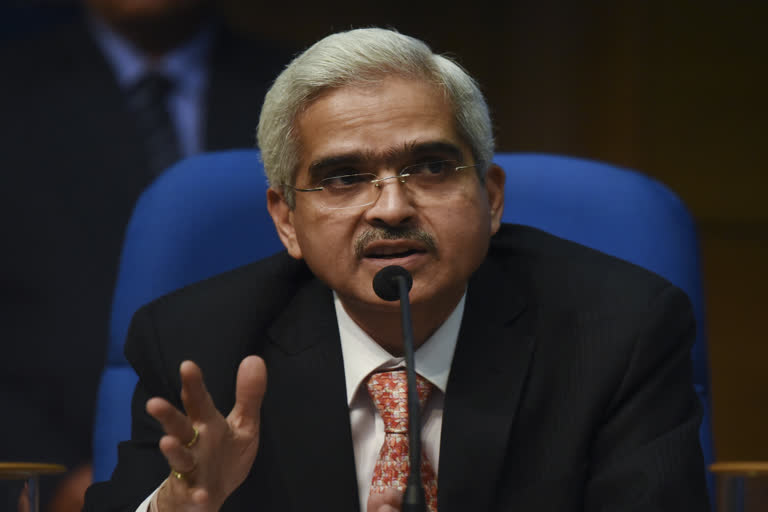

Mumbai: After over a dozen public sector banks, including State Bank, have voluntarily linked their loans and deposits pricing to the repo rate, Reserve Bank governor Shaktikanta Das on Monday stressed on the need for the entire system switching to this model, saying such a moved can speed up the monetary transmission process.

While SBI was to first one to link its loans and deposits to the repo rate from May and home loans from July, six other peer banks like Bank of Baroda, Union Bank, and Canara Bank among others announced the same last week under which the asset side pricing has moved down fast.

The move comes even as the regulator has decided not to push banks for this, considering their poor finances.

These six PSBs announced the switch-over after the last monetary policy wherein RBI lowered the repo rates by 35 bps to a nine-year low of 5.4 per cent and has ruled out asking banks to do so saying "banks are just about coming out of the NPA mess and it seems that they need to be given more time to improve their finances."

The process of shifting to an external benchmark on rates needs to be faster and our expectation is that they should move faster, Das told the annual banking conference organised by the industry lobby Ficci here this morning.

"I think the time has now come to formalise this linking of new loans to external benchmarks like repo rate. We are monitoring this and will be initiating necessary steps," Das said.

"We will definitely play our role as the regulator to work with banks, to see the trend in the market and take steps that will formalise these linking of new loans to the repo rate or to an external benchmark."

Das explained that the RBI has kept the external benchmarks in abeyance earlier because "we wanted to see how the market evolves. It is a positive trend to which banks have responded and are now linking their lending rates, especially the new loans, to the repo rate and other external benchmarks.