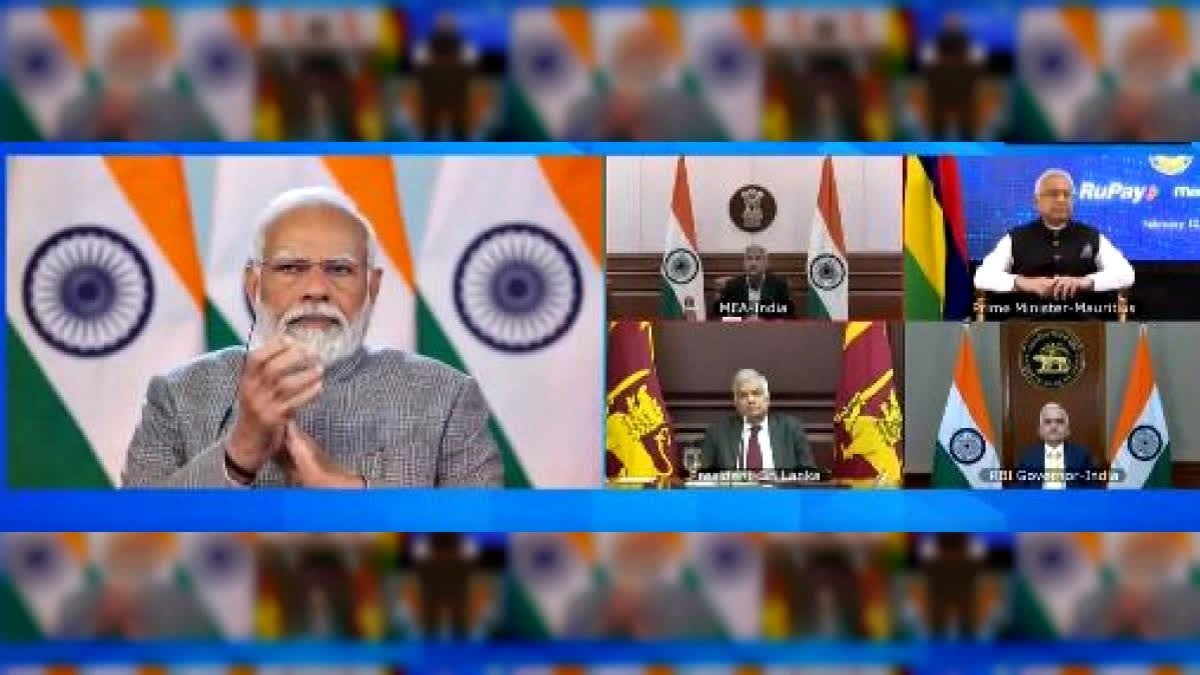

New Delhi: India's Unified Payment Interface (UPI) services were on Monday rolled out in Sri Lanka and Mauritius, with Prime Minister Narendra Modi describing it as linking historic ties with modern digital technology.

India's RuPay card services were also launched in Mauritius at a virtual ceremony attended by Prime Minister Modi, his Mauritian counterpart Pravind Jugnauth and Sri Lankan President Ranil Wickremesinghe.

In his remarks, Modi hoped the new fintech services would help the two nations and said the UPI is implementing "new responsibilities of uniting partners with India". "Today is a special day for the three friendly countries of the Indian Ocean Region as we are linking our historic ties with modern digital technology," he said.

"I believe that Sri Lanka and Mauritius will benefit from the UPI system," Modi said. The prime minister said digital public infrastructure has brought about a revolutionary change in India. He also highlighted India's focus on its "neighbourhood first policy". "Be it a natural disaster, health-related, economic or supporting on the international stage, India has been the first responder, and will continue to be so," he said.

The launch of the Indian services in Sri Lanka and Mauritius came amid New Delhi's increasing bilateral economic ties with the two countries. The move enables the availability of UPI settlement services for Indian nationals travelling to Sri Lanka and Mauritius as well as for Mauritian nationals travelling to India.

Speaking about the convenience and speed of UPI transactions, the Prime Minister said that more than 100 billion transactions took place via UPI last year worth Rs 2 lakh crores or 8 trillion Sri Lankan rupees or 1 trillion Mauritius rupees. He also mentioned making last-mile delivery through the GEM Trinity of bank accounts, Aadhar and mobile phones where Rs 34 lakh crores or 400 billion US dollars has been transferred into the bank accounts of beneficiaries.

Referring to the vision document that was adopted during the last visit of the Sri Lankan President, PM Modi highlighted the strengthening financial connectivity as its key component.

The Prime Minister also expressed the confidence that connection with UPI will benefit Sri Lanka and Mauritius and digital transformation will get a boost, local economies will witness positive change and tourism will be promoted.

“I am confident that Indian tourists will give priority to destinations with UPI. People of Indian origin living in Sri Lanka and Mauritius and students studying there will also get special benefits from it," he said. PM Modi expressed delight that after Nepal, Bhutan, Singapore and UAE in the Gulf in Asia, now from Mauritius RuPay card is being launched in Africa.

"This will also facilitate the people coming to India from Mauritius. The need to buy hard currency will also reduce. The UPI and RuPay card system will enable real-time, cost-effective and convenient payments in our own currency. In the coming time, we can move towards cross-border remittances i.e. Person to Person (P2P) payment facility," the Prime Minister added.

The Prime Minister underlined that the launch symbolizes the success of Global South cooperation. “Our relations are not just about transactions, it is a historical relation," PM Modi emphasized highlighting the strength of people-to-people relations between the three nations.

What is UPI?

Developed by the National Payments Corporation of India (NPCI), UPI is an instant real-time payment system to facilitate inter-bank transactions through mobile phones. RuPay is a global card payment network from India, with wide acceptance at shops, ATMs, and online. UPI powers multiple bank accounts into a single application, merging several banking features, seamless fund routing, and merchant payments into one hood. It also caters to peer-to-peer collect requests which can be scheduled and paid as per requirement and convenience.

Read More