Mumbai: The Reserve Bank of India (RBI) on Friday slashed interest rates, extended moratorium on loan repayments and allowed banks to lend more to corporates in an effort to support the economy which is likely to contract for the first time in over four decades.

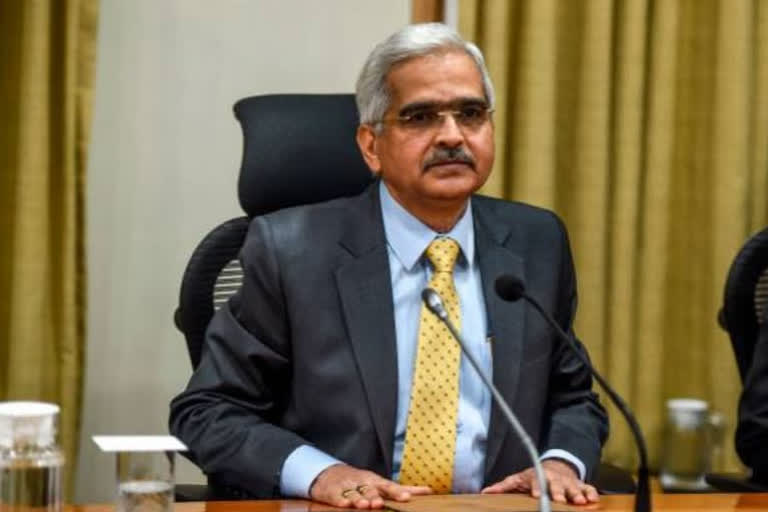

The benchmark repurchase (repo) rate was cut by 40 basis points to 4 per cent, Governor Shaktikanta Das said announcing the decisions taken by the central bank's Monetary Policy Committee (MPC) that met ahead of its scheduled meeting in early June.

Consequently, the reverse repo rate was reduced to 3.35 per cent from 3.75 per cent.

He said the MPC had voted to maintain its accommodative stance, implying more rate cuts in the future if need arises.

The RBI supplemented the interest rate cut by extending by three months the permission given to all banks to give a three-month moratorium on payment of monthly instalments on all outstanding loans, providing relief to home and auto buyers as well as real estate sector where construction activities are already at a standstill.

The moratorium on interest on working capital was also extended by three months.

Also, interest accumulated for the six-month moratorium period can be converted into a term loan, Das said.

Further, bank exposure to corporates has been raised to 30 per cent of the group's networth from the current limit of 25 per cent, a move that will allow lenders to give larger loans to companies.