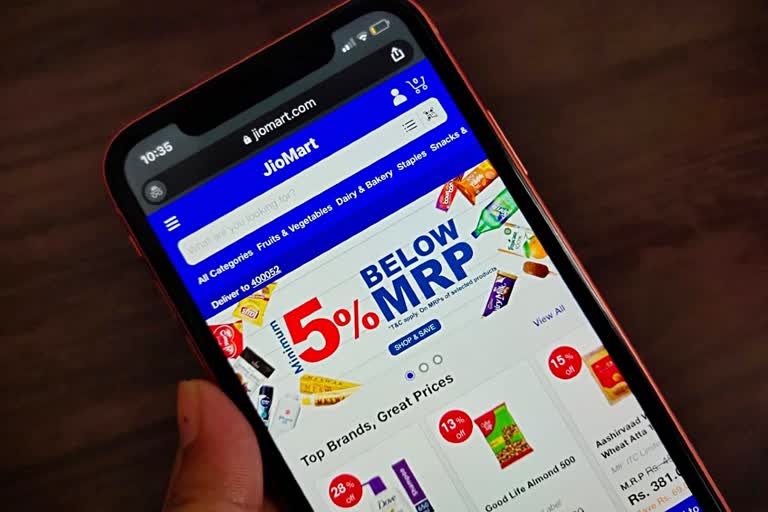

New Delhi:As kirana stores lose market share, a tie up with JioMart may be a potential solution and could be beneficial for the viability of kirana stores.

According to a report by ICICI Securities, despite all the noise, kiranas likely lost 4 per cent market share in March quarter.

The kiranas, as they stand today, have a demand-side problem as modern trade, discounters and online are gaining market share and a supply-side problem.

Jio Mart platform offers to retailers greater demand generation from taking the store online and leveraging the existing Jio customer base, the report said.

On the supply side, a tie-up with Jio Mart is likely to benefit the store from analytics-led understanding of the assortment at stores and better cost of procurement by benefitting from Reliance's scale.

Among the emerging consumer trends, there is premiumisation in some home care categories as the consumer is using the products themselves now.

Newer categories are getting created like pre-mixes, spices and an acceleration in adoption of healthier edible oils.

Read more:Reliance becomes net debt-free; raises over Rs 1.69 lakh cr in 58 days

There is a willingness to pay a premium for packaged grocery products, the price differential between loose and packaged groceries are 10% (4% for packaging, 5% GST).

Consumption in categories like laundry, discretionary personal care have reduced in the interim. New categories in health and wellness are getting created.

However, some launches have gone beyond what is really needed. These products are witnessing trial purchases but only a few categories see repeat purchases.

"Example of 'meat wash' products, which the consumer doesn't really need", the report said. Although a lot of brands have launched hygiene related products, the companies which specialise in the category are likely to be eventual winners and are seeing increased offtakes with improving product availability.

The report points out that the wholesale channel is under pressure due to least preference given by staples companies in current supply constrained situation. There are low synergies for D-Mart in cash and carry business as the model profitability is low and private labels in FMCG is long gestation, for instance, Big Basket's success has also been mostly in groceries.

(IANS Report)