Chennai:Financial Inclusion Challenges report released by the IIT Madras suggested that banking charges imposed on various aspects of usage be re-evaluated, while highlighting the challenges faced by low-income groups and senior citizens in availing financial services and recommends possible solutions.

Banking charges for even purely digital transactions like exceeding free number of transaction limit, insufficient balance, ECS bounce, standing instructions, SMS updates to be re-evaluated, the report said, while listing out the lack of flexibility in savings products, language, Cultural barriers and consumer protection as issues of concern.

Individuals and senior citizens exempted from filing Income Tax Returns (ITR) still being charged TDS by banks, thus making filing returns a necessity, which it said could have been avoided. KYC Process and need for PAN, OTP or biometric verification have made it cumbersome for low-income groups - in person KYC (and live-video KYC) to be replaced by non-live (non-human) option, with encrypted liveliness checks built in, the report suggested.

The report also recommended easier Cash in Cash Out (CICO) Accessby allowing individuals like grocery store owners, tradesmen etc. to function as Business Correspondents to reach the end customer, particularly in the remote parts of the country.

Also read: IIT Madras to launch 'Out of the Box Thinking' course, targets one million students

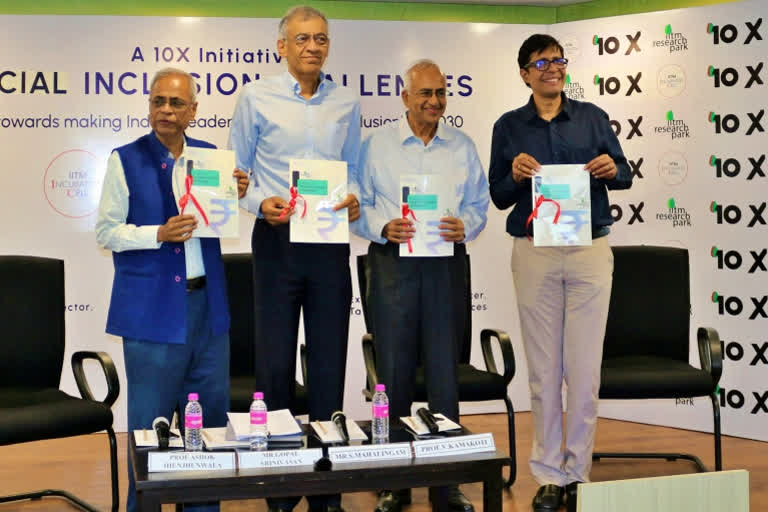

The report was released by financial industry stalwarts Gopal Srinivasan, Chairman and Managing Director, TVS Capital Funds, S. Mahalingam, Ex-Chief Financial Officer, Tata Consultancy Services, Prof. V. Kamakoti, Director, IIT Madras and Prof. Ashok Jhunjhunwala, president – IIT Madras Research Park (IITMRP), IITM Incubation Cell & RTBI (IITM’s Rural Technology and Business Incubator).

“In a country with a population of 90 crore adults, only a small percentage has ever made (at least one) digital transaction. Despite our achievements in financial services sector, a large section of the Indian society is still struggling with fundamental financial inequities," Ashok said.

"IIT Madras Research Park with its strong research backed technology focus has enabled multiple fintech brands to emerge from its ecosystem. As part of our ambitious 10X initiative aimed at making India a leader in ‘Fintech for Inclusion’, our team has put together a detailed analysis on the challenges faced by the low-income groups and the steps to bring them into the financial fold," he claimed.

Also read: From 'Bolt' to 'Hyperloop': IIT Madras features students' innovative tech projects

"We are confident, the authorities and administrative leaders will find this report a ready reckoner for bringing policy changes that will positively impact and enable India to truly become a leader in financial inclusion. We are uniquely placed for the first time in history to increase social mobility and lower the barriers to inclusion through collaboration and innovation,” the Prof. added.

As a part of IIT Madras Research Park and IITM Incubation Cell’s ambitious 10X program, the detailed study and resultant report aims to put the limelight on gaps in financial inclusion despite the transformation in the Financial Services sector. This report is a step towards enabling India to become a leader in ‘Fintech for Inclusion’ by 2030, a statement from the premier institute said.

Over the last decade, financial services in India have undergone a transformation, driven by technology enablers, and supported by the government and regulators such as RBI. Interventions like introduction of a national identification number (Aadhaar), Jan-Dhan Yojna scheme, increased push towards digitization via the UPI platform have played a key role, it said.

Despite these successes, according to the report, there are still significant hurdles in making a full range of financial services available to all sections of the population in India. People in low-income group and senior citizens often face challenges in accessing the full range of financial services from formal financial channels. The report outlines some of these obstacles and recommendations to overcome them.