Mumbai: The Reserve Bank of India (RBI) on Friday cut its benchmark lending rate by 0.25 per cent to revive growth that has hit six-year low of 5 per cent, and affirmed commitment to remain accommodative to address growth concerns 'as long as necessary'.

With this cut, the repo rate, at which it lends to the system, will now come down to 5.15 per cent and push consumption during the ongoing festival season.

This will help reduce borrowing costs for home and auto loans, which are now directly linked to this benchmark.

This is the fifth straight cut in rates by the Reserve Bank of India in as much policy reviews in 2019 and takes the total quantum of reductions to 1.35 per cent.

In the fourth bi-monthly review of the policy, the RBI sharply reduced its GDP growth estimate to 6.1 per cent for FY20 as against 6.9 per cent it was expecting earlier.

This cut came in the wake of June quarter growth slipping to a six-year low of 5 per cent, which is attributed to a slowdown in consumption, lack of new investments by the industry and also a slump in the global economy.

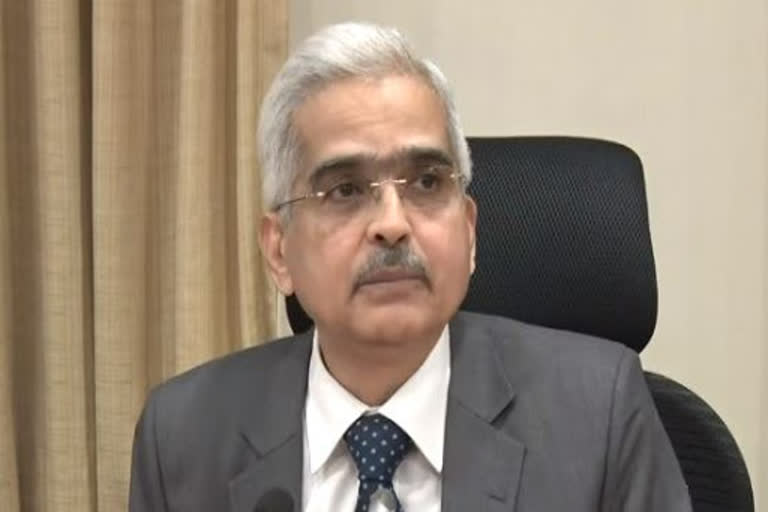

"...the MPC (monetary policy committee) decided to continue with an accommodative stance as long as it is necessary to revive growth while ensuring that inflation remains within the target," the resolution of the six-member panel headed by RBI Governor Shaktikanta Das said.

All the six members voted for a rate cut at the end of the three-day meeting, with Ravindra Dholakia voting for a 0.40 per cent reduction in rates.

On inflation, which is the key mandate of the RBI with the target of 4 per cent in the medium term, the MPC moved up the September quarter expectations "slightly upwards" to 3.6 per cent, but retained its projection for the second half of this fiscal at 3.5-3.7 per cent.

The half-yearly Monetary Policy Report presented along with the policy review suggested that inflation will remain within the target levels till early part of FY21.

On reviving growth, the MPC welcomed the recent moves by the government as the ones in right direction, but the resolution did not have any reference to fiscal deficit or fiscal management, which is generally deemed to have an inflationary impact.