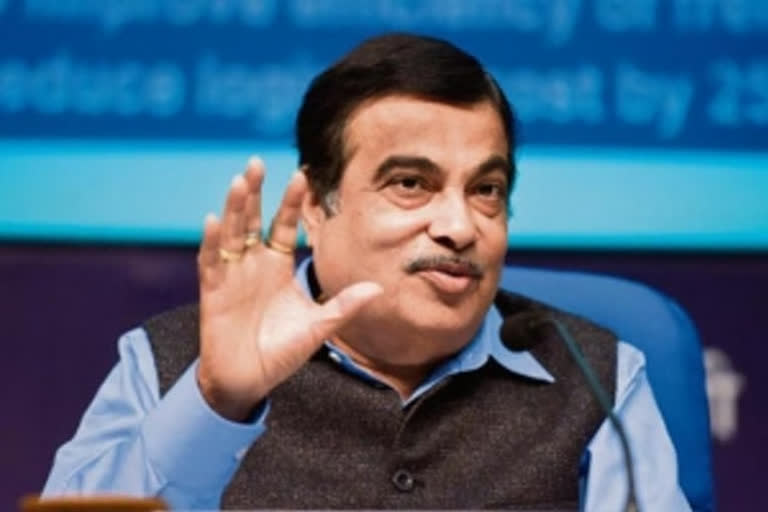

New Delhi:India needs foreign direct investments worth Rs 50 to 60 lakh crore and the money can be tapped mainly through infrastructure projects as well as MSME sector to accelerate the wheels of coronavirus-hit economy, according to Union Minister Nitin Gadkari.

Emphasising that at this juncture Foreign Direct Investment (FDI) is the need of the hour, the senior minister said such funds would benefit the country as there is a need for pumping in liquidity into the market.

Economic activities have been significantly disrupted in the wake of the pandemic and subsequent lockdowns that were in place to curb spreading of infections.

"Country at this juncture needs liquidity. Without liquidity our economy's wheel will not accelerate... Rs 50-60 lakh crore foreign investment is needed in the country under present circumstances to boost the economy," the Road Transport, Highways and MSME Minister told PTI in an interview.

Infrastructure sector including highways, airports, inland waterways, railways, logistic parks, broad gauge and metro, apart from Micro, Small and Medium Enterprises (MSMEs) can attract large scale foreign investment, he noted.

"FDI in MSME, Non-Banking Financial Companies (NBFCs) and banks are needed... in the highways sector, we are trying to bring foreign investment," he said.

Gadkari further said that talks are on with investors from Dubai and the US for various sectors, including MSMEs.

"Some MSMEs are already listed on the BSE. I have talked to investors in Dubai and the US to come and invest in such MSMEs based on their three-year turnover, GST track record, IT record and good rating. Investing in these can result in rich dividends as these do exports also," he said.

Read more:I-T dept extends deadline for tax-saving investments for FY20 till July 31