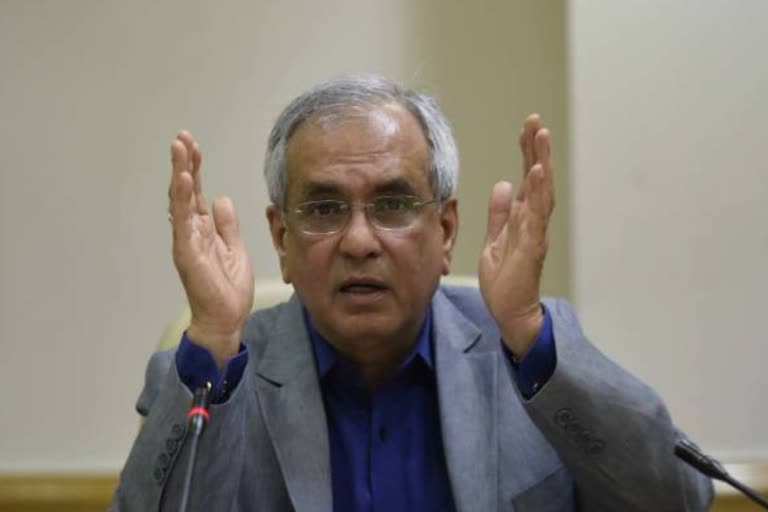

New Delhi:NITI Aayog Vice Chairman Rajiv Kumar on Wednesday said the middle class is "trained enough" to decide which personal income tax option is good for them and exuded confidence that their propensity to save will not come down.

Kumar was commenting on the Budget proposal of finance minister Nirmala Sitharaman to give option to personal income tax payers to remain in existing tax scheme with exemptions and deductions or opt for new simplified tax regime with lower tax rates but without exemptions and deductions.

"This is a recognition that the middle class especially the taxpayers are now trained enough to know what is good for them."

"You give her additional income in her pocket and let her decide, how much they want to save rather than link savings and make it in some sense compulsory," he told PTI.

Industry experts, however, said that two tax regimes with optionality for personal tax, as in the case of corporate taxes, only make the structure more complicated.

"Let them decide according to their situation... My view is that middle class' saving propensity won't come down," Kumar asserted.

As an economist, Kumar said he was thrilled about this simplification of the process.

However, eminent economist and National Institute of Public Finance and Policy (NIPFP) professor Ila Patnaik believes that households are generally short sighted and do not save adequately for old age.

Read more:DeMo, flawed GST, squeeze on banks sent economy in tailspin: Chidambaram

"This is one reason for governments to be paternalistic and nudge people towards saving for pension and old age. This was one rationale for tax exemption like 80C. The new system reduces these incentives," she opined.