Jaipur:During the time of the coronavirus pandemic that has affected the entire world, online transactions have increased rapidly.

With the increase in online transactions, cyber thugs have also started cheating people in large numbers.

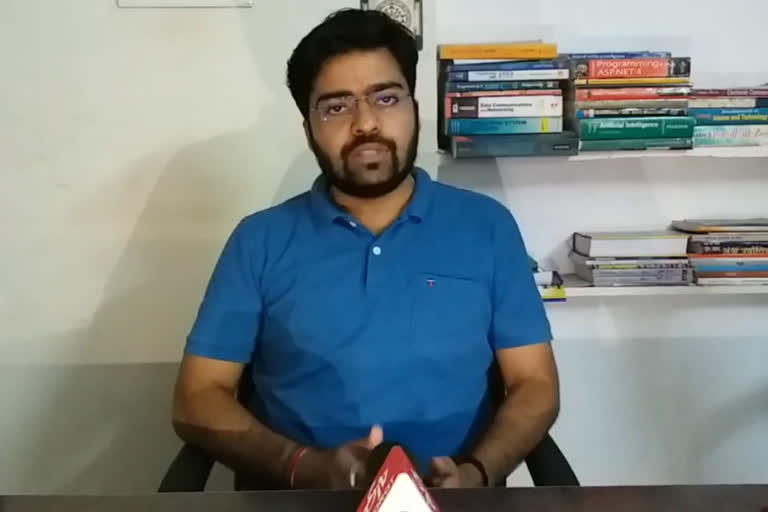

Cybersecurity expert Ayush Bhardwaj said that cyber thugs are making people a victim by using ‘social engineering’.

Cyber thugs who introduce themselves as representatives of the company send messages to people and assure 5 to 10% additional benefits as they pretend to renew the policy.

"People fall prey to the false promises and mindlessly agree to renew their policies or purchase new policies through these fraud agents without any further investigation," he said.

"The cyber thugs send a link through a message to the victim's mobile. As soon as they click on that link, the cyber thugs send malware from that mobile to their computer with the help of that link. Malware is a type of virus that cyber thugs operate and then the full access to the person's mobile or computer is passed on to cyber thugs. After this, the cyber thugs easily transact millions of rupees from the victim’s mobile through net banking or through other e-wallets and the victim do not even detect it until it is too late," Bhardwaj added.

Beware of Fake Websites

Bhardwaj said that people are being made a victim of fraud by creating fake websites.

There are several fake or similar websites of various well-known companies present on the internet, through them, cyber thugs try to trick people into renewing the policy.

When the victim goes to the renewal page to renew the policy after visiting the fake website of cyber thugs, then debit or credit card information is asked from him.

The moment the victim updates his card number, the expiry date and CVV on the fake website created by cyber thugs, they siphon off millions of rupees from the bank account, he said.

Apart from India, there are many countries where online transactions can be done only through credit or debit card numbers, expiry date and CVV. Due to this, when all the information is filled by the victim in the fake website created by the thugs, then the transaction can be carried out easily by them.

In India card number, expiry date and CVV, as well as PIN code, are also required for online transactions.

Therefore, the thugs do not transact the amount cheated from the victim's account in India rather they sit in other countries to carry out these fraudulent practices.

Bhardwaj said, "The common person does not need to conduct foreign transactions on a daily basis. In such a situation, the user can use his mobile banking app to discontinue the option of international use of the card by making required changes in the debit or credit card settings. After doing this, the user's card can only be used for domestic transactions and the cyber thugs will not be able to make international transactions with the card despite making millions of attempts."