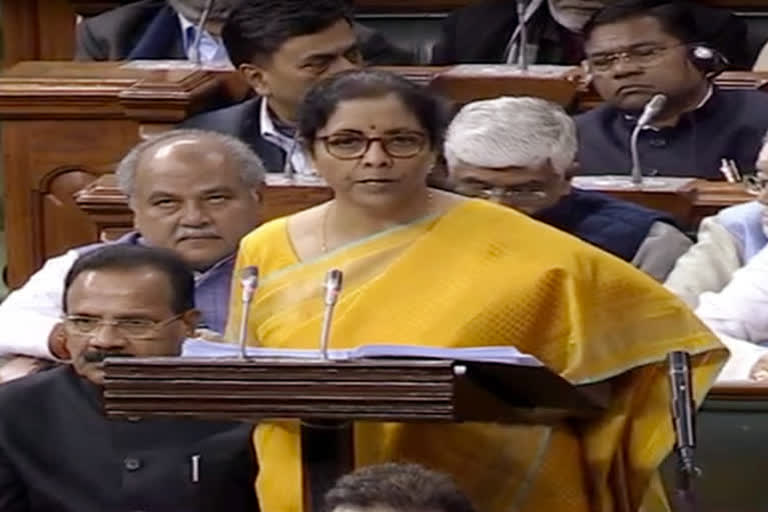

New Delhi:Finance Minister Nirmala Sitharaman on Sunday said that there is no intention to tax global income of NRIs and only income generated in India will be taxed.

Following the Budget announcement on Saturday, there was confusion about the tax liability of Non-Resident Indians (NRIs) on their global income.

"What we are doing now is that the income of an NRI generated in India will be taxed here. If he's earning something in a jurisdiction where there is no tax, why will I include that into mine that has been generated there?

"Whereas if you have a property here and you have rent out of it, but because you are living there, you carry this rent into your income there and pay no tax there, pay no tax here ... since the property is in India, I have got a sovereign right to tax," she said in a post Budget interaction with media.

"I am not taxing what you're earning in Dubai but that property which is giving you rent here, you may be an NRI, you may be living there but that is revenue being generated here for you. So that's the issue," she added.

The Finance Bill, 2020 has proposed that an Indian citizen shall be deemed to be resident in India if he is not liable to be taxed in any country or jurisdiction.