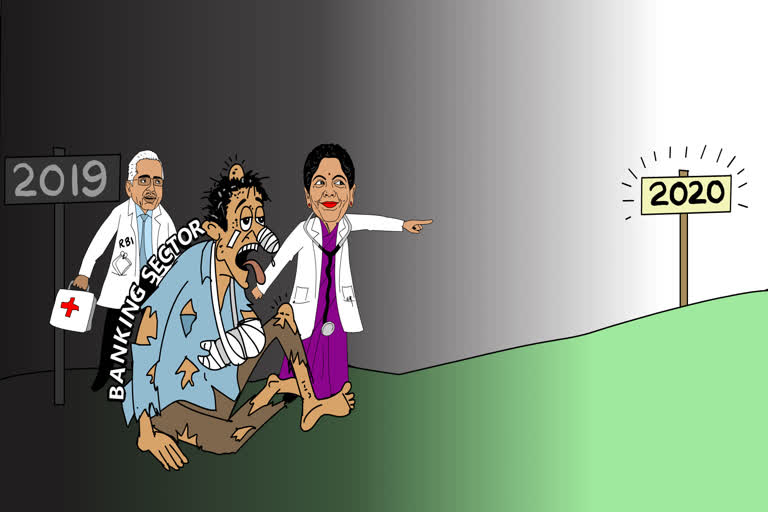

Hyderabad:Better banking is ahead with some early signs of potential improvements in the sector. While banks and non-banks were struggling to adjust to the prolonged disruption caused by failure of Infrastructure Leasing and Financial Services (IL&FS), the Punjab and Maharashtra Cooperative (PMC) bank fiasco exacerbated the woes.

Many large housing finance companies got trapped in the contagion risk of liquidity caused by asset-liability imbalance that followed the collapse of these, once mighty looking financial institutions.

This resulted in the migration of public savings from banks to post offices, partly due to interest rate differences. Hence, the year 2019 caused a lot of upheaval to the financial sector but due inbuilt resilience banks are fast regaining their market position.

The nuances of consolidation among Public Sector Banks (PSBs), continued asset quality erosion, prompt corrective action (PCA) continued in some of the PSBs, sluggish credit growth, need to link lending rates with external benchmark effective from October 2019 and deepening slow down marred the growth of banking sector in 2019.

Having put appropriate strategies by the stakeholders to tackle the impediments, banks are now looking better.

1. Softer interest rates:

In a diminishing interest rate cycle that began in February 2019, many banks have quickly reduced interest rates on term deposits to protect their margins while waiting to reduce lending rates. SBI had been the first to link even savings bank interest rates with repo rates while doing so for retail and certain other small and marginal loans.

Since most of the resources of banks are dependent upon the cost of deposits and not repo rates, the transmission of policy rates were slow.

As against cumulative repo rate cut of 135 basis points, according to RBI, lending rates on an average were down by 49 basis points. Having front-loaded rate cuts, RBI is persuading banks to provide the benefit of low-interest rates to entrepreneurs.

Read more:Free Trade: India at Crossroads

Despite lacklustre deposit growth, there is abundant liquidity in the markets due to low credit off-take. Banks are waiting for the impact of the reduction in term deposit interest rates to make space to cut lending rates.

It is only when an equilibrium in interest-earning equation is reached that the transmission of diminishing policy rates will be accelerated when small and marginal borrowers can look forward to loans at affordable interest rates. More than interest rates, it is the availability of credit that entrepreneurs to revive the economy. But RBI has been working on opening up new avenues for ensuring the wider flow of credit to the industry.

2. Collaborative credit growth:

Having adjusted to the new normal of managing asset quality issues with a combination of improved qualitative credit origination and closer monitoring of credit with the help of technology, banks, more importantly, PSBs should be able to work on accelerating credit growth that suffered in the last few years to restore the leadership position in the industry.

RBI having already alerted on the increasing riskiness concentration of banks on retail lending, the next focus will be on Micro, Small and Medium Enterprises (MSME) and agriculture sector that supports core industries. Government having provided two per cent of interest subvention to MSME loans can be an attractive thrust area to lend.

Co-origination of loans by banks, non-bank, Fintech companies and peer to peer (P2P) lenders is likely to pick up speed with greater collaboration with formal banking system. RBI has opened up these channels and issued guidance co-origination of loans and P2P lending operations.

3. Digital thrust:

The steady thrust of digital banking and guiding the economy towards a less cash society is evident. Making online remittances through National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement System (RTGS) in savings bank accounts free from January 2020 is indeed significant. It is also now made available on 24/7 basis facilitating quick fund transfer round the clock.

RBI vision for digital payments and settlement system – 2019-2021 released in May 2019 clearly intended to “empower every Indian with access to a bouquet of e-payment options that are safe, secure, convenient, quick and affordable”.

Even the “Report of the high level committee on deepening of digital payments (Chairman: Nandan Nilekani)” envisaged a tenfold increase in digital payments in the next three years. Enhanced access to financial touch points and reducing cost of access has been the twin drivers of digital inclusion.

Taking a cryptic view, improved banking services in 2020 will be built upon the resilience and digital centric steps taken so far that may assure speedy credit at affordable interest rates. Insolvency and Bankruptcy code (IBC) - 2016 getting deeply integrated with mainstream debt resolution system, it should reform and improve the loan repayment culture to benefit the borrower community.

(Article by Dr. K. Srinivasa Rao, Adjunct Professor, Institute of Insurance and Risk Management - IIRM, Hyderabad. The views are his own.)