Mumbai: The Monetary Policy Committee after the three-day meet has decided to cut the repo rate by 25 bps to 5.75%.

RBI cuts interest rates to 9-year low Consequently, the reverse repo rate under the LAF stands adjusted to 5.50 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.0 per cent.

Amid concerns of a slow down in the economy, the central bank lowered its gross domestic product (GDP) forecast to 7 per cent for the current fiscal from 7.2 per cent projected earlier.

The MPC also decided to change the stance of monetary policy from neutral to accommodative.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent while supporting growth.

RBI has also raised inflation projection to 3-3.1 per cent for April-September and 3.4%-3.7% for the second half of the year.

RBI has decided to do away with charges levied on RTGS and NEFT transactions, banks will be required to pass this benefit to their customers.

RBI has been decided to set up a Committee involving all stakeholders, under the chairmanship of CEO Indian Banks’ Association (IBA), to examine the entire gamut of ATM charges and fees. Committee will submit its recommendations within two months of its first meeting.

Read more:Sensex falls over 300 points despite RBI rate cut

The main reason behind reducing the repo rate is subdued domestic industrial activity and slow down in trade on the global front.

"The MPC (monetary policy committee) notes that growth impulses have weakened significantly… A sharp slowdown in investment activity along with a continuing moderation in private consumption growth is a matter of concern," read the policy resolution.

This is the third consecutive cut in repo rate after the April and February 2019 policy reviews. In these three back-to-back bi-monthly monetary policies, the RBI has lowered interest rates by 75 basis points (0.75 percentage point).

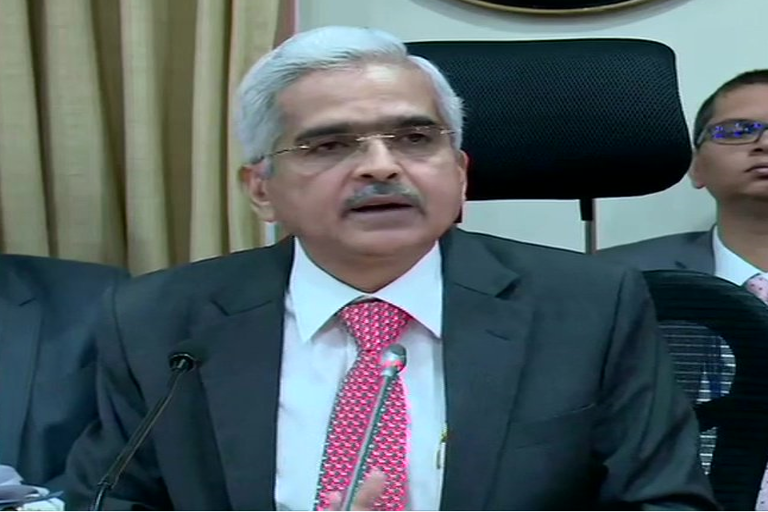

The six-member monetary policy committee under the chairmanship of RBI Governor Shaktikanta Das began their meet on June 3 for the second bi-monthly policy statement for 2019-20.

This was the first policy review meet after the results of 2019 Lok Sabha elections.

What is Repo Rate?

Repo rate is the rate at which RBI lends to the bank for a short period. The back to back cuts would enable banks to give personal, auto and home loans to customers at a reduced rate of interest. Consequently, the equated monthly instalments (EMI) would come down.

Let's understand it by an example:-

Know how low your EMIs would be If a person takes a car loan of up to Rs 10 lakh at an annual rate of 9.25 per cent for 5 years, then he has to pay Rs 20,880 per month as an EMI. If the bank also cuts its interest rates after the Reserve Bank's decision to cut the repo rate, then the same person will have to pay Rs 20,758 as an EMI for an interest rate of 9 per cent per annum. This will give relief of Rs 122 per month on the person's EMI.