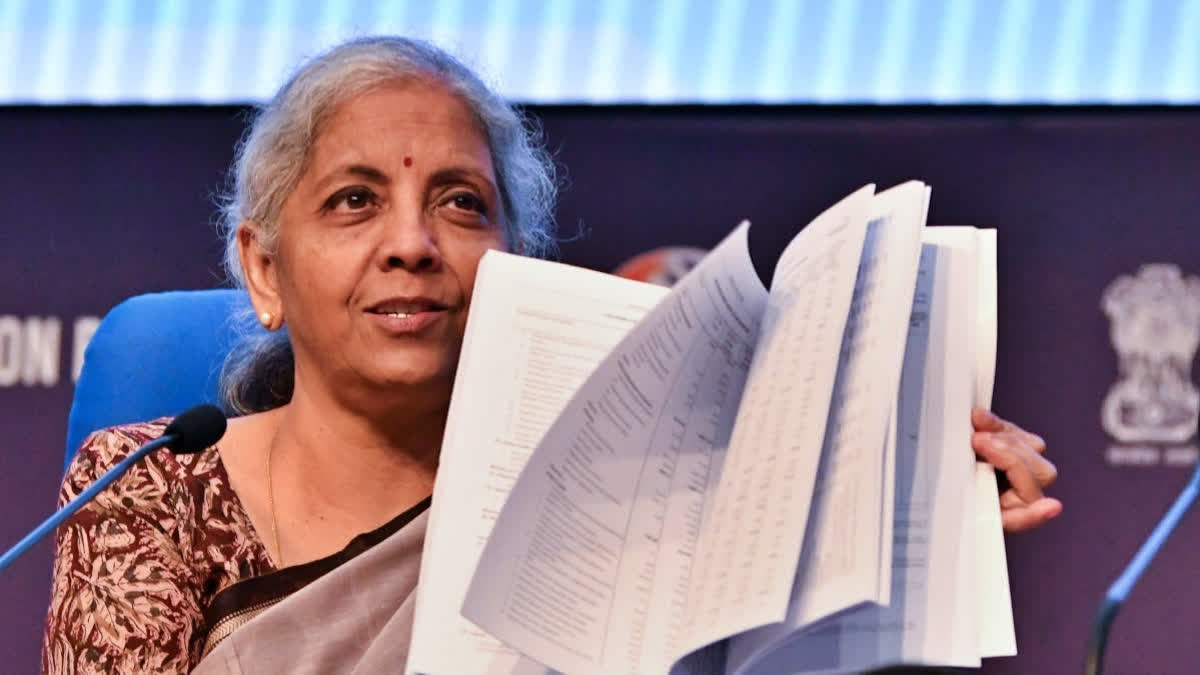

New Delhi: Union Finance Minister Nirmala Sitharaman convened a meeting here today to evaluate the performance of Public Sector Banks (PSBs). The review covered various aspects, including financial performance, deposit growth, digital payments, cyber security, and credit accessibility for financial inclusion, along with other emerging concerns.

According to the Finance Ministry, the meeting highlighted that PSBs had a strong performance in FY24. Key improvements included a drop in Net NPAs (non-performing assets) to 0.76%, a healthy capital adequacy ratio of 15.55%, and a Net Interest Margin (NIM) of 3.22%, officials said.

Additionally, PSBs achieved their highest-ever net profit of Rs. 1.45 lakh crore and paid out Rs. 27,830 crore in dividends to shareholders. These positive developments have also strengthened their ability to raise capital from the market, they added.

The discussion also covered digital payments and cyber security. Nirmala Sitharaman stressed the importance of viewing cyber security from a broad, systemic perspective. She called for a strong collaboration among banks, the government, regulators, and security agencies to effectively address cyber risks. She also recommended regular, thorough reviews of IT systems to ensure they are secure and protected against breaches, officials added.

During the meeting, the Finance Minister noted that although credit growth has increased, there is potential to further enhance deposit mobilisation to support this growth sustainably. She encouraged banks to undertake special initiatives to boost deposit collection. Additionally, Nirmala Sitharaman recommended that PSBs improve their customer relationships to deliver more efficient service.

She also urged banks to ensure their employees actively engage with customers, particularly in rural and semi-urban areas. Furthermore, she advised PSBs to explore collaborations to share best practices and adapt to evolving trends in the banking sector.

She urged banks to quickly put into action recent Budget measures, including a new credit assessment model for MSMEs based on digital footprints and cash flows. She also asked banks to focus on increasing credit flow to beneficiaries of government programs like the PM Surya Ghar Muft Bijli Yojana and PM Vishwakarma Yojana.

Furthermore, Nirmala Sitharaman reminded banks to follow the Reserve Bank of India’s guidelines for promptly handing over security documents after loan closures, stressing that there should be no delays. The meeting was attended by Dr Vivek Joshi, Secretary; Shri M. Nagaraju, Secretary-Designate, Department of Financial Services; the Heads of Public Sector Banks (PSBs); and senior officials from the Department of Financial Services (DFS).