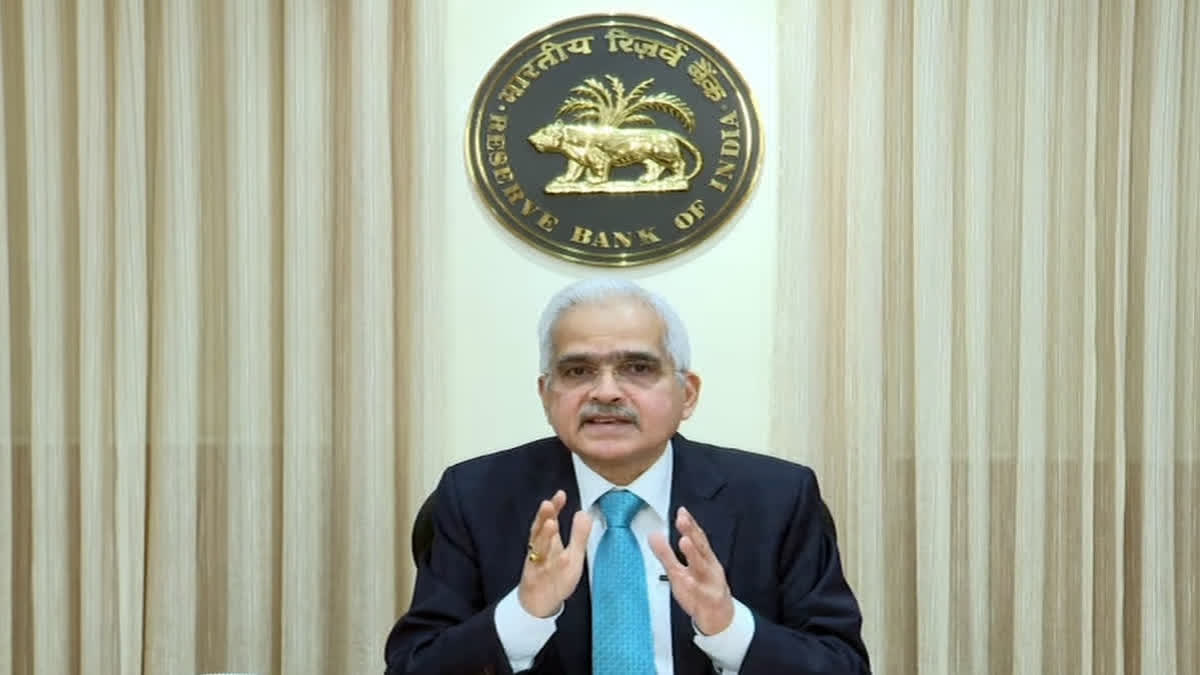

Announcing the fourth bi-monthly monetary policy for the current financial year, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged at 6.5 per cent. The RBI has maintained the status quo on benchmark interest rates since February 2023.

Das said RBI will remain watchful of elevated food inflation even when India's GDP growth remains strong. This was the first meeting of the reconstituted MPC. The three newly appointed external members are Ram Singh, Saugata Bhattacharya and Nagesh Kumar. The MPC was reconstituted by the government last month.

The Reserve Bank retained the retail inflation projection at 4.5 per cent for fiscal 2024-25, with Governor Shaktikanta Das stressing that the central bank will have to closely monitor the price situation and keep the "inflation horse" under tight leash lest it may bolt again.

Unveiling the October bi-monthly monetary policy, the Governor also said the flexible inflation targeting (FIT) framework has completed 8 years since its introduction in 2016 and is a major structural reform of the 21st century in India. Under the FIT, the central bank has ensured that the consumer price index (CPI) based retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

The RBI on Wednesday retained the CPI inflation projection for 2024-25 at 4.5 per cent, with Q2 at 4.1 per cent; Q3 at 4.8 per cent; and Q4 at 4.2 per cent. CPI inflation for Q1:2025-26 is projected at 4.3 per cent. The risks are evenly balanced.

"The CPI print for the month of September is expected to see a big jump due to unfavourable base effects and pick-up in food price momentum, caused by the lingering effects of a shortfall in the production of onion, potato and chana dal (gram) in 2023-24, among other factors," Das said.

He further said the headline inflation trajectory, however, is projected to sequentially moderate in the fourth quarter of this year due to good kharif harvest, ample buffer stocks of cereals and a likely good crop in the ensuing rabi season. Unexpected weather events and the worsening of geopolitical conflicts constitute major upside risks to inflation. International crude oil prices have become volatile in October, Das added.

The Governor also said food inflation pressures could see some easing later in this financial year on the back of strong kharif sowing, adequate buffer stocks and good soil moisture conditions which are conducive for rabi sowing. "It is with a lot of effort that the inflation horse has been brought to the stable, i.e., closer to the target within the tolerance band compared to its heightened levels two years ago.

"We have to be very careful about opening the gate as the horse may simply bolt again. We must keep the horse under tight leash, so that we do not lose control," he emphasised. Going forward, Das said there is a need to closely monitor the evolving conditions for further confirmation of the disinflationary impulses.

Retail inflation softened significantly in July and August, with base effect playing a major role in July. Food inflation experienced a certain degree of correction during these two months. Considerable divergence, however, was observed within the food sub-groups.

Deflation in fuel group deepened on softening electricity and LPG prices. Core inflation, on the other hand, edged up in July and August. Governor Das further said the developments since the August meeting of the Monetary Policy Committee (MPC) indicate further progress towards realising a durable disinflation towards the target.

Despite the near-term upsides to inflation from food prices, the evolving domestic price situation signals moderation in headline inflation thereafter, he added.