New Delhi: India is expected to record GDP growth of 6.3-6.8 per cent in the financial year 2025-26 on the back of strong fundamentals, calibrated fiscal consolidation and stable private consumption, said the Economic Survey tabled in Parliament on Friday.

In the current financial year, the GDP growth is estimated at a 4-year low of 6.4 per cent, which is in line with its decadal average. "...the fundamentals of the domestic economy remain robust, with a strong external account, calibrated fiscal consolidation and stable private consumption. On balance of these considerations, we expect that the growth in FY26 would be between 6.3 and 6.8 per cent," the survey said.

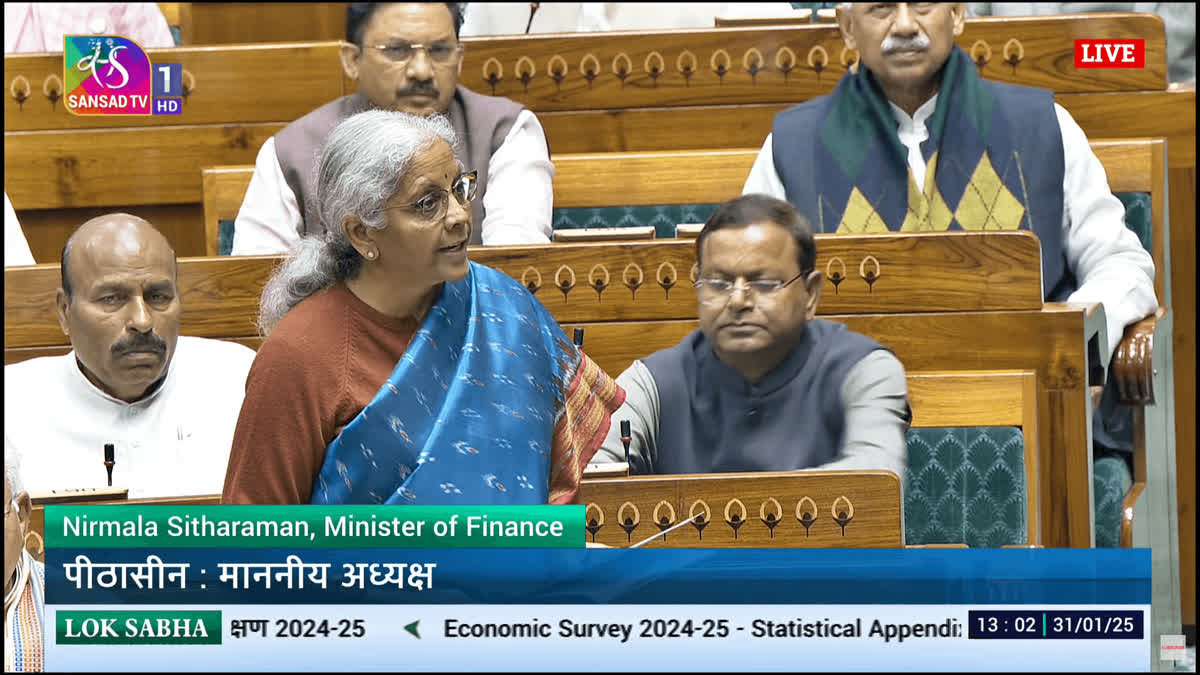

The Economic Survey 2024-25, tabled by Union Minister of Finance and Corporate Affairs Nirmala Sitharaman in both houses of Parliament, said navigating global headwinds will require strategic and prudent policy management and reinforcing the domestic fundamentals.

The survey expects a surge in exports, and forecasts 17.9% increase in FDI inflows and improved foreign exchange reserves. The government is focusing on infrastructure investment with a Rs 50,000 crore fund for MSMEs and continues to emphasize deregulation for sustainable growth.

Chief Economic Advisor V Anantha Nageswaran addressed a press conference immediately after the survey was tabled. "In the FY25, agriculture is expected to grow at 3.8%, while industrial output is projected to rise by 6.2%. Social services expenditure has increased significantly, and unemployment has dropped. There is need for a collaborative approach between the government, private sector, and academia to mitigate the societal impact of AI," he said.

Key Performing Sectors

The Economic Survey mentioned that the global economy grew by 3.3 percent in 2023. Survey pointed out that the global economy exhibited steady yet uneven growth across regions in 2024. A notable trend was the slowdown in global manufacturing mainly in Europe and parts of Asia. Main reason for this slowdown was supply chain disruptions and weak external demand. In contrast, the services sector performed better, supporting growth in many economies. The survey also noted that inflationary pressures eased in most economies. However, services inflation has remained persistent.

From the demand perspective, survey reveals that private final consumption expenditure at constant prices is estimated to grow by 7.3 percent, which is driven by a rebound in rural demand. Besides this, the industrial sector is estimated to grow by 6.2 percent in FY25. Fast and strong growth rates in construction activities and electricity, gas, water supply and other utility services are expected to support industrial expansion. Growth in the services sector is expected to remain robust at 7.2 percent, driven by healthy activity in financial, real estate, professional services, public administration, defence, and other services. Investment activity is expected to pick up, supported by higher public capex and improving business expectations.

Viksit Bharat 2047

The Survey puts forth a way forward to reinvigorate the internal engines and domestic levers of growth by focusing on one central element of systemic deregulation, which will enable a paradigm of economic freedom to businesses of individuals and organizations to pursue legitimate economic activity with ease. The Survey stresses that the reforms and economic policy must now be on systematic deregulation under Ease of Doing Business 2.0 so that it encourages creation of a viable Mittelstand, i.e. India’s SME sector. As per the survey, to realize the aspirations of Viksit Bharat by 2047, it is important that the medium-term growth outlook of India be assessed in the context of emerging global realities of Geo-Economic Fragmentation (GEF), Chinese manufacturing prowess, and global dependency on China for energy transition efforts.

Decline in NPAs

The Survey observes that stability in the banking sector is underscored by declining asset impairments, robust capital buffers, and strong operational performance. The gross non-performing assets (NPAs) in the banking system have declined to a 12-year low of 2.6 percent of gross loans and advances.

In addition to the services, trade surplus, remittances from abroad led to a healthy net inflow of private transfers. India was the top recipient of remittances in the world, driven by an uptick in job creation in OECD economies. These two factors combined to ensure that India’s current account deficit (CAD) remains relatively contained at 1.2 percent of GDP in Q2 FY25, as per the Survey.

Gross Foreign Direct Investment inflows recorded a revival in FY25, increasing from USD 47.2 billion in the first eight months of FY24 to USD 55.6 billion in the same period of FY25, a YoY growth of 17.9 percent, says the Survey, adding that foreign portfolio investment (FPI) flows have been volatile in the second half of 2024, primarily on account of global geopolitical and monetary policy developments.

The Economic Survey further mentioned that as a result of stable capital flows, India’s foreign exchange reserves increased from USD 616.7 billion at the end of January 2024 to USD 704.9 billion in September 2024 before moderating to USD 634.6 billion, as on January 3, 2025. India’s forex reserves are sufficient to cover 90 percent of external debt and provide an import cover of more than ten months, thereby safeguarding against external vulnerabilities.

Infra Push Required

On infrastructural front, the Economic Survey highlights the need for continued step-up of infrastructure investment over next two decades to sustain a high growth. Under railway connectivity, 2031 kilometer of railway network was commissioned between April and November, 2024, and 17 new pairs of Vande Bharat trains were introduced between April and October 2024. Port capacity improved significantly in FY25, leading to improvements in operational efficiency and reduction in average container turnaround time in major ports from 48.1 hours in FY24 to 30.4 hours during FY25 (Apr-Nov).

Challenges

As the Survey underscores, looking ahead, India’s economic prospects for FY26 are balanced. Headwinds to growth include elevated geopolitical and trade uncertainties and possible commodity price shocks. Domestically, the translation of order books of the private capital goods sector into sustained investment pick-up, improvements in consumer confidence, and corporate wage pick-up will be key to promoting growth. Rural demand backed by a rebound in agricultural production, an anticipated easing of food inflation and a stable macro-economic environment provides an upside to near-term growth. As regards inflation, it said risk from higher commodity prices seems limited in FY26. However, geopolitical tensions still remain an issue, the survey added.

Overall, India will need to improve its global competitiveness through grassroots-level structural reforms and deregulation to reinforce its medium-term growth potential, it said.

Expert Opinion

Commenting on the Economic Survey, Sudhir Sekhri, Chairman of Apparel Export Promotion Council (AEPC), highlighted that this year's survey is progressive, forward-looking and growth-oriented. "The Economic Survey has also listed the nation's challenges and provides a roadmap for reforms and growth. The industry looks forward to progressive reforms and continuity in policy, reflecting stability and trust," he said.

Mithileshwar Thakur, Secretary General AEPC, stated, “The economic survey reflects the Government’s commitment to make India a developed nation. This year's survey has provided a data-driven comprehensive overview of the country’s economic health and current economic situation and the roadmap for the future. The insights published in the economic survey will surely help the policy makers in framing inclusive policies for our country.”