New Delhi: Parliament on Thursday approved changes in the three-year old Insolvency and Bankruptcy Code (IBC) providing greater clarity over distribution of proceeds of auction of loan defaulting companies, with the Lok Sabha passing the Bill with voice vote.

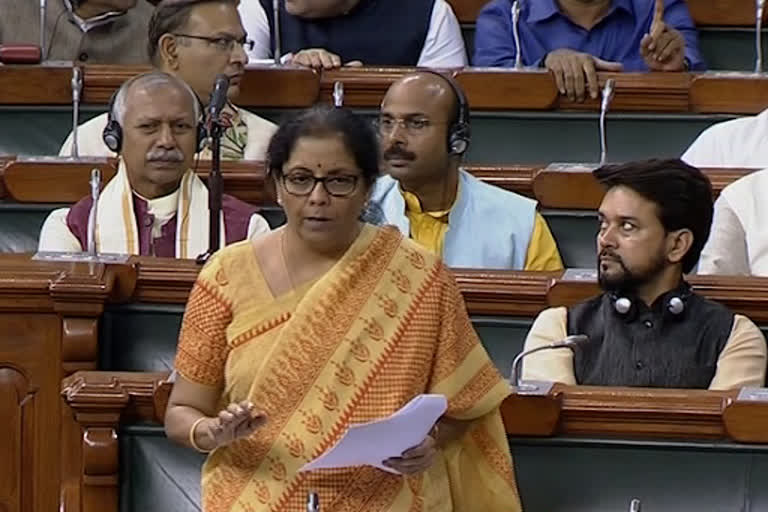

Piloted by Finance Minister Nirmala Sitharaman, the Insolvency and Bankruptcy Code (Amendment) Bill 2019 gives committee of creditors of a loan defaulting company explicit authority over the distribution of proceeds in the resolution process and fixes a firm timeline of 330 days for resolving cases referred to the IBC.

The amendments, she added, would also bring in more clarity on various provisions, including time-bound disposal at the application stage for resolution plan and treatment of financial creditors.

As many as seven sections of the Code are being amended.

Once the Corporate Insolvency Resolution Process (CIRP) begins, it has to be completed in 330 days, including litigation stages and judicial process, the minister said, citing the proposed amendments.

Among others, the approved resolution plan would be binding on central and state governments as well as various statutory authorities.

Sitharaman said proposed amendments also responds to issues pertaining to financial creditors in the wake of a recent ruling with respect to financial and operational creditors.

Recently, the National Company Law Appellate Tribunal (NCLAT) had ruled in the Essar Steel Ltd's case that the Committee of Creditors (CoC) had no role in distribution of claims and brought lenders (financial creditors) and vendors (operational creditors) on par.

Sitharaman quoted a Supreme Court judgement to say that with implementation of the Code, there is no longer a defaulter's paradise.

Read More:Insolvency law amendments to ensure greater timeliness: Nirmala Sitharaman

Referring to the issue of home buyers raised by some opposition members, the Minister said the provisions of the bill strengthen the hands of homebuyers and the government would endeavour to do full justice to them.