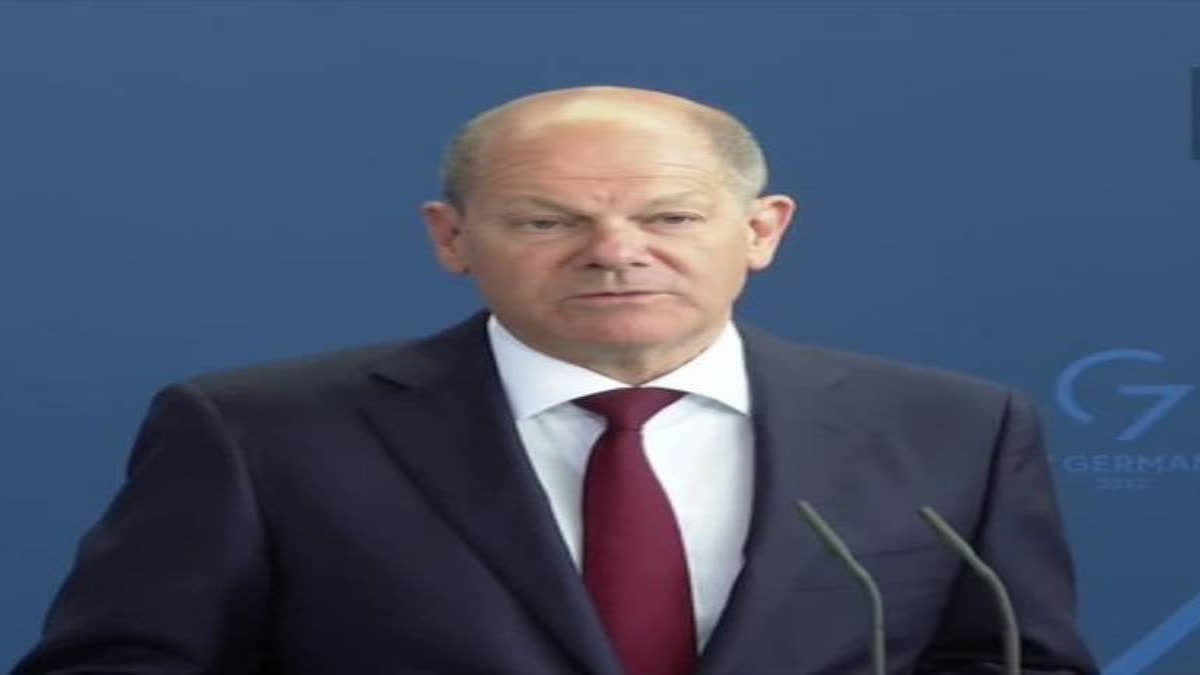

New Delhi: During German Chancellor Olaf Scholz’s three-day visit to India starting Thursday, a key area of focus will be boosting India-Germany economic ties in Berlin’s bid to reduce reliance on the Chinese market.

Scholz and Prime Minister Narendra Modi will co-chair the Seventh Intergovernmental Consultations (IGC) here on Friday. The IGC is a whole-of-government framework under which ministers from both sides hold discussions in their respective areas of responsibility and report on the outcome of their deliberations to the Prime Minister and the Chancellor.

India and Germany share a Strategic Partnership since 2000. The two countries have been holding IGCs since 2011. “Both leaders will hold bilateral talks to discuss enhanced security and defence cooperation, greater opportunities for the mobility of talent, deeper economic cooperation, Green and Sustainable Development Partnership and collaboration in the area of emerging and strategic technologies,” the Ministry of External Affairs stated while announcing Scholz’s visit earlier this week.

“Both leaders will also address the 18th Asia Pacific Conference of German Business (APK 2024) being held in New Delhi on 25 October,” it stated. “The APK, a biennial event for business leaders, executives, and political representatives from Germany and the countries in the Indo-Pacific, is expected to give a further fillip to trade and investment ties between our two countries. About 650 top business leaders and CEOs from Germany, India, and other countries are expected to participate in the event.”

What is the volume of bilateral trade and investments between the two countries?

Germany was the 12th largest trading partner for India in 2023-24. In 2021-22, it was Indiaʼs 11th largest trading partner and the seventh-largest trading partner in 2020-21. India constituted about 1 per cent of Germanyʼs total foreign trade in 2023 and Germany constituted over 2.37 per cent of India’s foreign trade in 2023-24 (2.24 per cent in 2022-23 and 2.4 per cent in 2021-22). While the balance of trade has been in favour of Germany, bilateral trade has experienced continuous growth over the last few years.

According to figures provided by Destatis (Statistisches Bundesamt), the Federal Statistical Office of Germany, trade with India touched an all-time high of $33.33 billion (+5.84 per cent) with exports from India at $15.48 billion (-2.3 per cent) and imports to India from Germany at $17.85 billion (+14.2 per cent) in the calendar year 2023. India was Germanyʼs 23rd largest trading partner in 2023.

Germany is the ninth largest foreign direct investor in India with a cumulative FDI in India of $14.5 billion. From April 2000 to December 2023, German investments in India in 2023-2024 totaled $507 million. According to the Indo-German Chamber of Commerce, there are more than 2,000 German companies active in India. German investments in India have been mainly in transportation, electrical equipment, metallurgical industries, services sector (particularly insurance), chemicals, construction activity, trading and automobiles. Most major German companies including the automobile and machinery giants are present in India. India offers significant prospects for cooperation with Germany, including in the areas of infrastructure, energy, and environmental and high technology.

Indian investments in Germany have shown an increase in the last few years. Besides trading, Indian companies are setting up value chain activities in

Germany, manufacturing goods and services locally as well as engaging in research and development and innovation activities. More than 215 Indian companies are operating in Germany. Sectors such as IT, automotive, pharmaceuticals, biotech and manufacturing have received a major portion of Indian investments.

However, if reports are to go by, in a bid to reduce its reliance on China, Germany wants to further boost economic ties with India.

Why does Germany want to reduce its economic reliance on China?

Germany, the largest economy in the European Union (EU), has long benefited from its robust trade relationship with China. Over the past two decades, China has emerged as one of Germany’s top trading partners, especially in industries like automobiles, machinery, and chemicals. However, escalating trade disputes between the European Union (EU) and China, fueled by issues such as market access, intellectual property rights, subsidies, and economic coercion, are having a profound impact on Germany’s economy.

European companies, including German firms, face challenges in accessing Chinese markets due to regulatory barriers, restrictions on foreign investments, and state favouritism towards Chinese companies.

China’s extensive use of subsidies for state-owned enterprises distorts competition, affecting European industries. This is particularly problematic for Germany’s manufacturing and automotive sectors, where Chinese firms, buoyed by state support, are increasingly becoming competitors.

European businesses also often report concerns about the theft of intellectual property and forced technology transfers when doing business in China. Apart from this, the EU has been raising concerns about economic coercion, especially regarding China’s retaliatory measures against countries or companies that criticise Beijing’s policies. Such coercion undermines the EU’s open market principles and adds an element of unpredictability for businesses.

According to an article titled ‘Tipping Point? Germany and China in an Era of Zero-Sum Competition’ published on the website of research provider Rhodium Group, in the first two decades of the 21st century, the German and Chinese economies were as complementary as two major economies can be.

“In recent years, however, this dynamic has begun to shift in important ways, with China emerging as a formidable competitor to Germany in the industries it once dominated,” the article, written by Noah Barkin and Gregor Sebastian of the Rhodium Group and published in February this year, states. “What for years felt like a win-win economic relationship, to borrow one of Beijing’s favourite expressions is trending increasingly in the direction of zero-sum. Looking ahead, German firms are likely to see their market shares in China erode, while coming under significant pressure from Chinese competitors at home and in third markets - a dynamic that is likely to have ripple effects for the bilateral relationship.”

According to the article, against the backdrop of a stagnating German economy and a more volatile political environment, job losses in key German industries could trigger a backlash that has been largely absent until now, even as the government line on China has hardened.

Why does Germany see India as a good alternative to China?

“India, the most populous country in the world, is a key partner of the German economy in the Indo-Pacific and plays a key role in the diversification of the German economy,” Radio France International (RFI) quoted German Finance Minister Robert Habeck as saying on Wednesday ahead of Scholz’s visit to India.

“We must reduce critical dependencies (read China) and strengthen the resilience of German companies and their supply chains to and from Asia,” Habeck said.

The RFI report also cited Volker Treier, head of foreign trade at the German Chamber of Commerce and Industry (DIHK), as saying that German direct investments in India have been valued at around 25 billion euros for 2022, which is about 20 per cent of the volume invested in China.

According to Treier, that share could rise to 40 per cent by the end of the decade. “China will not disappear, but India will become more important for German companies,” he stated. “India is the litmus test, so to speak. If de-risking China is to work, India is the key… because of the size of the market and the economic dynamism in the country.”

Last week, the German Cabinet adopted a key strategic document called ‘Focus on India’, which sheds light on the future direction of bilateral relations with India. The German government wants to raise the strategic partnership that has underpinned the bilateral relationship with India since 2000 to a new level. The chapter on ‘Economy, trade and agriculture’ in the document states that “India’s economy is innovative and growing at a dynamic pace”.

“In just a few years, India is expected to become the world’s third-largest economy,” it reads. “This development provides huge opportunities for diversifying our economic and foreign trade relations with Asia. The resilience of German companies’ supply chains will be boosted by closer economic ties with India. We therefore want to work with India to reduce the obstacles to trade and investment and strengthen our economic links. In particular, this includes strengthening the open, rules-based multilateral trade system with the WTO (World Trade Organisation) at its centre”.

Simply put, if things go according to Germany’s plan, China’s loss will be India’s gain.