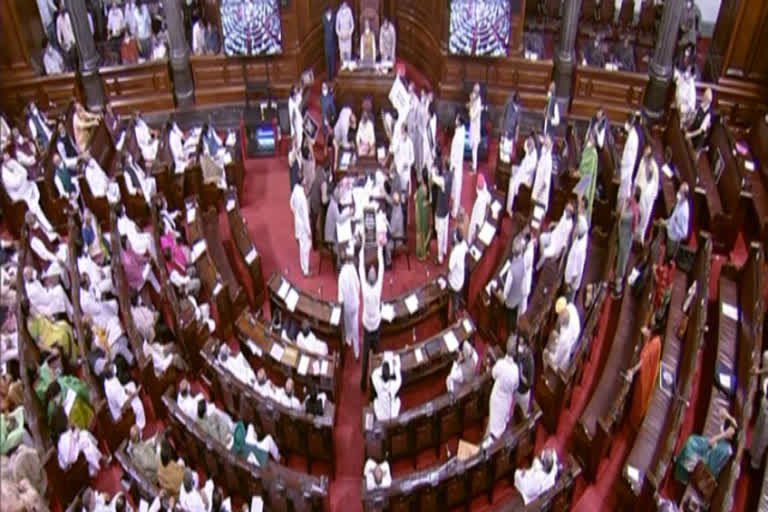

New Delhi: In a major relief for the bank depositors, the Rajya Sabha has passed the Deposit Insurance and Credit Guarantee Corporation (Amendment) Bill, 2021 for compulsory payment of insurance claims up to Rs 5 lakh within 90 days of moratorium period. The amendments will also cover those stressed banks, such as PMC Bank of Maharashtra, that have been placed under the payment moratorium by the Reserve Bank of India. The bill was introduced in the house on Friday.

Union Minister of Finance, Nirmala Sitharaman while moving the Bill for passing said that the timely Bill will be a huge relief for startups, Chartered Accountants. It will bolster ease of doing business.

The Bill has proposed that even if a bank is temporarily unable to fulfil its obligations due to restrictions such as moratorium, depositors can access their deposits to the extent of the deposit insurance cover through interim payments by the Deposit Insurance and Credit Guarantee Corporation (DICGC). For this, the Bill seeks to insert a new Section in the DICGC Act, 1961. Last year, the government had increased insurance cover on deposits by five times to Rs 5 lakh.