New York :The Federal Reserve raised its key rate by a quarter point Wednesday, bringing it to the highest level in 15 years as part of an ongoing effort to ease inflation by making borrowing more expensive. The rate increase will likely make it even costlier to borrow for homes, autos and other purchases. But if you have money to save, you’ll probably earn a bit more interest on it.

The latest rate increase is smaller than the Fed’s half-point rate hike in December and its four straight three-quarter-point increases earlier last year. The slowdown reflects the fact that inflation, while still high, is easing, and some parts of the economy seem to be cooling.

But it’s still an increase, to a range of 4.5% to 4.75%. And many economists say they still fear that a recession remains possible — and with it, job losses that could cause hardship for households already hurt by inflation.

Here’s what to know:

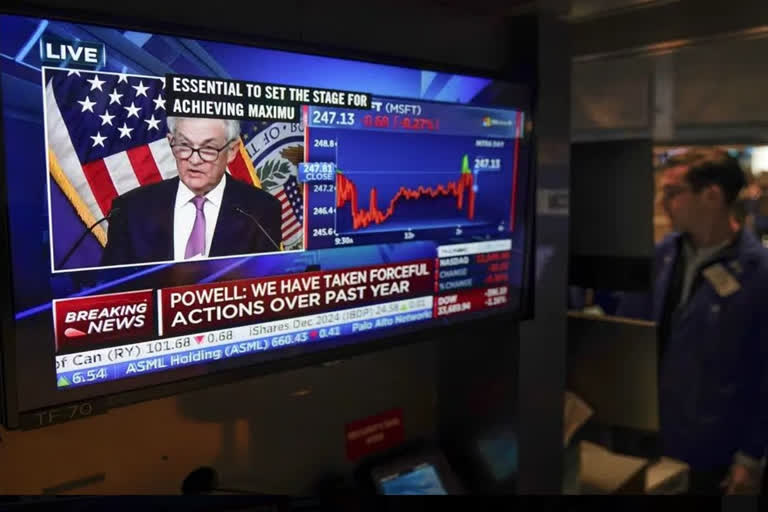

WHAT’S PROMPTING THE RATE INCREASES?The short answer: Inflation. Over the past year, consumer inflation in the United States has clocked in at 6.5% — a figure that reflects a sixth straight monthly slowdown but still uncomfortably high. The Fed’s goal is to slow consumer spending, thereby reducing demand for homes, cars and other goods and services, eventually cooling the economy and lowering prices. Fed Chair Jerome Powell has acknowledged in the past that aggressively raising rates would bring “some pain” for households but said that doing so is necessary to crush high inflation.

WHICH CONSUMERS ARE MOST AFFECTED?Anyone borrowing money to make a large purchase, such as a home, car or large appliance, will likely take a hit. The new rate will also increase monthly payments and costs for any consumer who is already paying interest on credit card debt. “It’s already been a really rough year with folks with credit card debt, and it’s only going to get worse,” said credit analyst Matt Schulz of LendingTree. “The immediacy of the increase is what’s hard — that it affects not just future purchases but current balances.”

That said, Scott Hoyt, an analyst with Moody’s Analytics, noted that household debt payments, as a proportion of income, remain relatively low, though they have risen lately. So even as borrowing rates steadily rise, many households might not feel a much heavier debt burden immediately.

HOW WILL THIS AFFECT CREDIT CARD RATES?Even before the Fed’s latest move, credit card borrowing rates had reached their highest level since 1996, according to Bankrate.com, and these will likely continue to rise.

As rates have risen, zero percent loans marketed as “Buy Now, Pay Later” have become popular with consumers. But longer-term loans of more than four payments that these companies offer are subject to the same increased borrowing rates as credit cards. For those who don’t qualify for low-rate credit cards because of weak credit scores, the higher interest rates are already affecting their balances.

For those who have home equity lines of credit or other variable-interest debt, rates will increase by roughly the same amount as the Fed hike, usually within one or two billing cycles. That’s because those rates are based in part on banks’ prime rate, which follow the Fed’s.