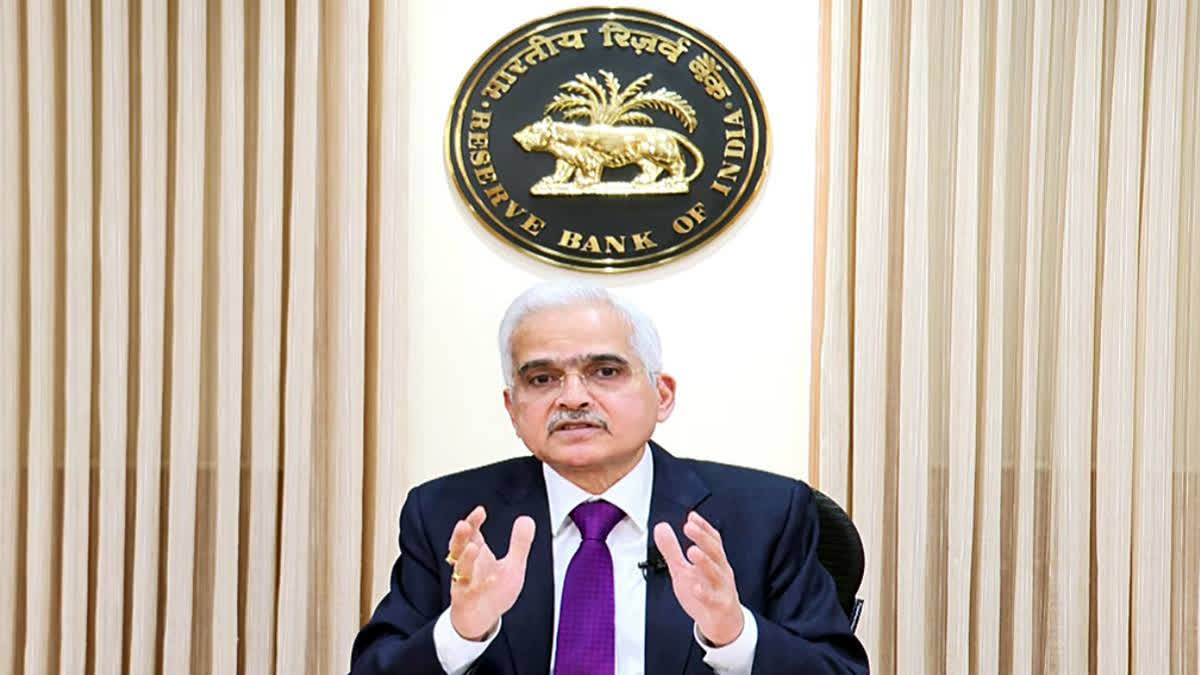

Mumbai (Maharashtra): Reserve Bank Governor Shaktikanta Das will announce the next set of monetary policy on Friday morning amid expectations of a status quo on the benchmark interest rates.

The Reserve Bank of India has been holding the key interest rate (repo) at 6.5 per cent since February 2023. Experts are of the opinion that the RBI will maintain the status quo on interest rates as inflation remains a matter of concern, though the European Central Bank and Bank of Canada have started reducing their respective key rates.

Das will announce the decision at 10 in the morning after deliberations of the RBI's rate-setting panel -- Monetary Policy Committee (MPC) -- which started discussions on Wednesday.

The MPC may also refrain from rate cuts as economic growth is picking up, notwithstanding the elevated repo rate of 6.5 per cent prevailing since February 2023, experts said.

According to a SBI research paper, the central bank needs to continue the current stance of withdrawal of accommodation. The report titled 'Prelude to MPC Meeting' expects the RBI to cut the repo rate in the third quarter of the current fiscal and "such rate cut cycle is likely to be shallow".

It also said CPI-based retail inflation is expected to remain close to 5 per cent in May (data to be released later this month) and decline thereafter to 3 per cent in July. Inflation is expected to stay below 5 per cent beginning October till the end of 2024-25, it added.

Ashish Agarwal, Director, AU Real Estate was of the view that keeping the repo rate unchanged will ensure affordability for potential homebuyers, sustaining momentum in the housing market.

"With consumer demand driving luxury housing, this move will support macroeconomic indicators and encourage new buyers to invest. As India's economy grows, the real estate sector will play a significant role, making the current repo rate policy crucial in fuelling demand and contributing to the country's growth," Agarwal said.

The government has mandated the Reserve Bank to ensure retail inflation at 4 per cent with a margin of 2 per cent on either side. Retail inflation was 4.83 per cent in April this year.

The MPC consists of three external members and three officials of the RBI. External members of the rate-setting panel are Shashanka Bhide, Ashima Goyal, and Jayanth R Varma.