Mumbai: With fintech innovations and their adoptions by the financial sector entities growing at a frenetic pace, the Reserve Bank is strengthening its surveillance framework.

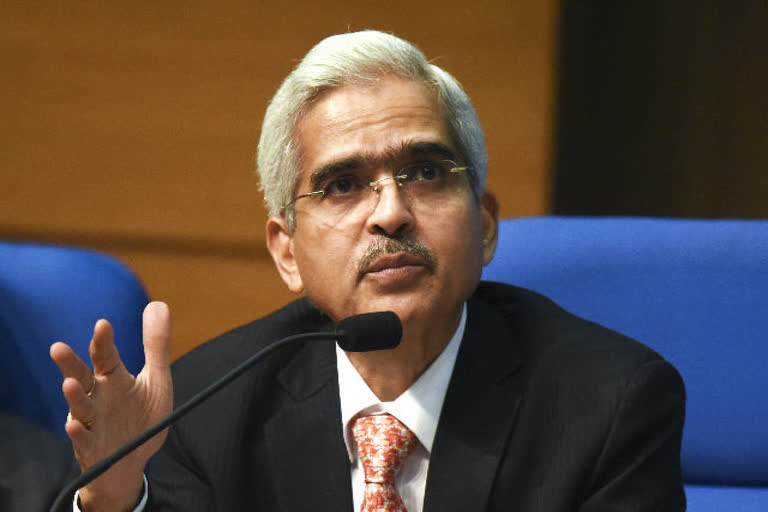

Governor Shaktikanta Das said the central bank is also aligning its framework to help the market intermediaries provide financial access to the bottom-of-the-pyramid.

"In view of the growing significance of fintech innovations and their growing interface with the financial sector entities, RBI is strengthening its surveillance framework," Das said while making the opening remarks at the CD Deshmukh memorial lecture at the Mint Road headquarters.

The central bank recently issued draft guidelines on 'Enabling framework for regulatory sandbox' to which is awaiting comments from stakeholders.

A regulatory sandbox refers to live-testing of new products/services in a controlled test/regulatory environment for which regulators may permit some relaxations of rules.

Das said the emergence of fintech/digital innovations is a strong transformative force that can reshape the global financial sector. A big benefit of these technological developments is the scope to expand financial outreach in a cost-effective manner, which in turn can deepen financial inclusion, he said.

"The RBI is continuously aligning its regulatory and supervisory framework so that the evolution of fintech can be leveraged to widen and ease the financial access to the excluded population," Das said.

Taking cognisance of the exponential growth of digitisation and online commerce, policy efforts are directed to put in place a state-of-the-art national payments infrastructure and technology platform, Das said.

Meanwhile, delivering the 17th CD Deshmukh memorial lecture, Agustin Carstens, a general manager at the Bank for International Settlements, said financial inclusion is key to participating in a modern economy.

Noting that substantial progress has been made in expanding financial access across the globe, Carstens said, since 2011, more than 1 billion adults have gained access to basic transaction accounts.