Hyderabad: Owing to Adani-Hindenburg row and considering the volatility witnessed in the securities market in recent times, Chief Justice of India DY Chandrachud had announced the formation of a six-member expert committee, headed by former Supreme Court Judge Justice Abhay Manohar Sapre.

Before going into the details of the investigative mechanism of the expert committee let us look at Adani-Hindenburg row and the financial crisis that stems from the US short sellers report

What is short selling?

The act of short-selling involves the sale of stocks that are not owned by the seller during the trade, with the objective of repurchasing them in the future at a reduced price. In order to carry out this strategy, short sellers "borrow" shares and sell them at their current market value, only to repurchase them when the stock price decreases. The profit margin is derived from the difference in value between the sale and repurchase price. In essence, short sellers gamble on the possibility of a stock's value decreasing in order to gain profit.

What are the allegations against the Adani Group?

According to the Hindenburg Report, the Adani group has been involved in extensive stock price manipulation, inflating the value of their assets, and exerting control over more than 75% of their shares through various offshore shell entities that are controlled by the group. These actions are in violation of the Securities Contracts (Regulation) Rules, 1957, which are designed to safeguard the interests of investors.

The report also alleges that the Adani Group has taken on a significant amount of debt by leveraging its assets to secure multiple loans totaling ₹2.2 lakh crores. If the Adani Group defaults on these loans, the banks that lent them the money will be at risk of not recovering their funds, which could put them in a precarious situation.

Why does it matter?

The Adani Group is facing serious accusations of engaging in large-scale stock manipulation and accounting fraud for several decades, which suggests that the Indian regulatory framework failed to prevent such illegal activities. If proven true, the allegations would implicate Mr. Gautam Adani and the Adani Group, who allegedly gained more than $100 billion in net worth through illicit means.

Alternatively, even if the Hindenburg report's claims are proven false, the Adani Group has already suffered significant damage. Following the report's publication, the group's share prices plummeted by a staggering $140 billion, causing considerable harm to investor confidence and enabling Hindenburg Research to reap substantial profits.

The Supreme Court’s role:

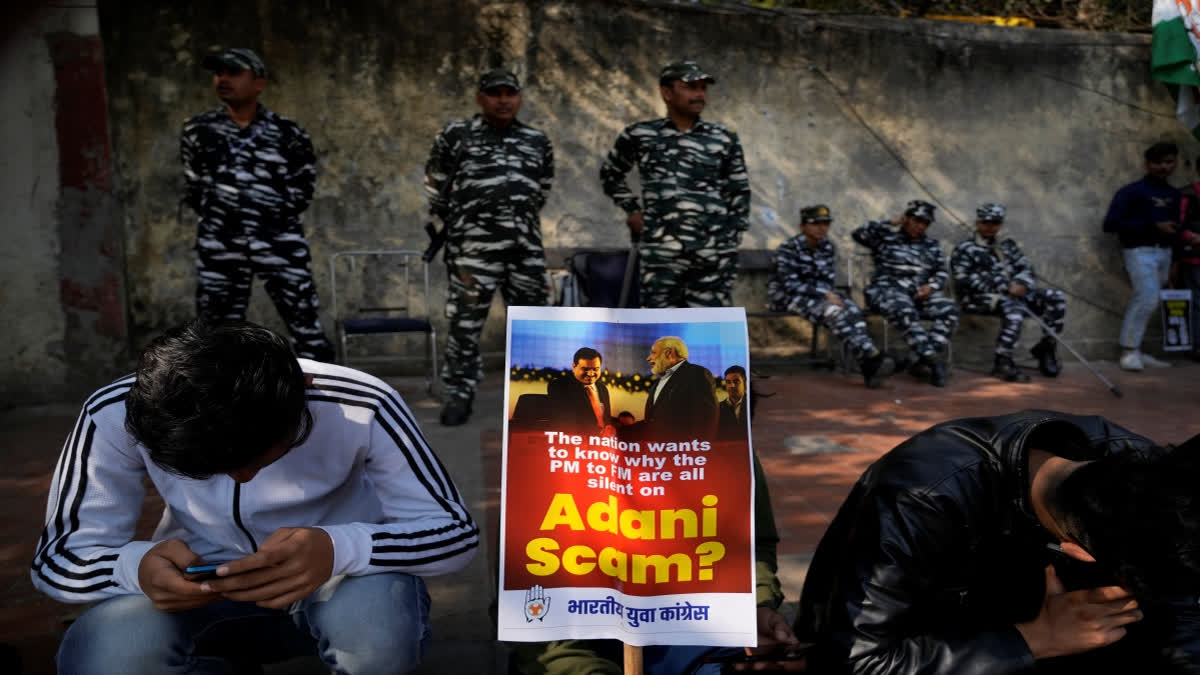

There were wide range of petitions were filed before the SC over the Adani-Hindenburg controversy. One batch of petitions alleged a conspiracy by Hindenburg Research to fraudulently make profits by crashing Adani stock prices. A second batch of petitions sought an investigation by an expert committee to investigate the possibility of fraud by the Adani Group.

Given the perspective, the expert committee, headed by Justice Abhay Manohar Sapre and comprising KV Kamath and Nandan Nilekani, will provide an overall assessment of the situation, including the relevant causal factors that have led to market volatility in recent times. It will also suggest measures to strengthen investor awareness and investigate alleged contraventions of securities market laws by the Adani Group or other companies.

The committee formed will also be responsible for assessing the regulatory framework, identifying the relevant causal factors that have led to market volatility, and recommending measures to strengthen investor awareness and protect Indian investors.

The committee will also investigate whether there has been a regulatory failure in dealing with alleged contraventions of securities market laws pertaining to the Adani Group or other companies. It will recommend measures to strengthen the statutory and regulatory framework and ensure compliance with existing frameworks for investor protection.

According to the order, the remit of the committee shall be:

- To provide an overall assessment of the situation, including the relevant causal factors which have led to the volatility in the securities market in the recent past.

- To suggest measures to strengthen investor awareness

- To investigate whether there has been a regulatory failure in dealing with the alleged contravention of laws pertaining to the securities market in relation to the Adani Group or other companies.

- To suggest measures to (i) strengthen the statutory and/or regulatory framework and (ii) secure compliance with the existing framework for the protection of investors.

Speaking to Etv Bharat one of the petitioners Advocate Vishal Tiwari said, “Supreme Court's main focus was to prevent investors' losses and present mechanism should be strengthened so that such type of activities does not repeat again and the money and investment of investors shall remain safe. Court has constituted a committee of experts under the chairmanship of former Supreme Court justice Abhay Manohar Sapre".

"Committee will work and analyse the present situation. It will also investigate if there were any irregularities in Adani group. And in other spheres committee will also look upon provision and procedure which SEBI is using to control the entire share market," he said.

The Securities and Exchange Board of India (SEBI) has been asked to continue its ongoing investigation and investigate whether there has been a violation of the Securities Contracts (Regulation) Rules 1957, whether there has been a failure to disclose transactions with related parties, and whether there was any manipulation of stock prices in contravention of existing laws.