New Delhi: Despite demands from several quarters to bring petroleum products under the GST regime as it will reduce their retail prices, the government on Monday said there is no such proposal under its consideration.

Under the present dual tax regime administered by both the Centre and States, taxes account for nearly two-thirds of the retail price of petrol and diesel.

If these two commodities are brought under the GST then under the present four-slab structure of GST, these two would attract a maximum of 28% tax.

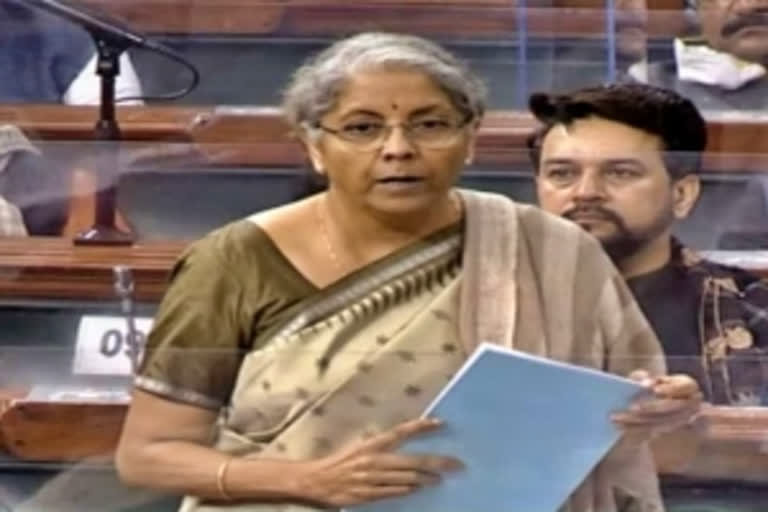

In response to a question in the Lok Sabha, finance minister Nirmala Sitharaman on Monday clarified that five commodities, crude oil, natural gas, petrol, diesel, and Aviation Turbine Fuel (ATF) have not been excluded from the GST as the GST Council, comprising both the Centre and States may recommend the date for inclusion of these products in the GST.

“So far, the GST Council, in which the states are also represented, has not made any recommendation for inclusion of these goods under GST,” Nirmala Sitharaman told the Lok Sabha.

Also Read:Petrol, diesel prices unmoved though global oil rate firm

Former finance minister Arun Jaitley, during whose tenure a constitutional amendment was passed to subsume most of the indirect taxes levied by both the Centre and States, had ensured the inclusion of petroleum products under the GST but left the date of implementation to the GST Council.

Sitharaman told the Lok Sabha members that the GST Council might consider the issue of inclusion of the five petroleum products (petrol, diesel, natural gas, ATF and crude oil) at an appropriate time keeping in view all the relevant factors, including revenue implication.

“At present, there is no proposal to bring crude oil, petrol, diesel, ATF and natural gas under GST,” said the finance minister.

A significant source of revenue