Business Desk, ETV Bharat: The Reserve Bank of India (RBI) in August this year announced the introduction of the Positive Pay System for Cheque Truncation System that had to be implemented from 1 January 2021.

As the date nears, banks have started announcing the launch of the new cheque payment system. If you also use cheques for issuing or receiving payments, here’s what you should know.

What is Positive Pay?

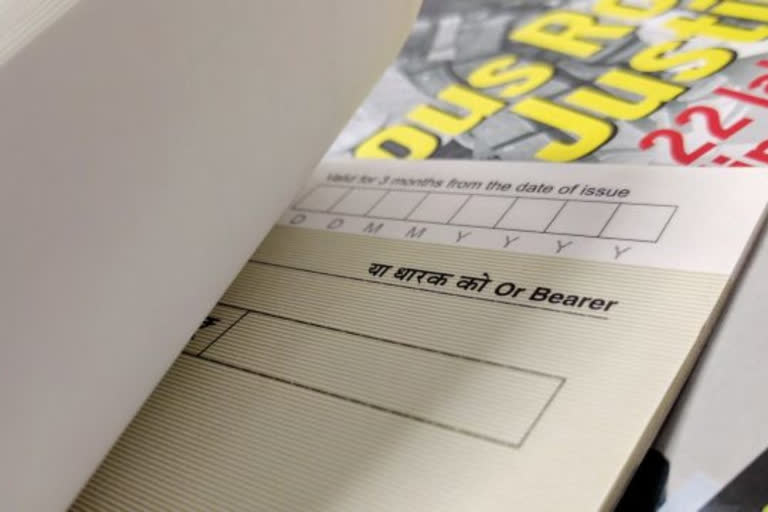

Positive Pay involves a process of reconfirming key details of large-value cheques before clearing them in order to prevent fraudulent activities.

Under this process, the issuer of the cheque, whether a company or an individual, submits certain details of the cheque like date, name of the beneficiary/payee, amount, etc. to the drawee bank.

Details can be submitted electronically, through channels like SMS, mobile app, internet banking, ATM, etc as instructed by the issuing bank.

When the cheque is presented for clearing, the Cheque Truncation System (CTS) then cross-checks its details with those submitted by the issuer.

If any discrepancy is found, then it is flagged by CTS to the drawee bank and presenting bank, who take redressal measures.

What kind of frauds Positive Pay can prevent?

Positive Pay can help in detecting cases which involve counterfeit cheques (i.e. those created on non-bank paper to look genuine), forged cheques (a genuine cheque, but forged signature) or most importantly fraudulently-altered cheques (i.e. a genuine cheque by a genuine customer, but where amount or recipient’s name is altered before it has been cleared).

Is it applicable on all cheques?

Banks will enable Positive Pay for all account holders issuing cheques for amounts of Rs 50,000 and above. Though RBI has also cleared that availing of the facility is at the discretion of the account holder.

Read more:Fuel prices unchanged for 23 days straight

In other words, if account holders do not want to submit the details of each and every cheque they issue, they can opt to not use the facility and CTS will clear their cheques without any cross-verification.

However, RBI said that banks may consider making it mandatory in case of cheques for amounts of Rs 5 lakh and above. Individual banks are yet to announce their decision on the same.

What should account holders know about Positive Pay?

Account holders should know that only those cheques which are compliant with Positive Pay mechanism will be accepted under dispute resolution mechanism at the CTS grids. So it is advisable that issuers opt for Positive Pay service.

RBI has also said that member banks may implement similar arrangements for cheques cleared/collected outside CTS as well.

Which banks have announced the implementation of Positive Pay?

State Bank of India (SBI), the country’s top lender, on Wednesday announced the launch of Positive Pay System for cheques from 1 January.

SBI wrote on its official Twitter account: “Keeping all your transactions safe including those done via Cheques. SBI is introducing the Positive Pay System from 1st January 2021 to make Cheque payment secure. To know more, contact your nearest SBI branch.”

Interestingly, ICICI Bank has been providing the optional Positive Pay service to its account holders since 2016, wherein customers can share the details of issued cheque along with an image of the front and reverse side of the cheque on the bank’s iMobile application before handing it over to the beneficiary. Now it is expected to widen the ambit of this service.