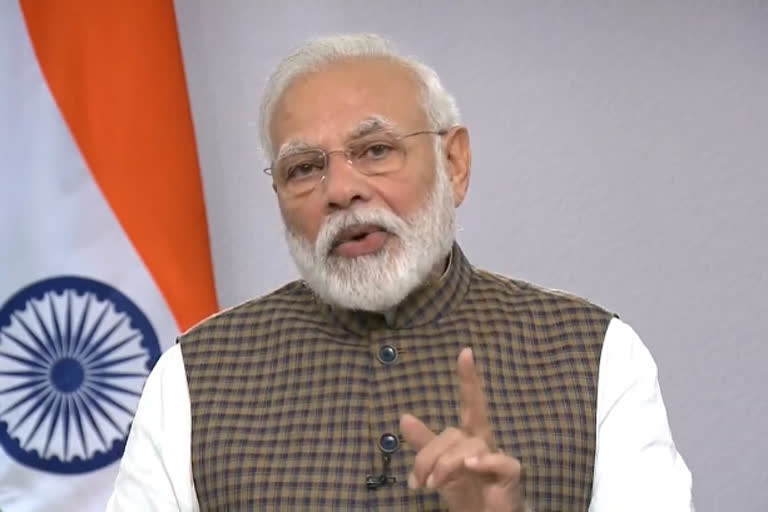

New Delhi: Emphasising on the crucial role of the financial sector in supporting the economy, Prime Minister Narendra Modi on Wednesday asked bankers to take a relook at their practices to ensure stable credit growth and not to turn down bankable proposals on apprehensions of prospective bad loans.

During a three-hour long virtual meeting with CEOs of large public and private sector banks along with heads of non-banking financial companies (NBFCs), the Prime Minister assured them that the government is ready to take all steps to support the financial sector.

"Had an extensive interaction with stakeholders from banks and NBFCs to deliberate on the roadmap for economic growth, helping entrepreneurs and a range of other aspects," he tweeted.

Modi exhorted bankers to motivate small entrepreneurs, self-help groups and farmers to use institutional credit in order to grow.

"Each bank needs to introspect and take a relook at its practices to ensure stable credit growth. Banks should not treat all proposals with the same yardstick and need to distinguish and identify bankable proposals and to ensure that these don't suffer in the name of past NPAs," an official statement quoted him as saying.

It was emphasised that the government is firmly behind the banking system, the statement said.

"Banks should adopt fintech like centralised data platforms, digital documentation and collaborative use of information to move towards digital acquisition of customers. This will help increase credit penetration, increase ease for customers, lower costs for banks and also reduce frauds," the Prime Minister said.

Stating that India has built a robust, low cost infrastructure which enables every Indian to undertake digital transactions of any size with great ease, he asked banks and financial institutions to actively promote the use of RuPay and UPI among their customers.

The progress of schemes like emergency credit line for MSMEs, additional Kisan Credit Cards, liquidity window for NBFCs and micro finance institutions was also reviewed, the statement said.