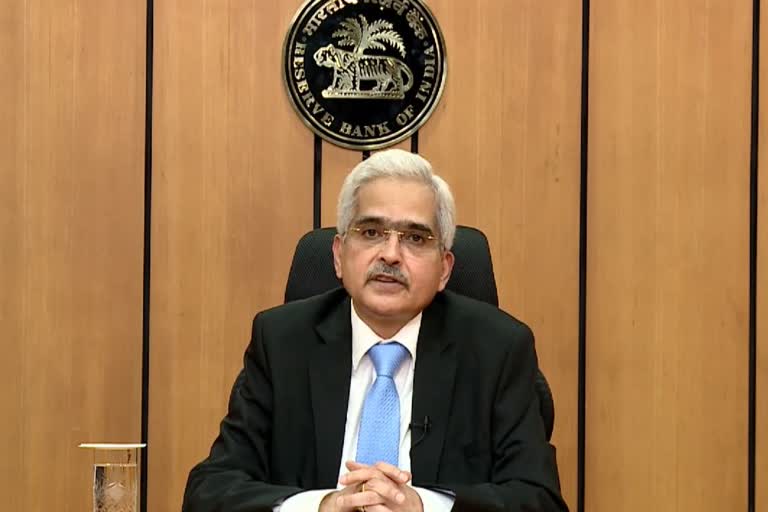

Mumbai:Reserve Bank Governor Shaktikanta Das addressed the media on Friday.

"Today humanity is facing the trial of its time, as COVID-19 grips the world with its deadly embrace. In this kind of environment Reserve Bank of India (RBI) has been very proactive & monitoring the situation closely," RBI Governor said.

RBI announced new measures to maintain adequate liquidity in system, facilitate bank credit flow and to ease financial stress.

This was the second time that the governor addressed the media since the nationwide lockdown was imposed from March 25.

Major statements made:

- TLTRO-2.0 to involve Rs 50,000 crore to begin with in tranches of appropriate sizes; this is in addition to the Rs 1 lakh crore that is being undertaken already

- Re-financing window of Rs 50,000 crore for financial institutions like National Bank for Agriculture & Rural Development (NABARD), National Housing Bank (NHB) and Small Industries Development Bank of India (SIDBI) for liquidity support, the advances are charged at existing repo rate of 4.4% to help cooperatives, msmes, housing sector

- It has been decided to reduce the fixed reverse repo rate under liquidity adjustment facility (LAF) by 25 basis points from 4% to 3.75%, with immediate effect; however repo rate is unchanged. This will encourage banks to lend to the productive sectors of the economy

- Asset classification standstill for three months from March to May

- Banks not to make any further dividend payout in view of financial difficulties arising from Covid-19

- As the situation warrants, they will announce new measures

- Inflation forecast- food prices rose by around 2% in April so far, as per ministry data; inflation could recede further

- 90-day NPA norm not to apply on moratorium granted on existing loans by banks

- Ways and means limit of states raised to help them, not bunch up their borrowing plans

- Loans given by NBFCs to real estate companies to get similar benefit as given by scheduled commercial banks

- Banks, financial institutions have risen to occasion to ensure normal functioning during outbreak of pandemic

- Since March 27, the macroeconomic and financial landscape has deteriorated precipitously in some areas, but light still shines through bravely in some others

- Contraction in exports in March 2020 at 34.6%, turned out to be much more severe than during the Global Financial Crisis. However, amidst all this, the level of Forex Exchange Reserves which we have continue to be robust

- No downtime of internet or mobile banking during lockdown; banking operations normal

- Surplus liquidity in banking system has increased substantially as result of central bank actions

- Impact of Covid-19 not captured in IIP data for Feb

- Automobile production, sales declined sharply in March; electricity demand has fallen sharply.

India fastest to grow among G20

Governor shaktikanta Das said that the IMF projection of 1.9% GDP growth for India is highest in G20.

On April 14, International Monetary Fund (IMF) released its global growth projections revealing that in 2020, the global economy is expected to plunge into the worst recession since 'The Great Depression', Das said.

IMF Economic Counsellor has named it 'The Great lockdown' estimating cumulative loss to global GDP over 2020-21 at around 9 trillion US dollars, which is greater than the economies of Japan & Germany combined.