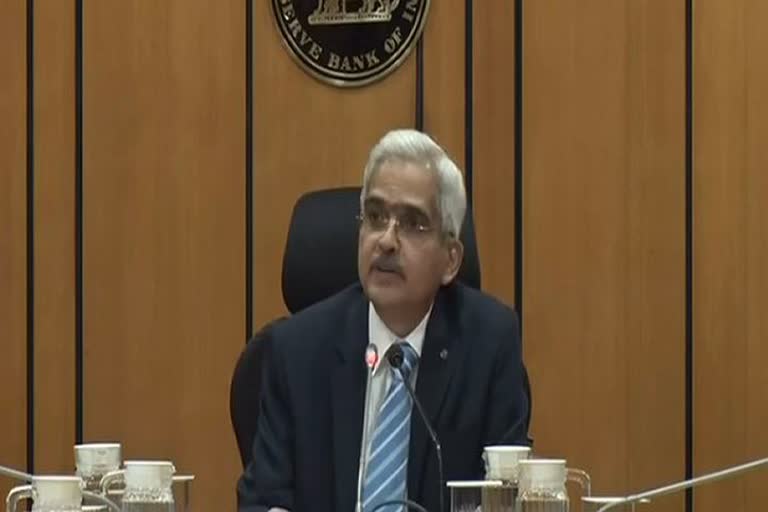

Mumbai: The moratorium on crisis-hit Yes Bank imposed early this month will be lifted on Wednesday at 6 pm, said Reserve Bank of India (RBI) Governor Shaktikanta Das here on Monday.

Das, while addressing media persons, assured depositors that their money is "completely safe and there is nothing to worry."

"Swift action has been taken by the RBI and the Government of India. The lifting of moratorium will be on Wednesday, 18th March at 6 pm," said Das.

Yes Bank Depositors' money is fully safe and secure says Shaktikanta Das "I would like to convey to the depositors of Yes Bank, through you, that their money is completely safe and there is nothing to worry. There is no reason for any undue worry," he added.

Read more:US Federal Reserve cuts interest rate to zero amid coronavirus crisis

RBI hints at rate cut in April 3 policy meet, announces more liquidity measures

The Reserve Bank has also hinted at a rate cut at the next Monetary Policy Committee (MPC) meet on April 3 and announced more liquidity enhancing measures.

RBI hints at rate cut in April 3 policy meet The market was expecting a rate cut as the presser was called only around noon after as many as 43 other central banks, including the US Fed, the European Central Bank and Bank of England, did so.

However, the RBI announced another round of USD 2 billion dollar-rupee swap on March 23 and up to Rs 1 lakh crore of long-term repo operations as and when the market needs it.

It will conduct the fifth tranche of the long-term repo operations (LTROs) for Rs 25,000 crore on March 18, in its bid to secure adequate liquidity to the troubled financial markets.

The central bank has already conducted four such operations of Rs 25,000 crore each since February 14 with huge success as the issue has been overbought multiple times.

RBI will also conduct another six months US dollar/rupee sell-buy swap on March 23 to ensure that financial markets and institutions remain sound and resilient in the wake of deadly coronavirus (COVID-19).

"The RBI has several instruments at its command and stands ready to take all necessary measures to mitigate the impact of COVID-19 on the Indian economy," said Das.

Das also admitted that the pandemic will have its toll on both the domestic as well as the global economy as the lockdown measures will crimp economic activities.

On a question on the Covid-19 impact on the economy, Das said the RBI is estimating it and when the MPC meeting next time, we'll give our estimate on the impact on the economy.

"There will be some impact as our economy is also integrated with the global economy to some extent. We are evaluating it and we will announce it when we hold the policy meeting at the next MPC meeting," he said.

(Input from agencies)