Hyderabad: The Central Statistical Organization(CSO)’s First Advance Estimates pegs 5% GDP (Gross Domestic Product) growth in 2019-20.

The Reserve Bank of India (RBI) had anticipated the CSO in this estimate, scaling down the Finance Ministry’s earlier Economic Survey’s projection of 7% growth for this year. This would be the lowest annual growth in the last 11 years.

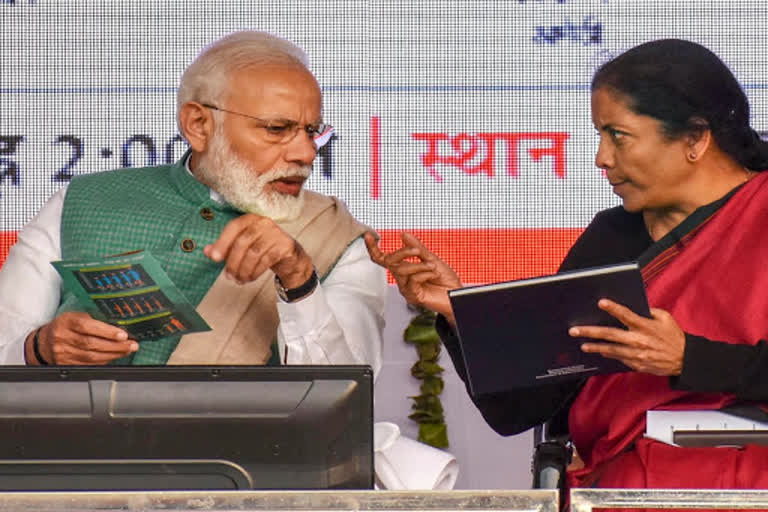

Since Government capital formation or investment was not rising, we had, commenting on the Budget presented by Finance Minister Nirmala Sitharaman after the elections, suggested that a good opportunity of a financial stimulus to a weakening growth process in the economy was lost.

The Finance Minister’s Budget speech compared Budget Estimates with last year’s Revised Estimates, which we suggested was not a good practice, because comparing like with like is the first lesson of Statistics.

Also, we wanted revival to be ‘pucca’ and not just words for a good presentation.

As anticipated on account of the fiscal crunch the projection of Government capital formation was cut down. It is now figured out that Government capital formation will fall by 0.54% in the Half Year 2020, based on numbers which have been released by the CSO.

The strategy of lecturing on ‘reforms’, for short-run revival is bound to fail. Genuine administrative and economic policy reform is a gradual process and must be followed steadily and through economic cycles to cover the last mile.

But a revival in the near future or the short run as economists describe it needs boosts of demand.

Analysts at home and abroad were already forecasting GDP growth of 5% (+/- 0.25%).

We had anticipated when the Budget papers were available last year that the Budget had made a very large number of announcements but had not raised Government investment in a significant manner and even at that time, the consequent reduction in expected growth rates, with investment rates falling, was obvious in the derived parameters of the budget figures.

The Finance Minister, being a good JNU trained economist, knew all this and announced that more real investment-led growth packages, would be announced later.

She did two such efforts. In both, a number of announcements were made. Most of them were on long term policy changes in housing, tax administration and the like. That was good. But they fell short of a macroeconomic stimulus.

In fact, the only outlay increase was for Women Self Help Groups. The rest was exhortations to PSUs and others to invest.

When one such announcement was coming I had a retired CMD of one of our more successful PSUs, whose share values are rising, sitting with me and I told him ‘Good. Now Government investment will go up and the corporate sector will pick up.’