Mumbai:The Reserve Bank of India on Thursday opted for a status quo on benchmark interest rate after the Union Budget for 2020-21 slipped on fiscal deficit target and there were signs of hardening inflation amid an uncertain global environment.

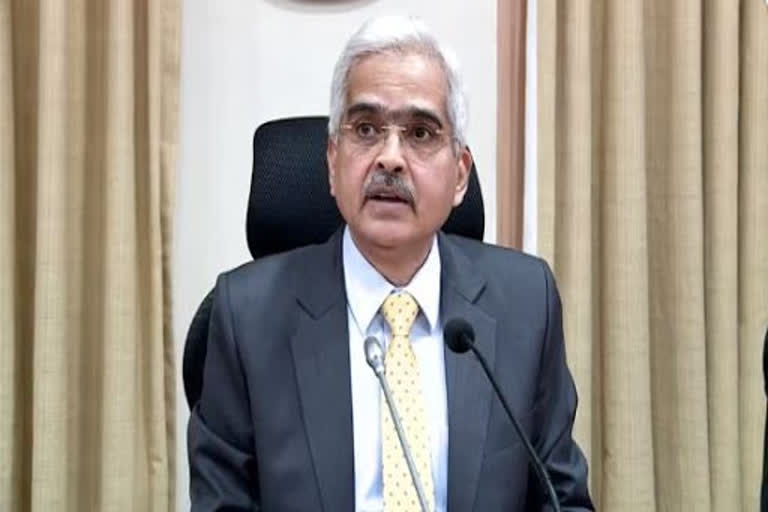

The six member-Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das, for the second meeting in a row, kept the repo rate unchanged at 5.15 per cent but maintained the accommodative policy stance which implies it was biased in favour of cutting the rate to boost growth.

RBI kept GDP growth rate unchanged for the current fiscal at 5 per cent and projected a pick up in growth to 6 per cent in the next financial year.

The MPC upped its inflation outlook for the second half of the next fiscal by 0.30 per cent to 5.4-5 per cent and termed the outlook on price rise as "highly uncertain".

"Economic activity remains subdued and the few indicators that have moved up recently are yet to gain traction in a more broad-based manner. Given the evolving growth-inflation dynamics, the MPC felt it appropriate to maintain the status quo," the MPC said.

The six-member committee voted unanimously to hold rates but also said that there is "policy space available for further action".

In a comment on the budget proposals, it said, "the rationalisation of personal income tax rates in the Union Budget 2020-21, should support domestic demand along with measures to boost rural and infrastructure spending."

It said though there has been a 0.50 per cent fiscal slippage in FY20, that has not increased the market borrowings, and also noted that the government has budgeted for a Rs 70,000 crore increase in the gross borrowings in FY21 when it has managed to crimp the fiscal gap to 3.5 per cent.

However, in the current year, the government will miss the fiscal deficit target of 3.3 per cent as it witnessed shortfall in tax revenue due to economic slowdown and a cut in the corporate tax rate.

The status quo in repo rate at 5.15 per cent and retaining accommodative stance is on expected lines. With PSBs facing disruption due to large scale consolidation has to now work towards (1) speedy transmission of interest rates to make credit affordable and (2) to increase the pace of credit growth to compete with private banks. Based on concessions given to MSMEs, Banks should play a more critical role in credit delivery to revive the economy says kembai Srinivasa Rao, Adjunct Professor at Institute of Insurance and Risk Management.

Read more:Middle Class people 'trained enough' to pick right Income Tax option: Rajiv Kumar

"The Union Budget 2020-21 has introduced several measures to provide an impetus to growth. While the emphasis on boosting the rural economy and infrastructure should help the growth momentum in the near-term, the corporate tax rate cuts of September 2019 should help boost the growth potential over the medium-term," it said.

There is a need for "adjustment" in interest rates on small saving schemes, the MPC said, adding that the external benchmark system adopted from October 1, has strengthened monetary policy transmission.