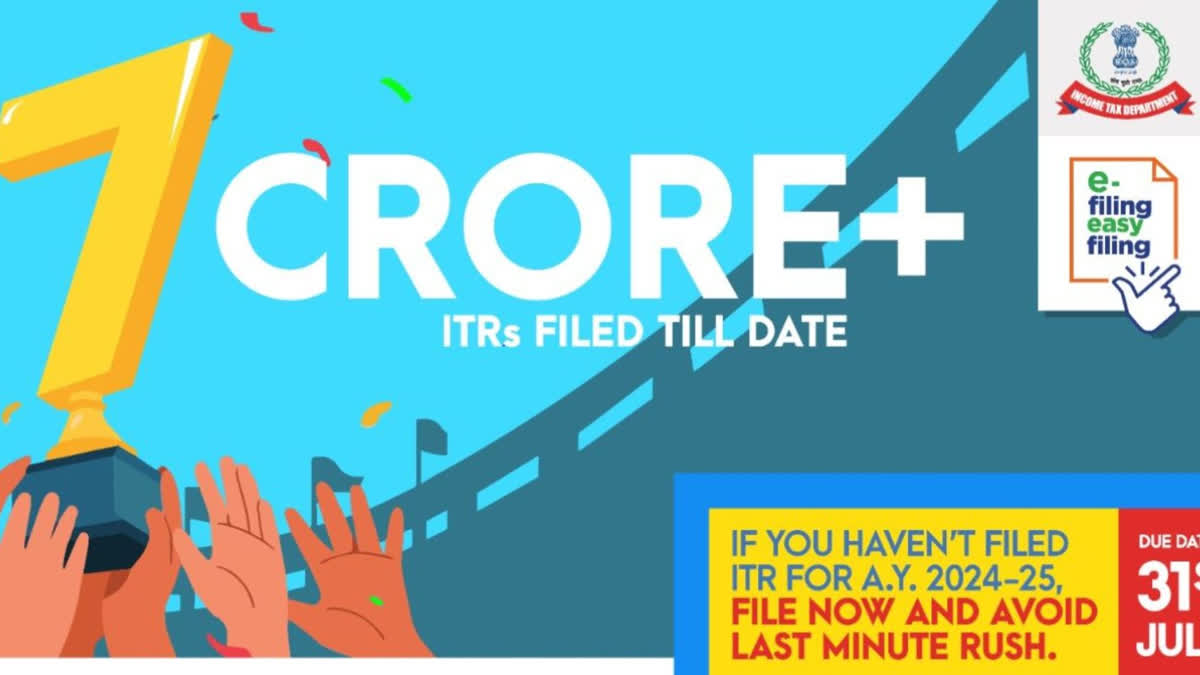

Delhi : The Income Tax Department has announced that by 7 PM on July 31, 2024, over 7 crore income tax returns (ITRs) had been filed. Notably, more than 50 lakh ITRs were submitted today alone by 7 PM.

To support taxpayers with ITR filing, tax payments, and other related services, the department's helpdesk is available 24/7. Assistance is provided through calls, live chats, WebEx sessions, and Twitter/X. In a social media post on X, the department expressed appreciation to taxpayers and tax professionals for contributing to this achievement and encouraged those who have not yet filed their ITR for AY 2024-25 to do so promptly.

ETV Bharat learned from highly placed sources at the Income Tax Department that many high-ranking officials have been assigned to ensure a smooth filing process, aiming to provide a hassle-free experience for taxpayers. They must address and resolve any issues, regardless of the medium, as quickly as possible.

Today, July 31, 2024, is the final day to file your Income Tax Return (ITR) for the 2023-24 financial year. If you’re a salaried individual or someone who doesn’t need an audit, make sure to file your return by the end of today to avoid any penalties. The Income Tax Department has been working hard to send out reminders and help everyone meet the deadline. If you haven't filed yet, now’s the time to get it done!

As of yesterday, over 6.5 crore ITRs had already been filed by July 30, 2024, showing a 7.5% increase from last year. On July 30 alone, more than 45 lakh ITRs were submitted, and today’s figures are expected to rise even more since it's the final deadline for many. Interestingly, we hit the 6.5 crore mark on July 31 last year, so reaching it a day earlier this year indicates a growing trend of timely submissions.

The department has also mentioned that taxpayers facing technical issues with filing can contact the toll-free helpdesk numbers (1800 103 0025 or 1800 419 0025) or email Efilingwebmanager@incometax.gov.in. If you're having trouble downloading the ITR Form PDF for AY 2024-25, please try again after 8 PM. For the best experience, it's recommended to use Edge, Chrome, or Firefox browsers.

Although the department is taking significant steps to address these issues, complaints about the website running slowly continue to flood social media. In a recent interview with ETV Bharat, CBDT Chairman Ravi Aggrawal made it clear that there are no plans to extend the ITR filing deadline, noting that the number of returns filed has increased compared to last year. The department is working hard to resolve these issues, but for those who still haven’t filed, a decision on whether to extend the deadline or impose penalties will be made after a thorough review after July 31.

More than 7 crore ITRs have been filed so far (31st July), out of which over 50 lakh ITRs have been filed today till 7 pm!

— Income Tax India (@IncomeTaxIndia) July 31, 2024

To assist taxpayers for ITR filing, tax payment and other related services, our helpdesk is functioning on a 24x7 basis, and we are providing support… pic.twitter.com/92z0rjSA13